Sustainability reporting consulting focuses on helping organizations measure, manage, and communicate their environmental, social, and governance (ESG) performance to meet regulatory requirements and stakeholder expectations. M&A consulting, on the other hand, provides strategic guidance during mergers and acquisitions, including due diligence, valuation, and integration to maximize deal value. Explore how specialized consulting services can drive both sustainable growth and successful transactions.

Why it is important

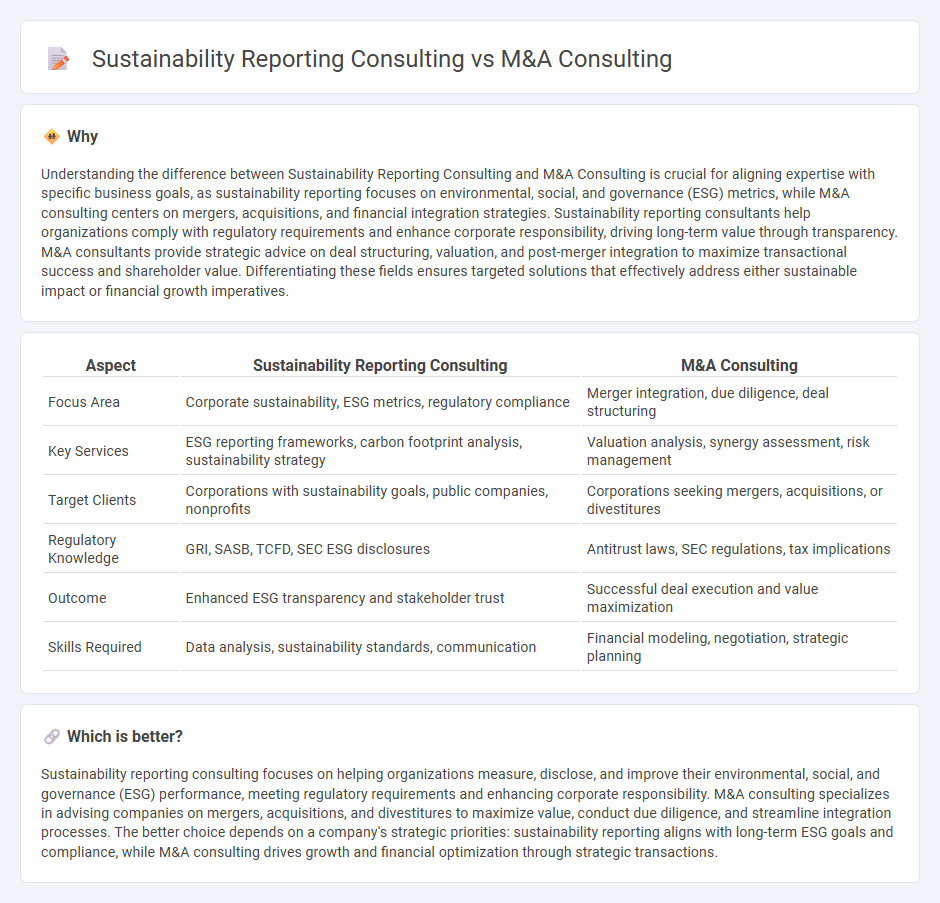

Understanding the difference between Sustainability Reporting Consulting and M&A Consulting is crucial for aligning expertise with specific business goals, as sustainability reporting focuses on environmental, social, and governance (ESG) metrics, while M&A consulting centers on mergers, acquisitions, and financial integration strategies. Sustainability reporting consultants help organizations comply with regulatory requirements and enhance corporate responsibility, driving long-term value through transparency. M&A consultants provide strategic advice on deal structuring, valuation, and post-merger integration to maximize transactional success and shareholder value. Differentiating these fields ensures targeted solutions that effectively address either sustainable impact or financial growth imperatives.

Comparison Table

| Aspect | Sustainability Reporting Consulting | M&A Consulting |

|---|---|---|

| Focus Area | Corporate sustainability, ESG metrics, regulatory compliance | Merger integration, due diligence, deal structuring |

| Key Services | ESG reporting frameworks, carbon footprint analysis, sustainability strategy | Valuation analysis, synergy assessment, risk management |

| Target Clients | Corporations with sustainability goals, public companies, nonprofits | Corporations seeking mergers, acquisitions, or divestitures |

| Regulatory Knowledge | GRI, SASB, TCFD, SEC ESG disclosures | Antitrust laws, SEC regulations, tax implications |

| Outcome | Enhanced ESG transparency and stakeholder trust | Successful deal execution and value maximization |

| Skills Required | Data analysis, sustainability standards, communication | Financial modeling, negotiation, strategic planning |

Which is better?

Sustainability reporting consulting focuses on helping organizations measure, disclose, and improve their environmental, social, and governance (ESG) performance, meeting regulatory requirements and enhancing corporate responsibility. M&A consulting specializes in advising companies on mergers, acquisitions, and divestitures to maximize value, conduct due diligence, and streamline integration processes. The better choice depends on a company's strategic priorities: sustainability reporting aligns with long-term ESG goals and compliance, while M&A consulting drives growth and financial optimization through strategic transactions.

Connection

Sustainability reporting consulting and M&A consulting intersect through the integration of environmental, social, and governance (ESG) due diligence in mergers and acquisitions, enabling firms to assess risks and opportunities linked to sustainability practices. Effective sustainability reporting informs M&A decisions by providing transparent data on a company's carbon footprint, resource efficiency, and social impact, which influences valuation and regulatory compliance. This connection enhances strategic alignment and long-term value creation in deal-making processes focused on sustainable growth.

Key Terms

**M&A Consulting:**

M&A consulting specializes in guiding companies through mergers and acquisitions by providing strategic due diligence, valuation analysis, and integration planning to maximize transaction value. Experts leverage financial modeling, risk assessment, and market analysis to ensure smooth deal execution and post-merger synergy realization. Explore in-depth insights into M&A consulting methodologies and benefits to enhance your corporate growth strategy.

Due Diligence

M&A consulting due diligence emphasizes financial, operational, and legal risk assessments to ensure transaction viability and value maximization. Sustainability reporting consulting due diligence centers on environmental, social, and governance (ESG) metrics, verifying data accuracy and compliance with standards like GRI or SASB. Explore more about how focused due diligence can optimize your strategic goals.

Synergy Identification

M&A consulting emphasizes synergy identification by evaluating potential financial, operational, and strategic benefits between merging entities to maximize value creation. Sustainability reporting consulting focuses on identifying synergies through aligning environmental, social, and governance (ESG) goals, ensuring compliance, and enhancing corporate responsibility across merged organizations. Explore more to understand how these consulting approaches uniquely drive integrated value and sustainable growth.

Source and External Links

Top M&A Consulting Services to Elevate Your Business - M&A consulting firms help businesses plan, execute, and manage mergers and acquisitions by providing tailored expertise, due diligence, advanced analytics, and ensuring legal compliance throughout complex transactions.

M&A (Mergers & Acquisitions) Strategy Consulting | BCG - BCG's M&A consultants deliver strategic, value-creating support at every stage--from target identification and due diligence to post-merger integration--using proprietary methodologies and industry-specific insights to avoid common pitfalls and maximize deal success.

M&A consulting - EY's M&A consulting teams offer end-to-end services including growth strategy, portfolio reshaping, due diligence, post-merger integration, and restructuring, leveraging AI-powered analytics and global sector experience to align acquisitions with strategic objectives and optimize value.

dowidth.com

dowidth.com