Diversity sourcing consulting focuses on helping organizations implement inclusive recruitment strategies that enhance workforce diversity and drive innovation. Financial advisory consulting specializes in delivering expert guidance on mergers, acquisitions, risk management, and investment strategies to optimize financial performance. Explore the distinct benefits and tailored approaches of both consulting types to determine the best fit for your business goals.

Why it is important

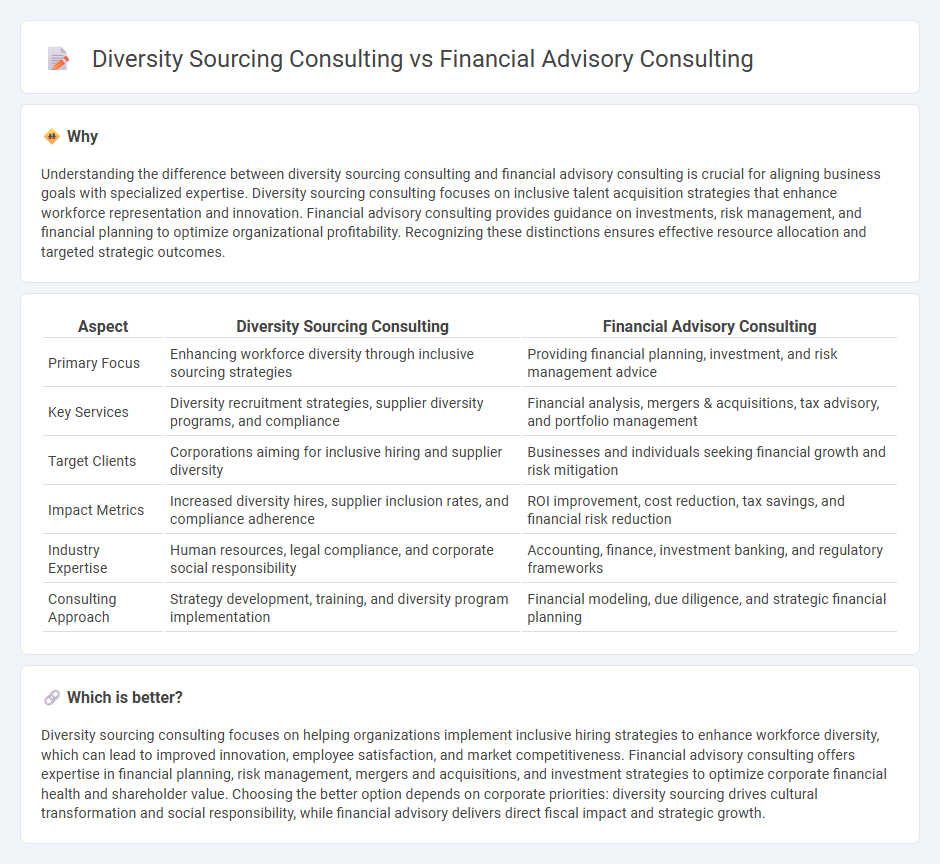

Understanding the difference between diversity sourcing consulting and financial advisory consulting is crucial for aligning business goals with specialized expertise. Diversity sourcing consulting focuses on inclusive talent acquisition strategies that enhance workforce representation and innovation. Financial advisory consulting provides guidance on investments, risk management, and financial planning to optimize organizational profitability. Recognizing these distinctions ensures effective resource allocation and targeted strategic outcomes.

Comparison Table

| Aspect | Diversity Sourcing Consulting | Financial Advisory Consulting |

|---|---|---|

| Primary Focus | Enhancing workforce diversity through inclusive sourcing strategies | Providing financial planning, investment, and risk management advice |

| Key Services | Diversity recruitment strategies, supplier diversity programs, and compliance | Financial analysis, mergers & acquisitions, tax advisory, and portfolio management |

| Target Clients | Corporations aiming for inclusive hiring and supplier diversity | Businesses and individuals seeking financial growth and risk mitigation |

| Impact Metrics | Increased diversity hires, supplier inclusion rates, and compliance adherence | ROI improvement, cost reduction, tax savings, and financial risk reduction |

| Industry Expertise | Human resources, legal compliance, and corporate social responsibility | Accounting, finance, investment banking, and regulatory frameworks |

| Consulting Approach | Strategy development, training, and diversity program implementation | Financial modeling, due diligence, and strategic financial planning |

Which is better?

Diversity sourcing consulting focuses on helping organizations implement inclusive hiring strategies to enhance workforce diversity, which can lead to improved innovation, employee satisfaction, and market competitiveness. Financial advisory consulting offers expertise in financial planning, risk management, mergers and acquisitions, and investment strategies to optimize corporate financial health and shareholder value. Choosing the better option depends on corporate priorities: diversity sourcing drives cultural transformation and social responsibility, while financial advisory delivers direct fiscal impact and strategic growth.

Connection

Diversity sourcing consulting enhances financial advisory consulting by promoting inclusive supplier networks that drive innovation and risk mitigation in investment portfolios. Leveraging diverse vendor partnerships improves compliance with regulatory standards and strengthens corporate governance frameworks integral to financial advisory services. Integrating diversity sourcing strategies supports financial advisors in delivering sustainable, socially responsible investment solutions aligned with stakeholder expectations.

Key Terms

Financial advisory consulting:

Financial advisory consulting specializes in providing expert guidance on investment strategies, risk management, and financial planning to maximize client wealth and ensure regulatory compliance. Firms in this sector analyze market trends, conduct due diligence, and offer tailored solutions to improve financial performance and strategic growth. Explore the benefits of financial advisory consulting for informed decision-making and sustainable business success.

Valuation

Financial advisory consulting specializes in comprehensive business valuation, leveraging financial modeling, market analysis, and risk assessment to determine the fair value of assets or companies for mergers, acquisitions, or investment decisions. Diversity sourcing consulting concentrates on enhancing supplier diversity by identifying and engaging underrepresented vendors, indirectly impacting valuation by promoting inclusive procurement strategies that can drive innovation and market competitiveness. Explore detailed insights on how valuation integrates differently within these consulting spheres.

Mergers & Acquisitions

Financial advisory consulting in Mergers & Acquisitions (M&A) centers on evaluating target companies, conducting due diligence, and optimizing deal structures to maximize shareholder value. Diversity sourcing consulting enhances M&A success by integrating diverse talent acquisition strategies, ensuring inclusive leadership, and fostering innovation through varied perspectives during integration phases. Explore how combining financial advisory expertise with diversity sourcing can create more resilient and profitable M&A outcomes.

Source and External Links

Financial Advisory - Consulting.us - Financial advisory consulting involves specialized services such as corporate finance, risk management, tax, transaction services, and compliance, providing expert advice tailored to clients' CFO-level financial concerns rather than broad economic trends.

What Is a Financial Consultant and What Do They Do? - SmartAsset - Financial consultants help individuals or businesses by analyzing their finances comprehensively to create personalized plans addressing goals like retirement, estate planning, taxes, or investment management, sometimes working as certified specialists such as ChFCs or CPAs.

Financial Advisory | Consultancy.org - Financial advisory consulting includes broad financial analysis services such as transaction services, tax and risk management, litigation support, real estate, and pensions advisory, often provided by firms with backgrounds in audit, tax, or specialized financial expertise.

dowidth.com

dowidth.com