Cost-to-serve analysis measures the total expenses incurred to deliver a product or service to a customer, highlighting specific cost drivers across distribution channels, customer segments, and product lines. Profitability analysis evaluates net financial gains by subtracting total costs from revenues, focusing on overall business performance and margins. Explore detailed insights on how these analyses drive strategic decision-making in consulting.

Why it is important

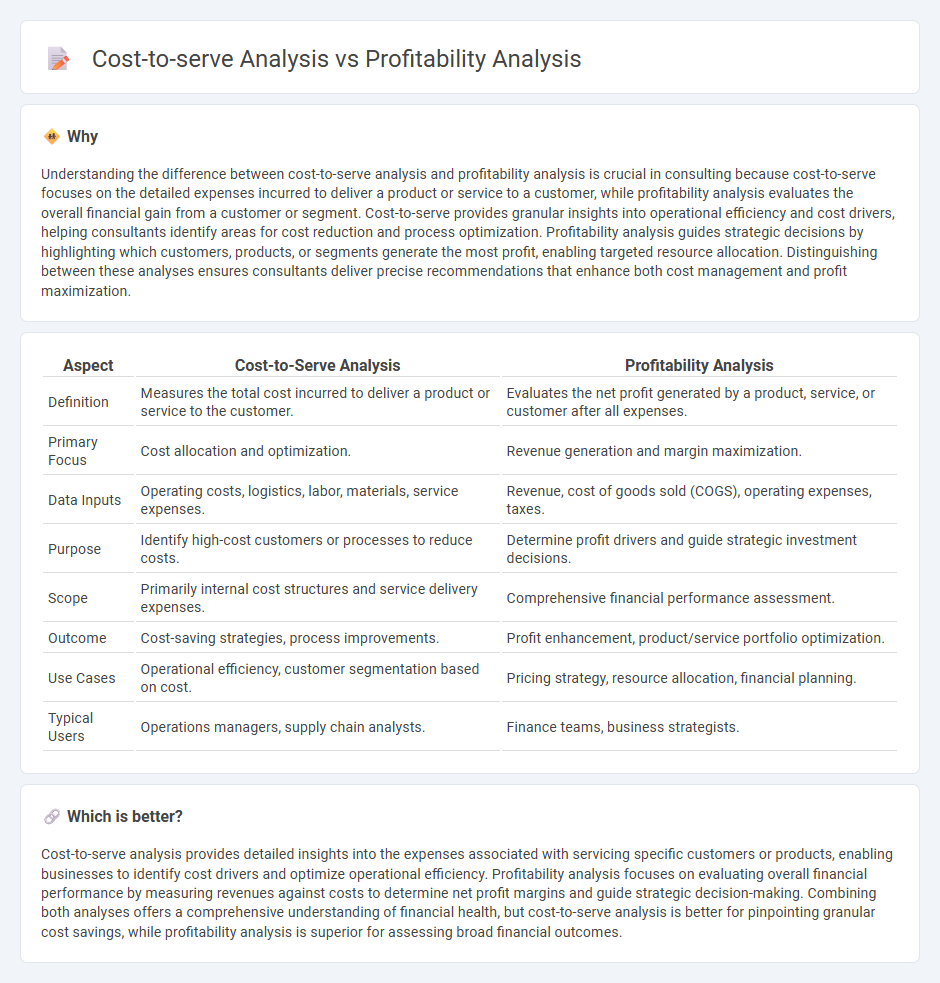

Understanding the difference between cost-to-serve analysis and profitability analysis is crucial in consulting because cost-to-serve focuses on the detailed expenses incurred to deliver a product or service to a customer, while profitability analysis evaluates the overall financial gain from a customer or segment. Cost-to-serve provides granular insights into operational efficiency and cost drivers, helping consultants identify areas for cost reduction and process optimization. Profitability analysis guides strategic decisions by highlighting which customers, products, or segments generate the most profit, enabling targeted resource allocation. Distinguishing between these analyses ensures consultants deliver precise recommendations that enhance both cost management and profit maximization.

