ESG due diligence focuses on evaluating a company's environmental, social, and governance practices to identify risks and opportunities related to sustainability and ethical impact. Commercial due diligence assesses market dynamics, competitive positioning, and financial viability to support investment decisions. Discover more about how integrating ESG and commercial insights enhances strategic consulting outcomes.

Why it is important

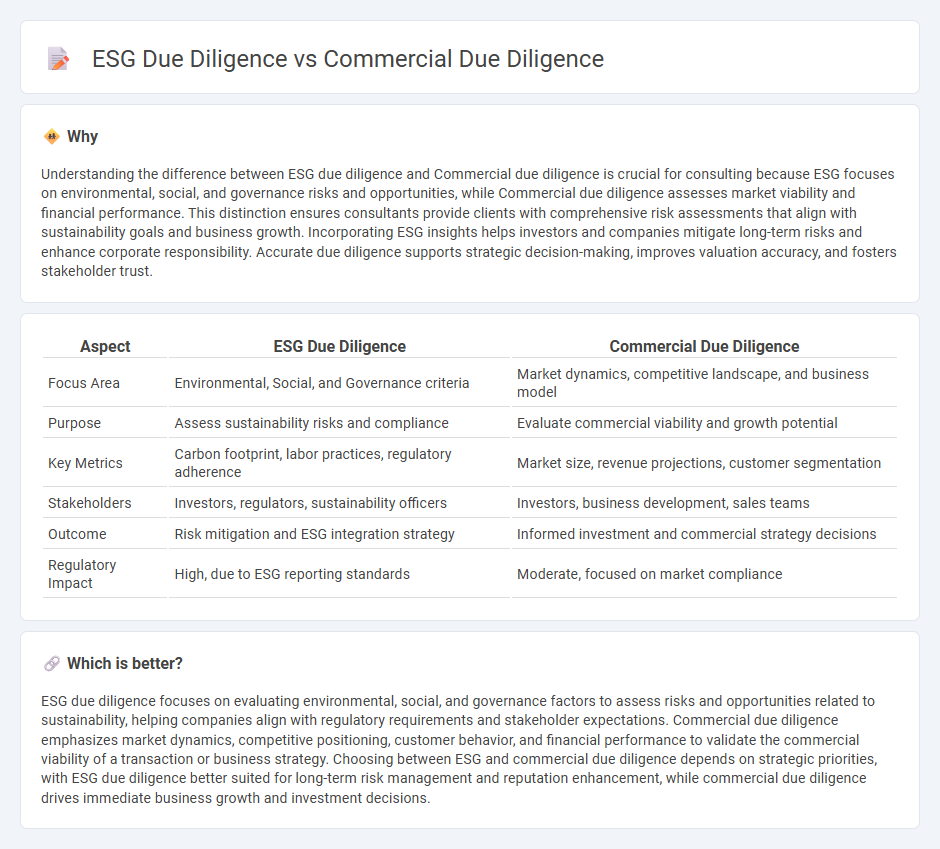

Understanding the difference between ESG due diligence and Commercial due diligence is crucial for consulting because ESG focuses on environmental, social, and governance risks and opportunities, while Commercial due diligence assesses market viability and financial performance. This distinction ensures consultants provide clients with comprehensive risk assessments that align with sustainability goals and business growth. Incorporating ESG insights helps investors and companies mitigate long-term risks and enhance corporate responsibility. Accurate due diligence supports strategic decision-making, improves valuation accuracy, and fosters stakeholder trust.

Comparison Table

| Aspect | ESG Due Diligence | Commercial Due Diligence |

|---|---|---|

| Focus Area | Environmental, Social, and Governance criteria | Market dynamics, competitive landscape, and business model |

| Purpose | Assess sustainability risks and compliance | Evaluate commercial viability and growth potential |

| Key Metrics | Carbon footprint, labor practices, regulatory adherence | Market size, revenue projections, customer segmentation |

| Stakeholders | Investors, regulators, sustainability officers | Investors, business development, sales teams |

| Outcome | Risk mitigation and ESG integration strategy | Informed investment and commercial strategy decisions |

| Regulatory Impact | High, due to ESG reporting standards | Moderate, focused on market compliance |

Which is better?

ESG due diligence focuses on evaluating environmental, social, and governance factors to assess risks and opportunities related to sustainability, helping companies align with regulatory requirements and stakeholder expectations. Commercial due diligence emphasizes market dynamics, competitive positioning, customer behavior, and financial performance to validate the commercial viability of a transaction or business strategy. Choosing between ESG and commercial due diligence depends on strategic priorities, with ESG due diligence better suited for long-term risk management and reputation enhancement, while commercial due diligence drives immediate business growth and investment decisions.

Connection

ESG due diligence and Commercial due diligence are interconnected through their focus on assessing risks and opportunities that impact business sustainability and long-term value. ESG due diligence evaluates environmental, social, and governance factors that can influence regulatory compliance, brand reputation, and stakeholder trust, while Commercial due diligence examines market positioning, competitive landscape, and financial performance. Integrating both processes enables consultants to provide a comprehensive risk assessment that supports informed investment decisions and strategic planning.

Key Terms

Market Analysis (Commercial)

Commercial due diligence emphasizes in-depth market analysis, assessing industry dynamics, competitor positioning, and customer demand to evaluate a company's growth potential and strategic fit. ESG due diligence, however, scrutinizes environmental, social, and governance factors within the market context, identifying risks and opportunities related to sustainability trends, regulatory compliance, and stakeholder expectations. Explore how integrating both approaches enhances investment decisions and long-term value creation.

Sustainability Assessment (ESG)

Commercial due diligence evaluates a company's financial performance, market position, and growth potential to inform investment decisions. ESG due diligence focuses on sustainability assessment, analyzing environmental impact, social responsibility, and governance practices to mitigate risks and enhance long-term value. Discover how integrating ESG factors with traditional commercial analysis drives more resilient investment strategies.

Risk Identification

Commercial due diligence primarily evaluates market position, competitive landscape, and financial performance to identify risks impacting business valuation and growth potential. ESG due diligence concentrates on environmental, social, and governance risks such as regulatory compliance, sustainability impact, and stakeholder relations, which can affect long-term operational viability and reputation. Explore detailed insights on how integrating both approaches enhances comprehensive risk identification and informed decision-making.

Source and External Links

How to Conduct Commercial Due Diligence More Efficiently - Commercial due diligence is a comprehensive review of a business from a financial, legal, operational, and market perspective, designed to identify strengths, weaknesses, opportunities, and threats before mergers, acquisitions, or significant investments.

What is Commercial Due Diligence? Types, Process & Checklist - Commercial due diligence is a detailed audit of a target company's commercial activities and long-term potential, providing insights into market demand, revenue, competitive dynamics, and overall commercial position to inform deal decisions.

Commercial Due Diligence - Definition, Importance, Process - Commercial due diligence is the process by which a buyer evaluates a target company's commercial viability, either initiated by the buyer to assess prospects or by the seller to prepare for sale and anticipate buyer concerns.

dowidth.com

dowidth.com