Talent marketplace advisory focuses on optimizing workforce strategies by leveraging on-demand talent platforms to enhance agility and reduce costs. Mergers and acquisitions (M&A) integration involves aligning organizational structures, systems, and cultures to realize synergies and drive value post-transaction. Explore how expert consulting can tailor solutions for both dynamic talent deployment and seamless M&A execution.

Why it is important

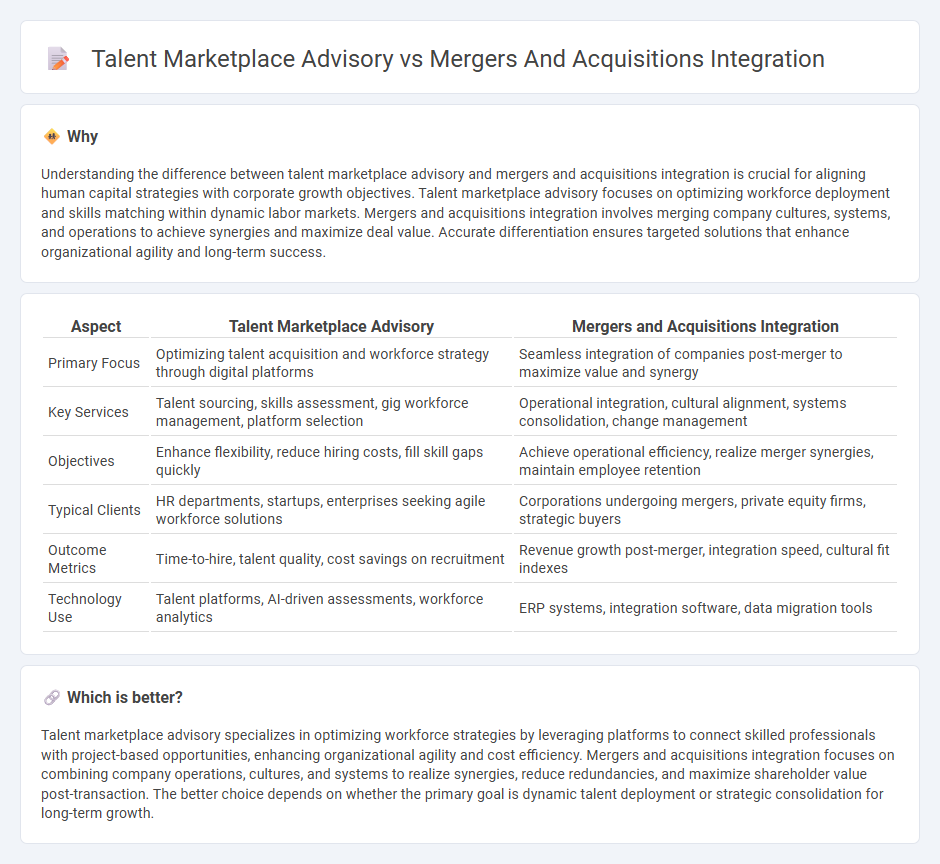

Understanding the difference between talent marketplace advisory and mergers and acquisitions integration is crucial for aligning human capital strategies with corporate growth objectives. Talent marketplace advisory focuses on optimizing workforce deployment and skills matching within dynamic labor markets. Mergers and acquisitions integration involves merging company cultures, systems, and operations to achieve synergies and maximize deal value. Accurate differentiation ensures targeted solutions that enhance organizational agility and long-term success.

Comparison Table

| Aspect | Talent Marketplace Advisory | Mergers and Acquisitions Integration |

|---|---|---|

| Primary Focus | Optimizing talent acquisition and workforce strategy through digital platforms | Seamless integration of companies post-merger to maximize value and synergy |

| Key Services | Talent sourcing, skills assessment, gig workforce management, platform selection | Operational integration, cultural alignment, systems consolidation, change management |

| Objectives | Enhance flexibility, reduce hiring costs, fill skill gaps quickly | Achieve operational efficiency, realize merger synergies, maintain employee retention |

| Typical Clients | HR departments, startups, enterprises seeking agile workforce solutions | Corporations undergoing mergers, private equity firms, strategic buyers |

| Outcome Metrics | Time-to-hire, talent quality, cost savings on recruitment | Revenue growth post-merger, integration speed, cultural fit indexes |

| Technology Use | Talent platforms, AI-driven assessments, workforce analytics | ERP systems, integration software, data migration tools |

Which is better?

Talent marketplace advisory specializes in optimizing workforce strategies by leveraging platforms to connect skilled professionals with project-based opportunities, enhancing organizational agility and cost efficiency. Mergers and acquisitions integration focuses on combining company operations, cultures, and systems to realize synergies, reduce redundancies, and maximize shareholder value post-transaction. The better choice depends on whether the primary goal is dynamic talent deployment or strategic consolidation for long-term growth.

Connection

Talent marketplace advisory plays a critical role in mergers and acquisitions (M&A) integration by aligning human capital strategies with organizational goals to ensure a smooth transition and retention of key employees. Effective talent marketplace advisory identifies skill gaps, optimizes workforce allocation, and supports cultural integration, directly impacting the success of post-M&A performance. This connection enhances operational efficiency, minimizes disruption, and accelerates value realization in combined entities.

Key Terms

**Mergers and acquisitions integration:**

Mergers and acquisitions integration involves the strategic alignment of business processes, cultural harmonization, and technology systems to maximize value creation and operational efficiency. Successful integration requires meticulous planning around organizational structures, workforce retention, and seamless communication to mitigate risks and disruption. Explore how expert advisory accelerates post-merger success through tailored integration frameworks and best practices.

Synergy realization

Mergers and acquisitions integration emphasizes aligning organizational structures, processes, and cultures to unlock financial and operational synergies for enhanced value creation. Talent marketplace advisory focuses on dynamic workforce planning and internal talent mobility to optimize human capital and accelerate synergy realization during integration phases. Explore our expertise to understand how combining strategic integration and talent advisory drives superior merger outcomes.

Change management

Change management in mergers and acquisitions integration centers on aligning organizational cultures, streamlining processes, and retaining key talent to ensure seamless operational transitions and value realization. Talent marketplace advisory emphasizes dynamic workforce agility by matching skills to evolving business needs, fostering employee engagement, and supporting continuous development during organizational change. Explore how strategic change management approaches enhance both M&A success and talent fluidity for sustainable growth.

Source and External Links

What is Integration in M&A - M&A integration (Post-merger integration) is the process of combining two or more companies to operate together, with approaches including targeted (light-touch), full (tuck-in), or selective functional integration depending on the buyer's goals to capture synergies and efficiencies.

Nine steps to setting up an M&A integration program - A successful M&A integration program starts with defining value drivers and integration strategy aligned with leadership priorities, typically involving nine phases to preserve value, realize synergies, and minimize risks throughout the process.

The 10 Steps to Successful M&A Integration - Modern M&A integration uses digital tools and artificial intelligence to accelerate planning and execution, providing data-driven insights and improving efficiency compared to traditional project-heavy methods.

dowidth.com

dowidth.com