Neurodiversity consulting focuses on creating inclusive work environments by leveraging the unique strengths of individuals with neurological differences such as autism, ADHD, and dyslexia, fostering innovation and productivity. Financial consulting centers on advising businesses and individuals on investment strategies, risk management, and financial planning to optimize wealth and growth. Explore how these specialized consulting fields offer tailored solutions to enhance organizational success and personal financial health.

Why it is important

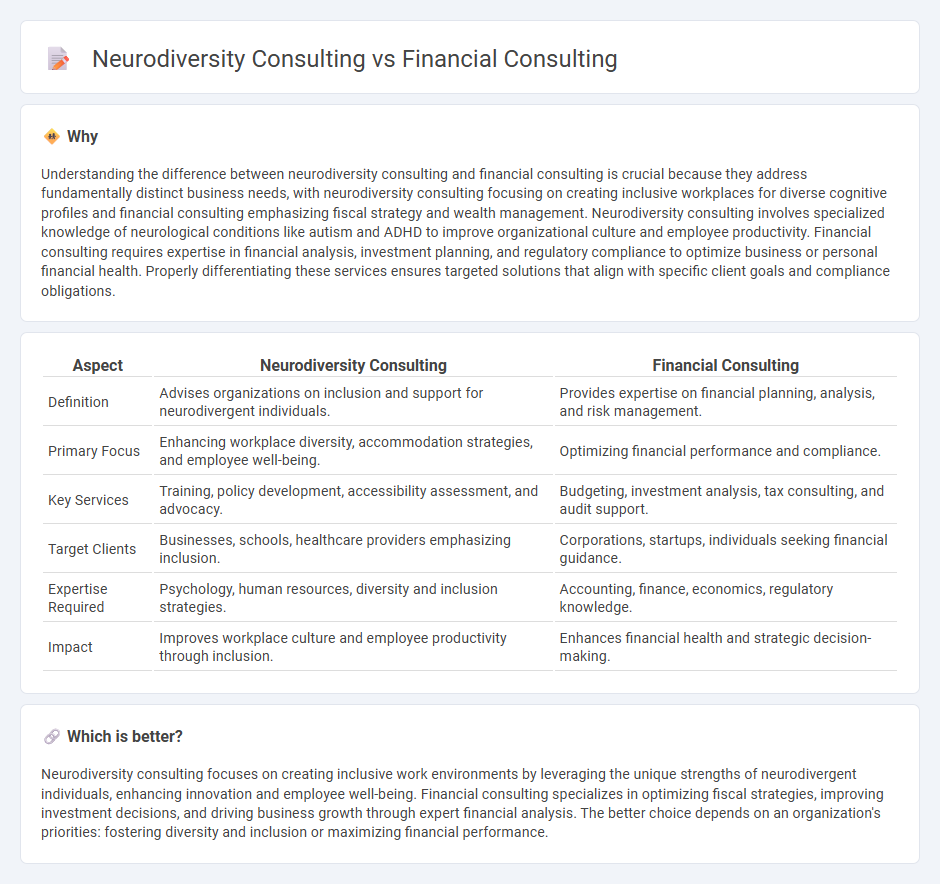

Understanding the difference between neurodiversity consulting and financial consulting is crucial because they address fundamentally distinct business needs, with neurodiversity consulting focusing on creating inclusive workplaces for diverse cognitive profiles and financial consulting emphasizing fiscal strategy and wealth management. Neurodiversity consulting involves specialized knowledge of neurological conditions like autism and ADHD to improve organizational culture and employee productivity. Financial consulting requires expertise in financial analysis, investment planning, and regulatory compliance to optimize business or personal financial health. Properly differentiating these services ensures targeted solutions that align with specific client goals and compliance obligations.

Comparison Table

| Aspect | Neurodiversity Consulting | Financial Consulting |

|---|---|---|

| Definition | Advises organizations on inclusion and support for neurodivergent individuals. | Provides expertise on financial planning, analysis, and risk management. |

| Primary Focus | Enhancing workplace diversity, accommodation strategies, and employee well-being. | Optimizing financial performance and compliance. |

| Key Services | Training, policy development, accessibility assessment, and advocacy. | Budgeting, investment analysis, tax consulting, and audit support. |

| Target Clients | Businesses, schools, healthcare providers emphasizing inclusion. | Corporations, startups, individuals seeking financial guidance. |

| Expertise Required | Psychology, human resources, diversity and inclusion strategies. | Accounting, finance, economics, regulatory knowledge. |

| Impact | Improves workplace culture and employee productivity through inclusion. | Enhances financial health and strategic decision-making. |

Which is better?

Neurodiversity consulting focuses on creating inclusive work environments by leveraging the unique strengths of neurodivergent individuals, enhancing innovation and employee well-being. Financial consulting specializes in optimizing fiscal strategies, improving investment decisions, and driving business growth through expert financial analysis. The better choice depends on an organization's priorities: fostering diversity and inclusion or maximizing financial performance.

Connection

Neurodiversity consulting enhances financial consulting by promoting inclusive work environments that leverage diverse cognitive strengths for innovative problem-solving and risk assessment. Financial consulting firms benefit from neurodiversity strategies by improving team dynamics, client communication, and adaptability in complex market analyses. Integrating neurodiversity consulting fosters ethical decision-making and supports compliance with diversity regulations, ultimately driving sustainable financial performance.

Key Terms

Financial consulting:

Financial consulting offers expert guidance on budgeting, investment strategies, and risk management to maximize clients' financial growth and stability. It involves analyzing market trends, tax regulations, and financial statements to create customized plans that align with clients' goals. Explore our comprehensive services to enhance your financial decision-making and achieve sustainable success.

Investment strategy

Financial consulting centers on optimizing investment portfolios through market analysis, risk assessment, and asset allocation strategies tailored for maximum return. Neurodiversity consulting enhances investment strategy by incorporating diverse cognitive approaches, fostering innovative problem-solving and risk perspectives within portfolio management. Discover how integrating neurodiversity insights can transform your investment strategy.

Risk assessment

Financial consulting prioritizes risk assessment by analyzing market trends, financial statements, and regulatory compliance to minimize investment losses and ensure portfolio stability. Neurodiversity consulting emphasizes identifying workplace risks associated with cognitive differences, promoting inclusive strategies that enhance employee well-being and productivity. Explore how specialized risk assessment approaches tailor solutions in both consulting fields for comprehensive organizational success.

Source and External Links

Financial Consultants: What They Do And How To Find ... - Financial consulting involves creating comprehensive financial plans including retirement, estate, tax strategies, and debt management to help clients reach their financial goals, with financial consultants assessing assets, liabilities, and risk tolerance to develop personalized strategies.

What Is a Financial Consultant? - A financial consultant audits a client's current financial situation and designs strategies to meet future goals, often advising on retirement savings, investment selection, and sometimes specialized areas like tax preparation or insurance, although the terms financial consultant and advisor are used interchangeably.

What Is a Financial Consultant and What Do They Do? - Financial consultants provide personalized advice by analyzing a client's finances to create plans for milestones such as buying a home, retirement, or education funding, with services varying by certifications like ChFC, CPA, or CLU, and they may charge different fees based on assets managed.

dowidth.com

dowidth.com