ESG reporting advisory focuses on helping companies integrate environmental, social, and governance criteria into their disclosure practices to meet regulatory requirements and enhance stakeholder trust. Mergers & acquisitions advisory specializes in guiding firms through complex transactions, including valuation, due diligence, and deal structuring to maximize value and minimize risk. Explore how tailored consulting services can drive strategic decisions in both ESG compliance and M&A success.

Why it is important

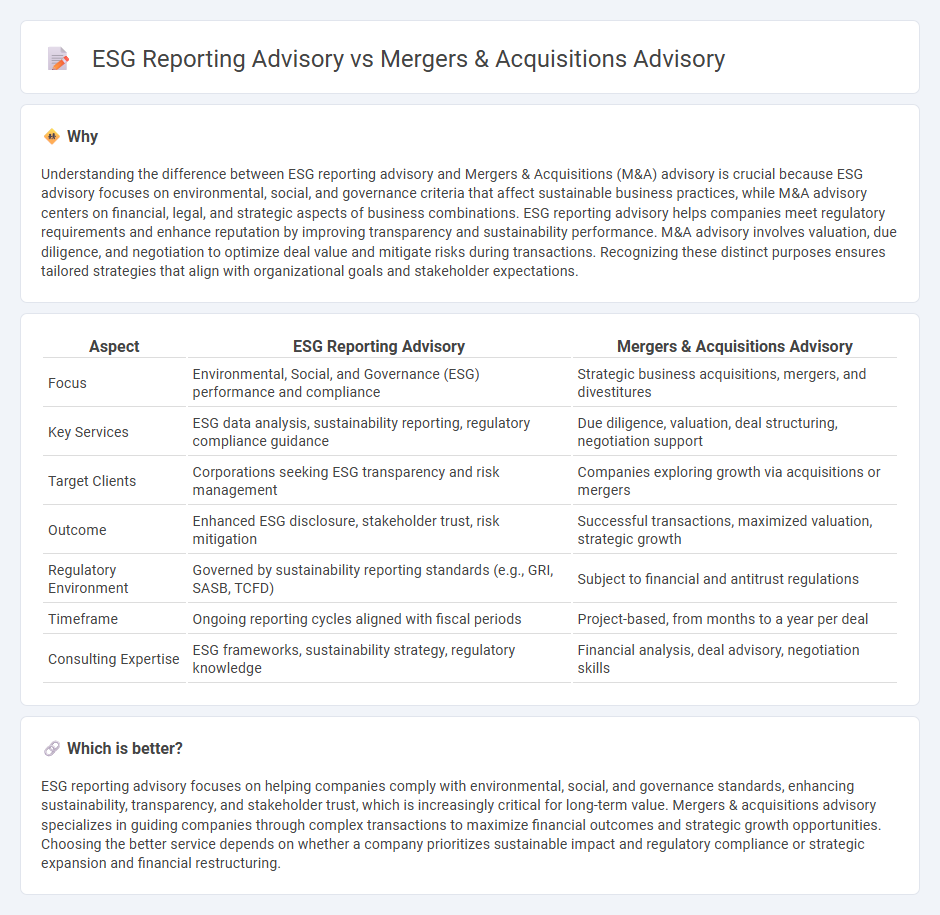

Understanding the difference between ESG reporting advisory and Mergers & Acquisitions (M&A) advisory is crucial because ESG advisory focuses on environmental, social, and governance criteria that affect sustainable business practices, while M&A advisory centers on financial, legal, and strategic aspects of business combinations. ESG reporting advisory helps companies meet regulatory requirements and enhance reputation by improving transparency and sustainability performance. M&A advisory involves valuation, due diligence, and negotiation to optimize deal value and mitigate risks during transactions. Recognizing these distinct purposes ensures tailored strategies that align with organizational goals and stakeholder expectations.

