Cost-to-serve analysis identifies the actual expenses associated with delivering products or services to customers, focusing on logistics, production, and support costs. Margin analysis evaluates the profitability of products or services by comparing revenue against direct and indirect costs. Discover how integrating these analyses can optimize pricing and resource allocation strategies.

Why it is important

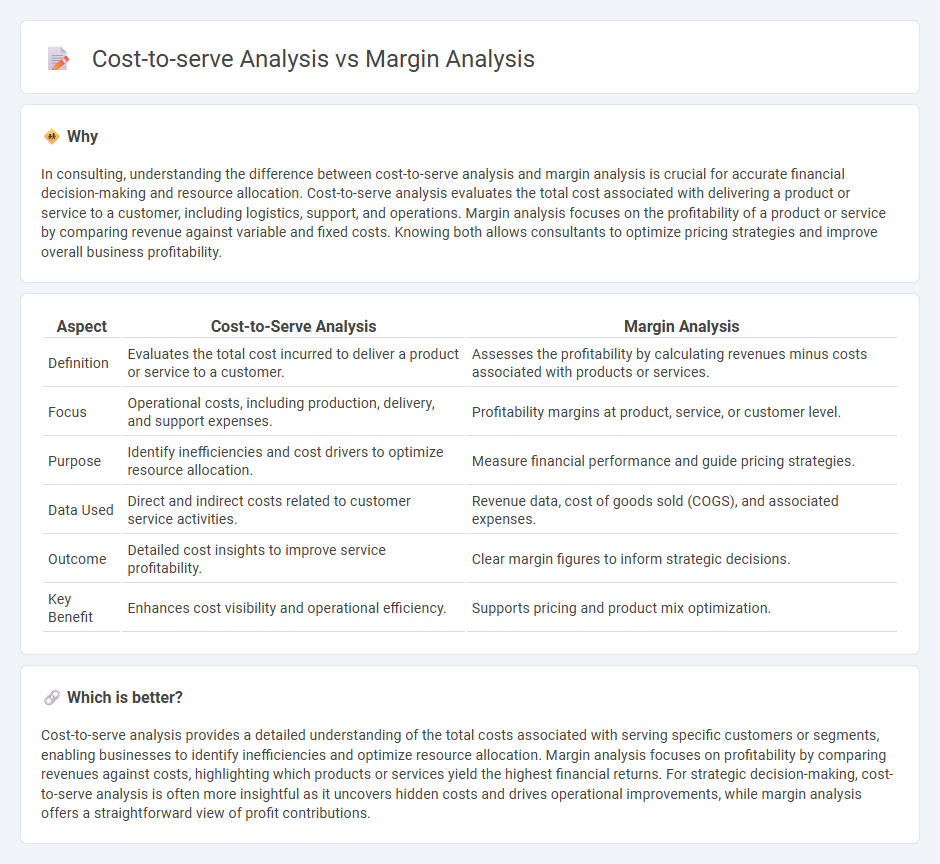

In consulting, understanding the difference between cost-to-serve analysis and margin analysis is crucial for accurate financial decision-making and resource allocation. Cost-to-serve analysis evaluates the total cost associated with delivering a product or service to a customer, including logistics, support, and operations. Margin analysis focuses on the profitability of a product or service by comparing revenue against variable and fixed costs. Knowing both allows consultants to optimize pricing strategies and improve overall business profitability.

Comparison Table

| Aspect | Cost-to-Serve Analysis | Margin Analysis |

|---|---|---|

| Definition | Evaluates the total cost incurred to deliver a product or service to a customer. | Assesses the profitability by calculating revenues minus costs associated with products or services. |

| Focus | Operational costs, including production, delivery, and support expenses. | Profitability margins at product, service, or customer level. |

| Purpose | Identify inefficiencies and cost drivers to optimize resource allocation. | Measure financial performance and guide pricing strategies. |

| Data Used | Direct and indirect costs related to customer service activities. | Revenue data, cost of goods sold (COGS), and associated expenses. |

| Outcome | Detailed cost insights to improve service profitability. | Clear margin figures to inform strategic decisions. |

| Key Benefit | Enhances cost visibility and operational efficiency. | Supports pricing and product mix optimization. |

Which is better?

Cost-to-serve analysis provides a detailed understanding of the total costs associated with serving specific customers or segments, enabling businesses to identify inefficiencies and optimize resource allocation. Margin analysis focuses on profitability by comparing revenues against costs, highlighting which products or services yield the highest financial returns. For strategic decision-making, cost-to-serve analysis is often more insightful as it uncovers hidden costs and drives operational improvements, while margin analysis offers a straightforward view of profit contributions.

Connection

Cost-to-serve analysis identifies the total expenses incurred to deliver a product or service to a customer, providing detailed insights into resource allocation and operational costs. Margin analysis leverages this data to calculate profitability at various levels, highlighting which customers or products generate the highest returns. Integrating both analyses enables businesses to optimize pricing strategies, reduce inefficiencies, and enhance overall financial performance.

Key Terms

Profitability

Margin analysis evaluates the profitability of products or services by comparing sales revenue to direct costs, highlighting contribution per item to overall profit. Cost-to-serve analysis allocates total supply chain and operational costs to individual customers or channels, providing a detailed view of true profit margins by factoring in indirect expenses. Explore how integrating both approaches can optimize pricing strategies and enhance business profitability.

Activity-based costing

Margin analysis evaluates product profitability by comparing revenues against direct and indirect costs, whereas cost-to-serve analysis allocates expenses based on specific customer activities and service requirements. Activity-based costing (ABC) enhances cost-to-serve analysis by assigning overhead and indirect costs more accurately through identifying cost drivers related to production, distribution, and customer service. Explore how integrating ABC in margin and cost-to-serve analyses can optimize pricing strategies and improve operational efficiency.

Customer segmentation

Margin analysis evaluates profitability by examining revenue minus costs for each customer segment, highlighting high-margin groups for targeted growth. Cost-to-serve analysis digs deeper into the specific expenses incurred to serve distinct customer segments, identifying cost-drivers that impact service efficiency and overall profitability. Explore how integrating both analyses can optimize customer segmentation strategies and improve financial performance.

Source and External Links

What is Margin Analysis? - DealHub - Margin analysis evaluates profitability by analyzing the difference between sales price and cost of goods sold across gross, net, and operating margins to identify the most and least profitable products or services and guide strategic decisions.

How to Use Profitability & Margin Ratios - Profit margin, expressed as a percentage, measures income remaining after costs are deducted from revenue, and margin ratios help assess a company's profitability and operational efficiency over time.

What is Contribution Margin: Profitability Analysis - Saras Analytics - Contribution margin measures profitability per product by calculating sales minus variable costs, which helps determine the break-even point and guides cost management, pricing, and financial planning decisions.

dowidth.com

dowidth.com