Consulting in stakeholder capitalism emphasizes creating long-term value for all parties including employees, customers, communities, and shareholders rather than focusing solely on profit maximization. This approach integrates social responsibility and sustainable practices into business strategies to drive ethical growth and resilience. Explore how consulting can help organizations balance stakeholder interests with profitability.

Why it is important

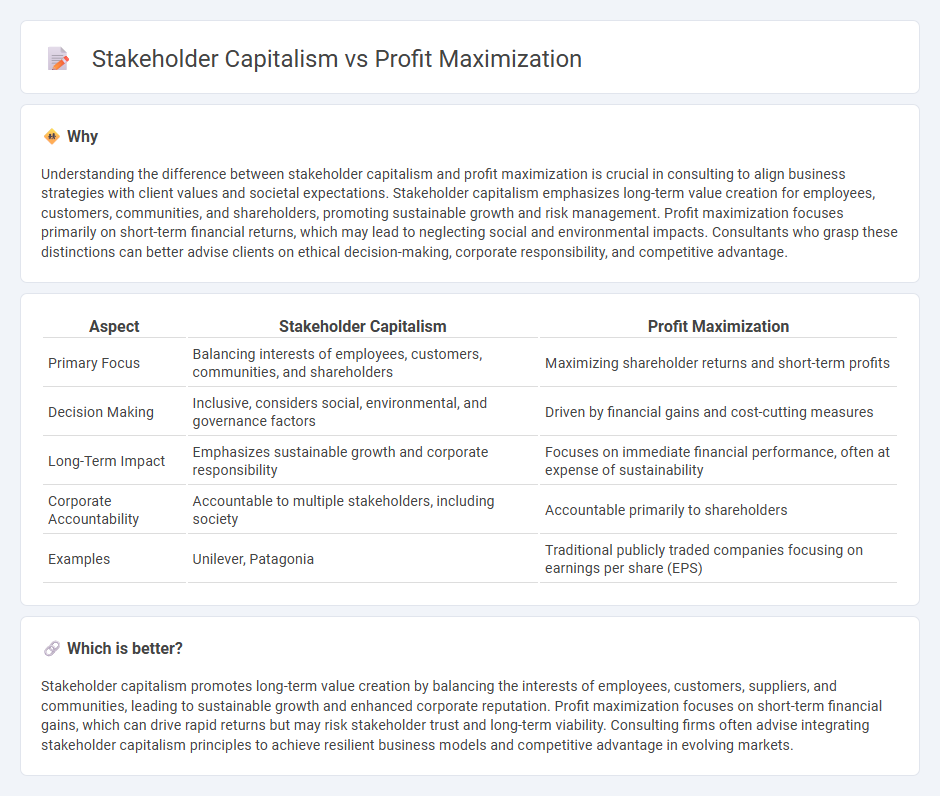

Understanding the difference between stakeholder capitalism and profit maximization is crucial in consulting to align business strategies with client values and societal expectations. Stakeholder capitalism emphasizes long-term value creation for employees, customers, communities, and shareholders, promoting sustainable growth and risk management. Profit maximization focuses primarily on short-term financial returns, which may lead to neglecting social and environmental impacts. Consultants who grasp these distinctions can better advise clients on ethical decision-making, corporate responsibility, and competitive advantage.

Comparison Table

| Aspect | Stakeholder Capitalism | Profit Maximization |

|---|---|---|

| Primary Focus | Balancing interests of employees, customers, communities, and shareholders | Maximizing shareholder returns and short-term profits |

| Decision Making | Inclusive, considers social, environmental, and governance factors | Driven by financial gains and cost-cutting measures |

| Long-Term Impact | Emphasizes sustainable growth and corporate responsibility | Focuses on immediate financial performance, often at expense of sustainability |

| Corporate Accountability | Accountable to multiple stakeholders, including society | Accountable primarily to shareholders |

| Examples | Unilever, Patagonia | Traditional publicly traded companies focusing on earnings per share (EPS) |

Which is better?

Stakeholder capitalism promotes long-term value creation by balancing the interests of employees, customers, suppliers, and communities, leading to sustainable growth and enhanced corporate reputation. Profit maximization focuses on short-term financial gains, which can drive rapid returns but may risk stakeholder trust and long-term viability. Consulting firms often advise integrating stakeholder capitalism principles to achieve resilient business models and competitive advantage in evolving markets.

Connection

Stakeholder capitalism integrates profit maximization by emphasizing long-term value creation for all stakeholders, including employees, customers, and communities, rather than focusing solely on shareholder returns. Consulting firms advocate strategies that balance financial performance with social responsibility, driving sustainable growth and enhanced corporate reputation. This paradigm shift aligns profit goals with ethical governance and stakeholder engagement, fostering resilient business models.

Key Terms

Shareholder Value

Profit maximization centers on increasing shareholder value by prioritizing short-term financial gains and stock price growth, often at the expense of broader social and environmental considerations. Stakeholder capitalism expands this focus by integrating the interests of employees, customers, communities, and the environment into corporate decision-making, promoting sustainable long-term value. Explore the dynamics between these models to understand their impact on corporate strategy and economic outcomes.

Triple Bottom Line

Profit maximization prioritizes financial gains as the primary business objective, often emphasizing short-term shareholder returns while minimizing costs. Stakeholder capitalism, aligned with the Triple Bottom Line framework, seeks balanced value creation by integrating economic performance with social responsibility and environmental sustainability. Explore how embracing the Triple Bottom Line drives long-term resilience and ethical growth in modern enterprises.

ESG (Environmental, Social, Governance)

Profit maximization prioritizes short-term financial gains, often sidelining environmental and social concerns, whereas stakeholder capitalism integrates ESG (Environmental, Social, Governance) criteria to balance financial performance with social responsibility and sustainability. Companies adopting stakeholder capitalism actively engage in reducing carbon footprints, promoting diversity, and ensuring transparent governance to meet the expectations of a broader set of stakeholders including employees, communities, and investors. Explore how embracing ESG principles reshapes corporate strategies for long-term value creation and ethical business practices.

Source and External Links

How Can Profit Maximization Grow Your Business? - Profit maximization involves producing at the point where marginal revenue equals marginal cost to generate the highest possible profit, calculated as total revenue minus total cost.

The Profit Maximization Rule - The rule states that profit is maximized when a firm produces at the output level where marginal cost equals marginal revenue and the marginal cost curve is rising.

Profit Maximization: Definition and Strategies for Business - Profit maximization is the goal of generating the highest profit after costs, achieved by balancing input and output so that marginal revenue equals or exceeds marginal cost, ensuring efficient resource use for sustained growth.

dowidth.com

dowidth.com