Comparison Table

| Aspect | ESG Reporting Advisory | Mergers & Acquisitions Advisory |

|---|---|---|

| Focus | Environmental, Social, and Governance (ESG) performance and compliance | Strategic business acquisitions, mergers, and divestitures |

| Key Services | ESG data analysis, sustainability reporting, regulatory compliance guidance | Due diligence, valuation, deal structuring, negotiation support |

| Target Clients | Corporations seeking ESG transparency and risk management | Companies exploring growth via acquisitions or mergers |

| Outcome | Enhanced ESG disclosure, stakeholder trust, risk mitigation | Successful transactions, maximized valuation, strategic growth |

| Regulatory Environment | Governed by sustainability reporting standards (e.g., GRI, SASB, TCFD) | Subject to financial and antitrust regulations |

| Timeframe | Ongoing reporting cycles aligned with fiscal periods | Project-based, from months to a year per deal |

| Consulting Expertise | ESG frameworks, sustainability strategy, regulatory knowledge | Financial analysis, deal advisory, negotiation skills |

Which is better?

ESG reporting advisory focuses on helping companies comply with environmental, social, and governance standards, enhancing sustainability, transparency, and stakeholder trust, which is increasingly critical for long-term value. Mergers & acquisitions advisory specializes in guiding companies through complex transactions to maximize financial outcomes and strategic growth opportunities. Choosing the better service depends on whether a company prioritizes sustainable impact and regulatory compliance or strategic expansion and financial restructuring.

Connection

ESG reporting advisory and mergers & acquisitions (M&A) advisory are interconnected through their focus on risk assessment, value creation, and stakeholder transparency. ESG reporting advisory helps identify environmental, social, and governance risks that can impact the valuation and integration processes in M&A transactions. Incorporating ESG metrics during due diligence enhances decision-making and supports sustainable growth strategies in mergers and acquisitions.

Key Terms

**Mergers & Acquisitions Advisory:**

Mergers & acquisitions advisory specializes in facilitating strategic transactions by providing expert guidance on deal structuring, valuation, due diligence, and negotiation to maximize shareholder value. This advisory service leverages market analysis, financial modeling, and regulatory expertise to ensure seamless integration and risk mitigation across diverse industries. Explore our comprehensive M&A solutions to unlock growth opportunities and gain a competitive edge.

Due Diligence

Mergers & acquisitions advisory emphasizes thorough due diligence to assess financial, operational, and legal risks before transaction completion, ensuring informed decision-making and minimizing liabilities. ESG reporting advisory due diligence focuses on verifying environmental, social, and governance data accuracy, identifying sustainability risks, and aligning disclosures with regulatory standards and stakeholder expectations. Explore how specialized due diligence approaches in both areas drive strategic value and compliance excellence.

Valuation

Mergers & acquisitions advisory prioritizes accurate business valuation using financial metrics, market trends, and synergy potential to guide deal negotiations and strategic decisions. ESG reporting advisory integrates environmental, social, and governance criteria into valuation models, emphasizing sustainability risks and long-term value creation for investors and stakeholders. Explore how combining these advisory services can enhance comprehensive valuation insights and drive informed investment choices.

Source and External Links

What is M&A advisory? Key roles and their functions - M&A Community - M&A advisory services assist companies in all aspects of mergers and acquisitions, including strategic planning, market analysis, valuation, deal structuring, due diligence, negotiation, financing, legal compliance, and post-merger integration.

M&A and Strategic Advisory - Lazard - Leading advisory firms like Lazard partner with corporate clients to provide independent advice on financial and strategic elements of M&A, helping clients evaluate, execute deals, and formulate growth strategies to maximize shareholder value.

Who are M&A Advisors and What Do They Do? - DealRoom.net - M&A advisory firms guide companies through the complexities of buy-side and sell-side transactions, offering expertise in deal evaluation, negotiation, and handling legal and financial aspects, typically earning fees based on transaction value or retainers.

dowidth.com

dowidth.com