ESG due diligence focuses on assessing environmental, social, and governance risks to ensure sustainable and ethical business practices, while IT due diligence evaluates technological infrastructure, cybersecurity, and system integrations for operational efficiency. Both play critical roles in mergers and acquisitions by identifying potential liabilities and opportunities within their respective domains. Explore how these due diligence types complement each other to drive informed investment decisions.

Why it is important

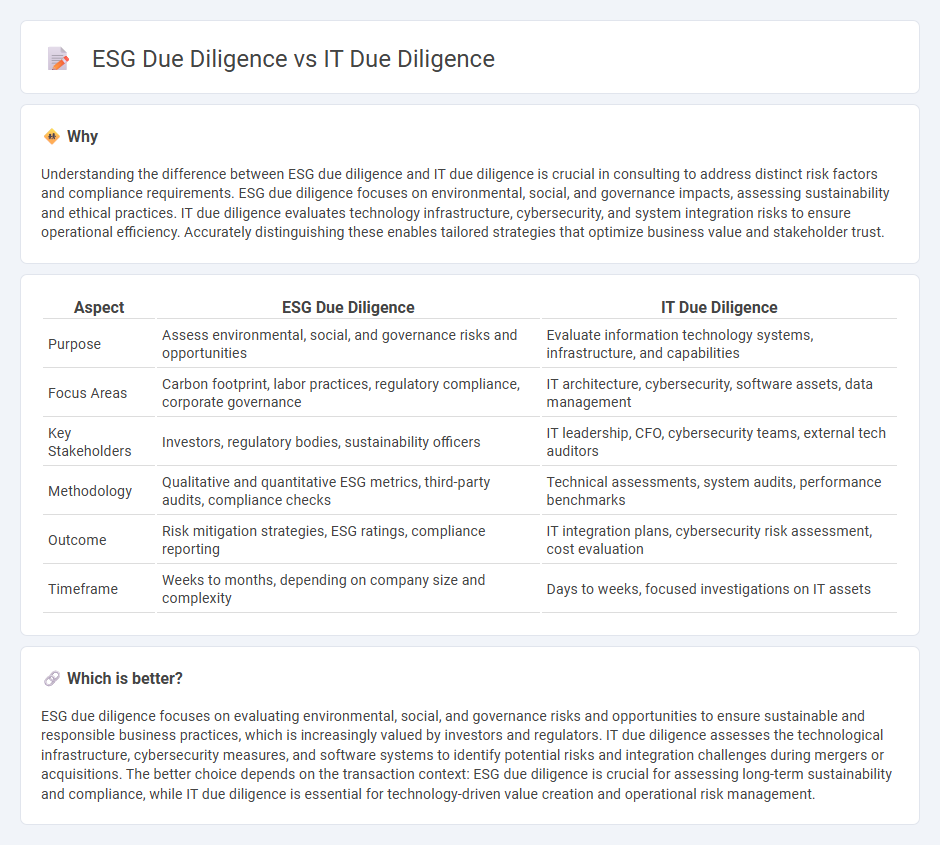

Understanding the difference between ESG due diligence and IT due diligence is crucial in consulting to address distinct risk factors and compliance requirements. ESG due diligence focuses on environmental, social, and governance impacts, assessing sustainability and ethical practices. IT due diligence evaluates technology infrastructure, cybersecurity, and system integration risks to ensure operational efficiency. Accurately distinguishing these enables tailored strategies that optimize business value and stakeholder trust.

Comparison Table

| Aspect | ESG Due Diligence | IT Due Diligence |

|---|---|---|

| Purpose | Assess environmental, social, and governance risks and opportunities | Evaluate information technology systems, infrastructure, and capabilities |

| Focus Areas | Carbon footprint, labor practices, regulatory compliance, corporate governance | IT architecture, cybersecurity, software assets, data management |

| Key Stakeholders | Investors, regulatory bodies, sustainability officers | IT leadership, CFO, cybersecurity teams, external tech auditors |

| Methodology | Qualitative and quantitative ESG metrics, third-party audits, compliance checks | Technical assessments, system audits, performance benchmarks |

| Outcome | Risk mitigation strategies, ESG ratings, compliance reporting | IT integration plans, cybersecurity risk assessment, cost evaluation |

| Timeframe | Weeks to months, depending on company size and complexity | Days to weeks, focused investigations on IT assets |

Which is better?

ESG due diligence focuses on evaluating environmental, social, and governance risks and opportunities to ensure sustainable and responsible business practices, which is increasingly valued by investors and regulators. IT due diligence assesses the technological infrastructure, cybersecurity measures, and software systems to identify potential risks and integration challenges during mergers or acquisitions. The better choice depends on the transaction context: ESG due diligence is crucial for assessing long-term sustainability and compliance, while IT due diligence is essential for technology-driven value creation and operational risk management.

Connection

ESG due diligence evaluates environmental, social, and governance risks, while IT due diligence assesses a company's technological infrastructure and data security, both crucial for comprehensive risk management in mergers and acquisitions. Integrating ESG and IT due diligence identifies potential regulatory compliance issues and cybersecurity vulnerabilities that could impact sustainable business practices. This combined approach enhances informed decision-making by providing a holistic view of operational and ethical risks.

Key Terms

**IT due diligence:**

IT due diligence involves a comprehensive assessment of a company's technology infrastructure, software, cybersecurity measures, and IT team capabilities to identify risks and opportunities before mergers, acquisitions, or investments. It evaluates system integrations, data integrity, compliance with industry standards, and scalability to ensure alignment with business goals and reduce potential liabilities. Explore more to understand how IT due diligence safeguards technology assets and drives informed decision-making in transactions.

Cybersecurity

IT due diligence centers on evaluating a company's technological infrastructure, cybersecurity protocols, and data protection measures to identify potential risks and vulnerabilities. ESG due diligence incorporates cybersecurity as a critical factor under the "Governance" pillar, emphasizing the company's resilience against cyber threats and its compliance with data privacy regulations to ensure sustainable and ethical business practices. Explore how a comprehensive assessment of both IT and ESG due diligence can enhance organizational security and stakeholder confidence.

Systems Integration

IT due diligence evaluates the technical infrastructure, software systems, and cybersecurity protocols to ensure seamless systems integration and operational efficiency. ESG due diligence assesses environmental, social, and governance factors that impact the sustainability and ethical implications of technology deployment during systems integration projects. Explore how combining IT and ESG due diligence enhances integration outcomes and drives long-term value.

Source and External Links

IT Due Diligence For M&A: Technology Audit Guide & Checklist - Provides a detailed checklist for evaluating IT infrastructure, system architecture, software assets, and backup and failover strategies during IT due diligence for mergers and acquisitions.

A complete technology due diligence checklist - M&A Community - Covers key aspects of IT due diligence such as cybersecurity evaluation, portfolio investment balance, and spin-off scenarios to identify risks and ensure compliance in technology assessments.

IT Due Diligence Checklist: Must-Assess Technology Elements Prior ... - Highlights important elements including network and cybersecurity, hardware lifecycle management, software review including licensing and support, and risk identification related to IT and business alignment.

dowidth.com

dowidth.com