Operational due diligence focuses on evaluating a company's internal processes, management systems, and operational efficiency to identify potential risks and improvement areas. Financial due diligence analyzes the accuracy of financial statements, cash flow, and overall fiscal health to ensure sound investment decisions. Explore our detailed guide to understand the key differences and benefits of both types of due diligence.

Why it is important

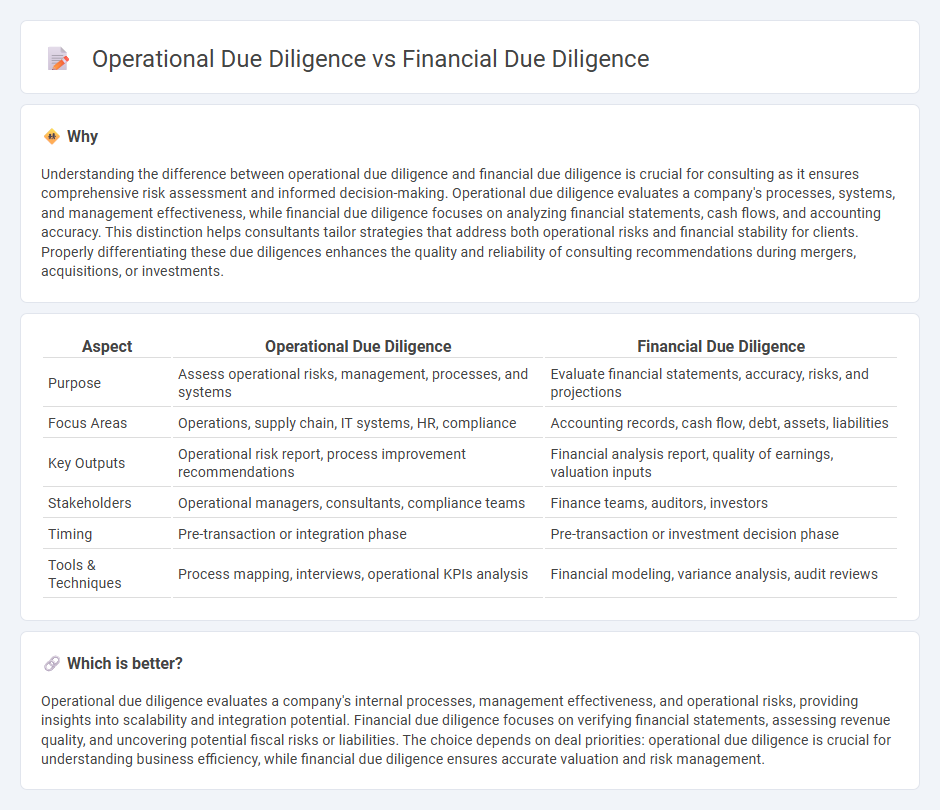

Understanding the difference between operational due diligence and financial due diligence is crucial for consulting as it ensures comprehensive risk assessment and informed decision-making. Operational due diligence evaluates a company's processes, systems, and management effectiveness, while financial due diligence focuses on analyzing financial statements, cash flows, and accounting accuracy. This distinction helps consultants tailor strategies that address both operational risks and financial stability for clients. Properly differentiating these due diligences enhances the quality and reliability of consulting recommendations during mergers, acquisitions, or investments.

Comparison Table

| Aspect | Operational Due Diligence | Financial Due Diligence |

|---|---|---|

| Purpose | Assess operational risks, management, processes, and systems | Evaluate financial statements, accuracy, risks, and projections |

| Focus Areas | Operations, supply chain, IT systems, HR, compliance | Accounting records, cash flow, debt, assets, liabilities |

| Key Outputs | Operational risk report, process improvement recommendations | Financial analysis report, quality of earnings, valuation inputs |

| Stakeholders | Operational managers, consultants, compliance teams | Finance teams, auditors, investors |

| Timing | Pre-transaction or integration phase | Pre-transaction or investment decision phase |

| Tools & Techniques | Process mapping, interviews, operational KPIs analysis | Financial modeling, variance analysis, audit reviews |

Which is better?

Operational due diligence evaluates a company's internal processes, management effectiveness, and operational risks, providing insights into scalability and integration potential. Financial due diligence focuses on verifying financial statements, assessing revenue quality, and uncovering potential fiscal risks or liabilities. The choice depends on deal priorities: operational due diligence is crucial for understanding business efficiency, while financial due diligence ensures accurate valuation and risk management.

Connection

Operational due diligence assesses a company's internal processes, management efficiency, and operational risks, while financial due diligence examines financial statements, cash flow, and profitability metrics. Both types of due diligence are interconnected as operational insights directly impact financial performance, revealing potential red flags or growth opportunities. Integrating findings from both ensures a comprehensive evaluation of a target company's overall viability and risk profile in consulting engagements.

Key Terms

**Financial Due Diligence:**

Financial Due Diligence focuses on analyzing a company's historical and projected financial statements, verifying assets, liabilities, cash flow, and profitability to assess its fiscal health and uncover potential risks. This in-depth review helps investors validate valuation, identify financial irregularities, and ensure compliance with accounting standards before transactions. Discover more insights into how financial due diligence drives informed investment decisions.

EBITDA

Financial due diligence centers on verifying the accuracy of EBITDA by analyzing historical financial statements, cash flow, and accounting practices to ensure the reported earnings are reliable and sustainable. Operational due diligence evaluates the underlying business operations, including cost structures, efficiency, and scalability, to identify factors that directly impact EBITDA performance and growth potential. Explore further to understand how these distinct due diligence approaches influence investment decisions and valuation.

Working Capital

Financial due diligence rigorously examines working capital to verify the accuracy of reported figures and identify potential liquidity risks impacting cash flow. Operational due diligence assesses working capital efficiency by analyzing inventory turnover, receivables management, and supplier payment terms to optimize day-to-day business performance. Discover detailed insights on how working capital evaluation varies between financial and operational due diligence.

Source and External Links

How to Conduct Financial Due Diligence + Checklist - DealRoom.net - Financial due diligence is a deep investigation into a company's financial statements over five years, analyzing income statements, balance sheets, expenses, earnings quality, and exceptional items to assess financial health and risks before a transaction.

Financial Due Diligence: An essential step in the M&A process - Grant Thornton - Financial due diligence provides an in-depth assessment of a company's financial stability and growth potential, uncovering hidden liabilities, validating statements, and influencing transaction terms to ensure informed decision-making in mergers and acquisitions.

Difference Between Audit and Financial Due Diligence | ML&R - Unlike audits, financial due diligence focuses on sustainable earnings, sales trends, working capital, management forecasts, and qualitative factors like internal controls and management, aiming to provide investors with a forward-looking evaluation beyond historical financials.

dowidth.com

dowidth.com