ESG due diligence focuses on evaluating a company's environmental, social, and governance practices to identify potential risks and opportunities linked to sustainability and ethical factors. Strategic due diligence assesses the overall business model, market positioning, and growth prospects to inform investment decisions and corporate strategy. Explore how integrating ESG and strategic due diligence can enhance decision-making and long-term value creation.

Why it is important

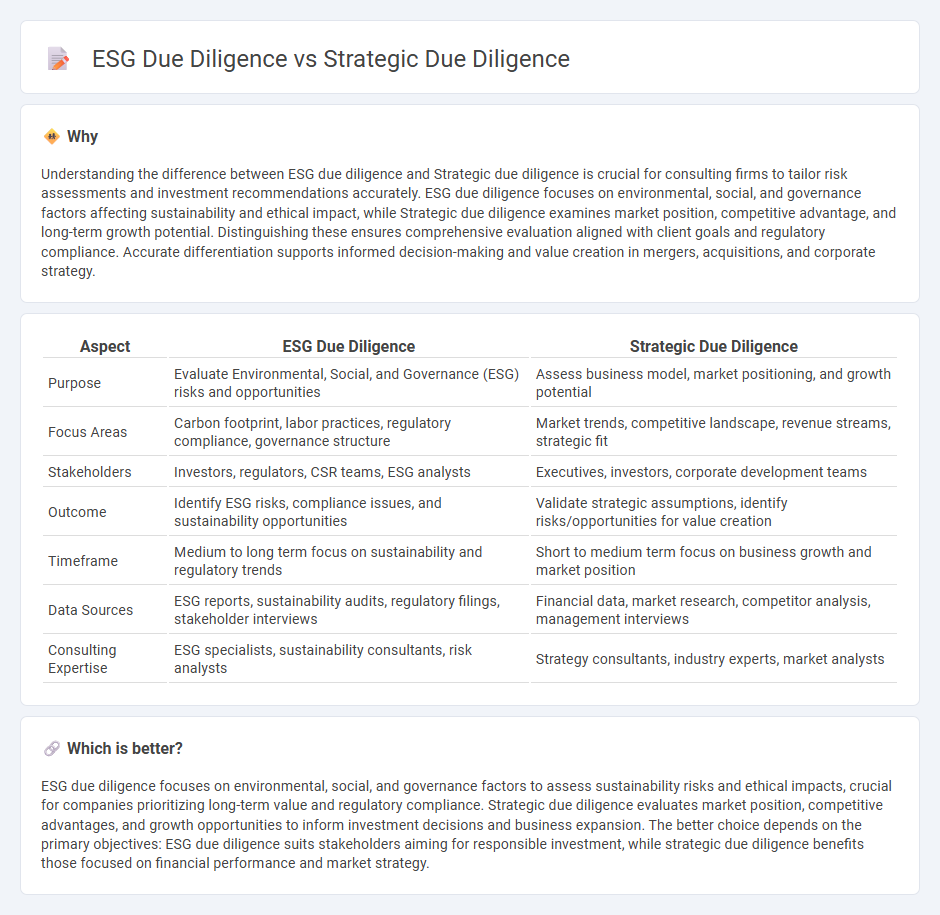

Understanding the difference between ESG due diligence and Strategic due diligence is crucial for consulting firms to tailor risk assessments and investment recommendations accurately. ESG due diligence focuses on environmental, social, and governance factors affecting sustainability and ethical impact, while Strategic due diligence examines market position, competitive advantage, and long-term growth potential. Distinguishing these ensures comprehensive evaluation aligned with client goals and regulatory compliance. Accurate differentiation supports informed decision-making and value creation in mergers, acquisitions, and corporate strategy.

Comparison Table

| Aspect | ESG Due Diligence | Strategic Due Diligence |

|---|---|---|

| Purpose | Evaluate Environmental, Social, and Governance (ESG) risks and opportunities | Assess business model, market positioning, and growth potential |

| Focus Areas | Carbon footprint, labor practices, regulatory compliance, governance structure | Market trends, competitive landscape, revenue streams, strategic fit |

| Stakeholders | Investors, regulators, CSR teams, ESG analysts | Executives, investors, corporate development teams |

| Outcome | Identify ESG risks, compliance issues, and sustainability opportunities | Validate strategic assumptions, identify risks/opportunities for value creation |

| Timeframe | Medium to long term focus on sustainability and regulatory trends | Short to medium term focus on business growth and market position |

| Data Sources | ESG reports, sustainability audits, regulatory filings, stakeholder interviews | Financial data, market research, competitor analysis, management interviews |

| Consulting Expertise | ESG specialists, sustainability consultants, risk analysts | Strategy consultants, industry experts, market analysts |

Which is better?

ESG due diligence focuses on environmental, social, and governance factors to assess sustainability risks and ethical impacts, crucial for companies prioritizing long-term value and regulatory compliance. Strategic due diligence evaluates market position, competitive advantages, and growth opportunities to inform investment decisions and business expansion. The better choice depends on the primary objectives: ESG due diligence suits stakeholders aiming for responsible investment, while strategic due diligence benefits those focused on financial performance and market strategy.

Connection

ESG due diligence evaluates environmental, social, and governance risks integral to a company's sustainability and ethical impact, directly influencing strategic decision-making. Strategic due diligence assesses a target's market positioning, competitive advantage, and long-term growth potential, incorporating ESG insights to ensure alignment with corporate values and regulatory expectations. The integration of ESG criteria into strategic due diligence enhances risk management and supports sustainable value creation in consulting engagements.

Key Terms

Market Analysis (Strategic due diligence)

Strategic due diligence emphasizes comprehensive market analysis by evaluating industry trends, competitive dynamics, and growth opportunities to inform investment decisions. This process involves assessing market size, customer segments, regulatory impacts, and potential risks that affect strategic positioning and long-term value creation. Explore more about how market analysis drives effective strategic due diligence and investment success.

Sustainability Risk Assessment (ESG due diligence)

Sustainability risk assessment within ESG due diligence rigorously evaluates environmental, social, and governance factors that impact long-term business viability and stakeholder value. Unlike traditional strategic due diligence, ESG due diligence integrates material sustainability risks into financial analysis, ensuring compliance with regulatory frameworks and aligning with investor expectations. Explore deeper insights on how ESG-focused risk assessment drives resilient investment strategies and sustainable business practices.

Synergy Evaluation (Strategic due diligence)

Strategic due diligence emphasizes synergy evaluation by assessing potential operational, financial, and market advantages that arise from mergers or acquisitions, focusing on value creation through integration. ESG due diligence, while concerned with environmental, social, and governance risks, typically does not prioritize synergy-driven growth potential but rather evaluates sustainability and compliance factors. Explore more to understand how combining these diligence approaches optimizes deal outcomes.

Source and External Links

Term: Strategic Due Diligence | Quantified Strategy Consulting - Strategic due diligence is the comprehensive investigation and analysis of a company before a major transaction, focusing on strategic fit, market positioning, value creation, and risk identification to ensure the deal aligns with long-term business goals and adds sustainable value.

Strategic Due Diligence - The key to unlocking a deal's full potential - It involves a deep review of the target's capabilities, culture, management team, financial projections, synergies, and operational processes to assess whether the deal will enable the company to outperform competitors and achieve strategic objectives safely.

Strategic Due Diligence: A Comprehensive Guide to Smarter Decision Making - Strategic due diligence is a crucial evaluation process for mergers, acquisitions, investments, or partnerships that combines financial, legal, operational, and strategic assessments to uncover risks, confirm cultural fit, and verify that the transaction supports growth and mitigates surprises.

dowidth.com

dowidth.com