Acquihire strategy involves acquiring a company primarily for its skilled workforce, enabling rapid talent integration and innovation acceleration within consulting firms. In contrast, a joint venture establishes a collaborative partnership between companies to share resources, risks, and expertise for a specific consulting project or market expansion. Discover more about how these strategic approaches can drive growth and competitive advantage in the consulting industry.

Why it is important

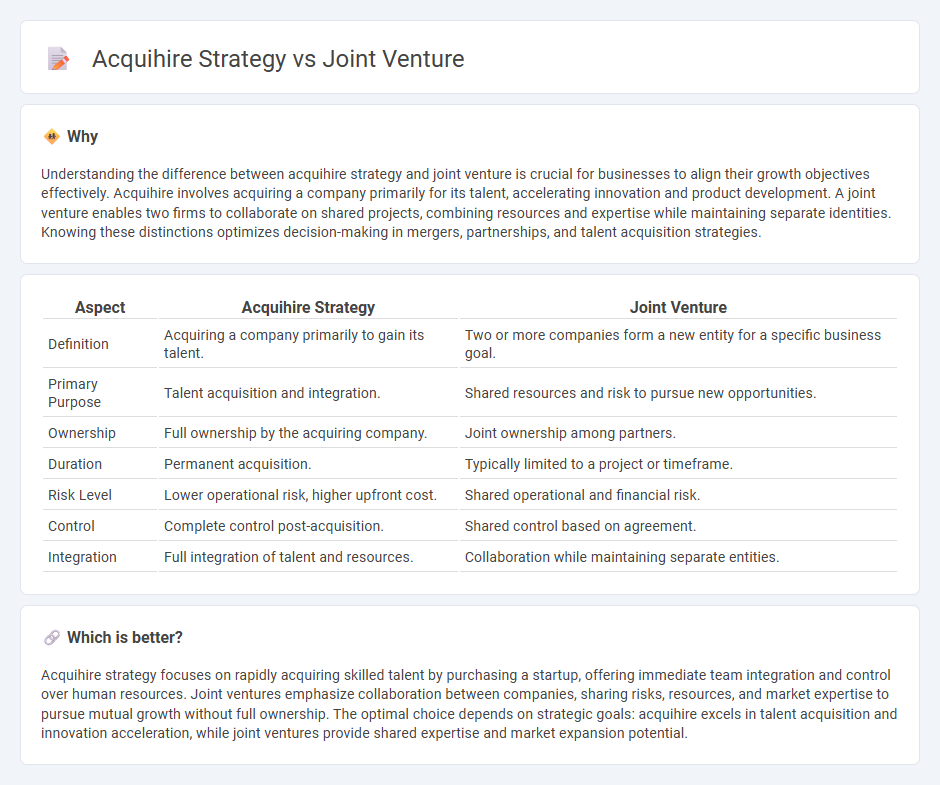

Understanding the difference between acquihire strategy and joint venture is crucial for businesses to align their growth objectives effectively. Acquihire involves acquiring a company primarily for its talent, accelerating innovation and product development. A joint venture enables two firms to collaborate on shared projects, combining resources and expertise while maintaining separate identities. Knowing these distinctions optimizes decision-making in mergers, partnerships, and talent acquisition strategies.

Comparison Table

| Aspect | Acquihire Strategy | Joint Venture |

|---|---|---|

| Definition | Acquiring a company primarily to gain its talent. | Two or more companies form a new entity for a specific business goal. |

| Primary Purpose | Talent acquisition and integration. | Shared resources and risk to pursue new opportunities. |

| Ownership | Full ownership by the acquiring company. | Joint ownership among partners. |

| Duration | Permanent acquisition. | Typically limited to a project or timeframe. |

| Risk Level | Lower operational risk, higher upfront cost. | Shared operational and financial risk. |

| Control | Complete control post-acquisition. | Shared control based on agreement. |

| Integration | Full integration of talent and resources. | Collaboration while maintaining separate entities. |

Which is better?

Acquihire strategy focuses on rapidly acquiring skilled talent by purchasing a startup, offering immediate team integration and control over human resources. Joint ventures emphasize collaboration between companies, sharing risks, resources, and market expertise to pursue mutual growth without full ownership. The optimal choice depends on strategic goals: acquihire excels in talent acquisition and innovation acceleration, while joint ventures provide shared expertise and market expansion potential.

Connection

Acquihire strategy and joint ventures both facilitate synergistic business growth by combining resources and expertise. Acquihires focus on acquiring talent through company purchase, enhancing innovation and operational capabilities, while joint ventures involve collaborative partnerships to share risks and market access. Together, these approaches optimize competitive advantage through strategic integration of human capital and market opportunities.

Key Terms

Ownership Structure

Joint ventures involve shared ownership between two or more companies, each contributing resources and sharing profits, risks, and management control. Acquihires refer to the acquisition of a company primarily for its talented employees, resulting in full ownership transfer to the acquiring firm with less emphasis on the target company's existing structure or assets. Explore detailed comparisons of ownership structures to understand which strategy fits your business goals.

Talent Acquisition

A joint venture enables companies to collaborate strategically, combining resources to access new markets and share talent acquisition goals without full integration. Acquihire focuses on rapidly acquiring specialized teams or key individuals to boost innovation and fill critical skill gaps within an organization. Explore the unique benefits and considerations of each approach for effective talent acquisition strategies.

Strategic Control

Joint ventures allow companies to share strategic control and resources equally, facilitating collaboration while maintaining mutual decision-making power. Acquihires prioritize acquiring talent and integrating teams, often leading to a shift in control toward the acquiring company. Explore these strategies further to understand their impact on strategic control and business growth.

Source and External Links

What Is a Joint Venture and How Does It Work? - NerdWallet - A joint venture is an agreement where two or more people or companies collaborate to achieve a specific business goal, often formed to access new markets or complementary resources.

Joint Venture (JV) - Corporate Finance Institute - A joint venture is a commercial enterprise where two or more organizations combine resources to gain strategic market advantages, share profits and losses, and enter new markets more efficiently.

joint venture | Wex | US Law | LII / Legal Information Institute - A joint venture is a partnership between at least two parties to develop a single enterprise or project for profit, sharing risks, contributions, and control; it is distinct from a corporation or general partnership.

dowidth.com

dowidth.com