Red team consulting specializes in cybersecurity by simulating cyberattacks to identify vulnerabilities and strengthen defenses across organizations. Financial consulting focuses on advising businesses on financial planning, risk management, and investment strategies to optimize fiscal performance. Discover how each consulting type uniquely supports organizational resilience and growth.

Why it is important

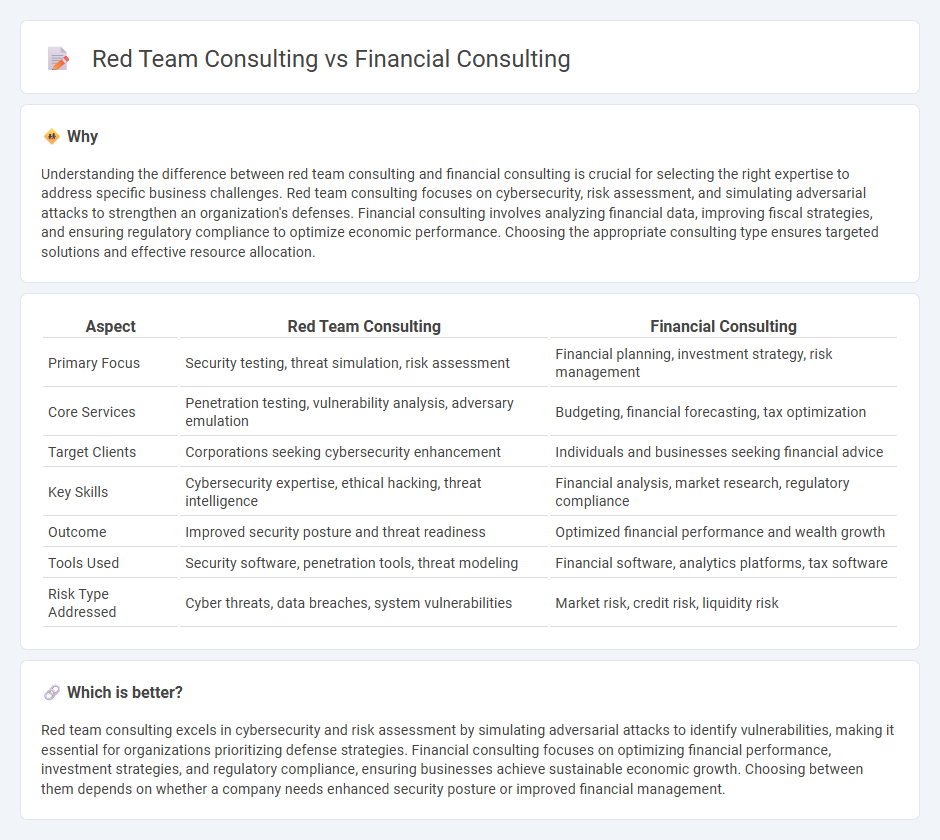

Understanding the difference between red team consulting and financial consulting is crucial for selecting the right expertise to address specific business challenges. Red team consulting focuses on cybersecurity, risk assessment, and simulating adversarial attacks to strengthen an organization's defenses. Financial consulting involves analyzing financial data, improving fiscal strategies, and ensuring regulatory compliance to optimize economic performance. Choosing the appropriate consulting type ensures targeted solutions and effective resource allocation.

Comparison Table

| Aspect | Red Team Consulting | Financial Consulting |

|---|---|---|

| Primary Focus | Security testing, threat simulation, risk assessment | Financial planning, investment strategy, risk management |

| Core Services | Penetration testing, vulnerability analysis, adversary emulation | Budgeting, financial forecasting, tax optimization |

| Target Clients | Corporations seeking cybersecurity enhancement | Individuals and businesses seeking financial advice |

| Key Skills | Cybersecurity expertise, ethical hacking, threat intelligence | Financial analysis, market research, regulatory compliance |

| Outcome | Improved security posture and threat readiness | Optimized financial performance and wealth growth |

| Tools Used | Security software, penetration tools, threat modeling | Financial software, analytics platforms, tax software |

| Risk Type Addressed | Cyber threats, data breaches, system vulnerabilities | Market risk, credit risk, liquidity risk |

Which is better?

Red team consulting excels in cybersecurity and risk assessment by simulating adversarial attacks to identify vulnerabilities, making it essential for organizations prioritizing defense strategies. Financial consulting focuses on optimizing financial performance, investment strategies, and regulatory compliance, ensuring businesses achieve sustainable economic growth. Choosing between them depends on whether a company needs enhanced security posture or improved financial management.

Connection

Red team consulting and financial consulting intersect through risk assessment and strategic decision-making frameworks. Red team consulting challenges financial models and assumptions by simulating adversarial scenarios to identify vulnerabilities within investment strategies or compliance frameworks. This approach enhances financial consultants' ability to develop robust risk mitigation plans and optimize asset management under uncertain market conditions.

Key Terms

**Financial Consulting:**

Financial consulting specializes in providing expert advice on investment strategies, risk management, and corporate finance to optimize an organization's financial performance and growth. This field utilizes quantitative analysis, financial modeling, and regulatory compliance expertise to enhance decision-making and increase profitability. Discover how financial consultants can transform your business's financial health with tailored strategies and insights.

Portfolio Management

Financial consulting in portfolio management emphasizes optimizing investment strategies, risk assessment, and asset allocation to maximize returns and ensure client financial goals are met. Red team consulting, in contrast, applies adversarial simulations and strategic stress-testing to identify vulnerabilities and improve decision-making within portfolio management frameworks. Explore how integrating financial and red team consulting can enhance portfolio resilience and performance.

Risk Assessment

Financial consulting centers on evaluating fiscal risks such as market volatility, credit exposure, and liquidity challenges to protect organizational assets. Red team consulting specializes in simulating adversarial threats, identifying vulnerabilities in cybersecurity, physical security, and operational processes to enhance overall defense strategies. Explore how integrating both approaches can create a comprehensive risk assessment framework for your business.

Source and External Links

What Is a Financial Consultant? - NerdWallet - A financial consultant is a financial advisor who audits your current financial situation and designs strategies to help achieve your future goals, offering services like retirement planning, investment advice, tax preparation, and insurance guidance depending on their credentials.

Best Financial Consulting Providers in Chicago, IL - G2 - Financial consulting firms help businesses improve financial strategy and efficiency to maximize revenue, often collaborating closely with CFOs, and operate independently or within larger consulting firms.

What Is a Financial Consultant and What Do They Do? - SmartAsset - Financial consultants provide personalized analysis and planning covering assets, expenses, and income to help clients meet goals such as retirement, home buying, or education funding, with various types specializing in tax planning, investment management, or insurance.

dowidth.com

dowidth.com