Comparison Table

| Aspect | Cost-to-Serve Analysis | Profitability Analysis |

|---|---|---|

| Definition | Measures the total cost incurred to deliver a product or service to the customer. | Evaluates the net profit generated by a product, service, or customer after all expenses. |

| Primary Focus | Cost allocation and optimization. | Revenue generation and margin maximization. |

| Data Inputs | Operating costs, logistics, labor, materials, service expenses. | Revenue, cost of goods sold (COGS), operating expenses, taxes. |

| Purpose | Identify high-cost customers or processes to reduce costs. | Determine profit drivers and guide strategic investment decisions. |

| Scope | Primarily internal cost structures and service delivery expenses. | Comprehensive financial performance assessment. |

| Outcome | Cost-saving strategies, process improvements. | Profit enhancement, product/service portfolio optimization. |

| Use Cases | Operational efficiency, customer segmentation based on cost. | Pricing strategy, resource allocation, financial planning. |

| Typical Users | Operations managers, supply chain analysts. | Finance teams, business strategists. |

Which is better?

Cost-to-serve analysis provides detailed insights into the expenses associated with servicing specific customers or products, enabling businesses to identify cost drivers and optimize operational efficiency. Profitability analysis focuses on evaluating overall financial performance by measuring revenues against costs to determine net profit margins and guide strategic decision-making. Combining both analyses offers a comprehensive understanding of financial health, but cost-to-serve analysis is better for pinpointing granular cost savings, while profitability analysis is superior for assessing broad financial outcomes.

Connection

Cost-to-serve analysis identifies the specific expenses associated with delivering products or services to customers, providing detailed insights into cost drivers. Profitability analysis uses this data to evaluate the financial performance of individual customers, products, or channels, guiding resource allocation and strategic decision-making. Together, these analyses enable consulting firms to optimize pricing, enhance customer segmentation, and improve overall business profitability.

Key Terms

Revenue Streams

Profitability analysis evaluates overall income and expenses to identify which revenue streams generate the highest net returns, while cost-to-serve analysis breaks down the specific costs associated with delivering products or services to each customer segment. Understanding revenue streams through profitability analysis highlights which products or services are most lucrative, whereas cost-to-serve analysis reveals the true profitability by factoring in delivery and service costs. Explore how integrating both analyses can optimize revenue management and enhance strategic decision-making.

Direct Costs

Profitability analysis examines overall revenue against all expenses to assess business viability, while cost-to-serve analysis zeroes in on direct costs such as materials, labor, and logistics associated with delivering products or services to customers. Direct costs are pivotal in cost-to-serve because they directly influence product pricing, customer profitability, and supply chain efficiency. Explore further to understand how focusing on direct costs enhances strategic decision-making and resource allocation.

Customer Segmentation

Profitability analysis evaluates the financial returns from different customer segments to identify high-value clients, while cost-to-serve analysis calculates the expenses associated with fulfilling orders for each segment. Together, these analyses offer a detailed understanding of customer profitability by balancing revenue against service costs. Explore how integrating these methods can optimize customer segmentation strategies for better resource allocation.

Source and External Links

Product Profitability Analysis: Definition and Examples - CostPerform - Profitability analysis measures financial gain by subtracting all costs (including direct and indirect costs) from a product's revenue, crucial for strategic decisions and resource management.

Profitability Analysis: A Comprehensive Guide to Success - Fathom - It involves examining revenue streams and costs using financial statements and ratios, performing break-even analyses, and identifying profitability trends by product or customer.

Profitability analysis - Wikipedia - This cost accounting process allocates all organizational costs to output units (products, customers, locations) to calculate unit margins, supporting management decisions on optimizing or discontinuing certain outputs.

dowidth.com

dowidth.com