Carbon accounting advisory specializes in measuring and managing greenhouse gas emissions to help organizations reduce their carbon footprint and comply with climate-related regulations. ESG reporting advisory focuses on broader environmental, social, and governance criteria, enabling companies to enhance transparency, attract investors, and meet stakeholder expectations. Discover how tailored consulting in these areas can drive sustainable business performance.

Why it is important

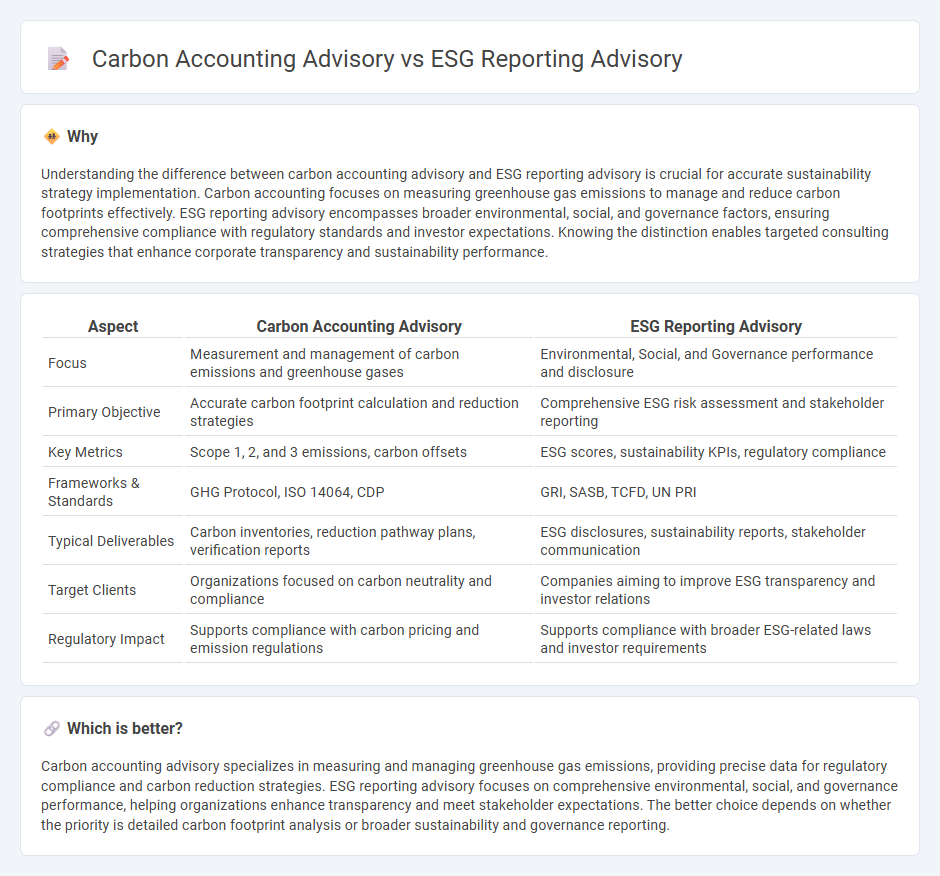

Understanding the difference between carbon accounting advisory and ESG reporting advisory is crucial for accurate sustainability strategy implementation. Carbon accounting focuses on measuring greenhouse gas emissions to manage and reduce carbon footprints effectively. ESG reporting advisory encompasses broader environmental, social, and governance factors, ensuring comprehensive compliance with regulatory standards and investor expectations. Knowing the distinction enables targeted consulting strategies that enhance corporate transparency and sustainability performance.

Comparison Table

| Aspect | Carbon Accounting Advisory | ESG Reporting Advisory |

|---|---|---|

| Focus | Measurement and management of carbon emissions and greenhouse gases | Environmental, Social, and Governance performance and disclosure |

| Primary Objective | Accurate carbon footprint calculation and reduction strategies | Comprehensive ESG risk assessment and stakeholder reporting |

| Key Metrics | Scope 1, 2, and 3 emissions, carbon offsets | ESG scores, sustainability KPIs, regulatory compliance |

| Frameworks & Standards | GHG Protocol, ISO 14064, CDP | GRI, SASB, TCFD, UN PRI |

| Typical Deliverables | Carbon inventories, reduction pathway plans, verification reports | ESG disclosures, sustainability reports, stakeholder communication |

| Target Clients | Organizations focused on carbon neutrality and compliance | Companies aiming to improve ESG transparency and investor relations |

| Regulatory Impact | Supports compliance with carbon pricing and emission regulations | Supports compliance with broader ESG-related laws and investor requirements |

Which is better?

Carbon accounting advisory specializes in measuring and managing greenhouse gas emissions, providing precise data for regulatory compliance and carbon reduction strategies. ESG reporting advisory focuses on comprehensive environmental, social, and governance performance, helping organizations enhance transparency and meet stakeholder expectations. The better choice depends on whether the priority is detailed carbon footprint analysis or broader sustainability and governance reporting.

Connection

Carbon accounting advisory and ESG reporting advisory are interconnected through their focus on sustainability metrics and transparent environmental impact disclosure. Carbon accounting provides precise measurement and analysis of greenhouse gas emissions essential for accurate ESG reporting frameworks. ESG reporting advisory utilizes this data to guide companies in meeting regulatory requirements and investor expectations on climate-related risks and opportunities.

Key Terms

**ESG Reporting Advisory:**

ESG reporting advisory services help organizations develop comprehensive frameworks to disclose environmental, social, and governance metrics aligned with global standards such as GRI, SASB, and TCFD. These services enable companies to enhance transparency, manage risks, and meet stakeholder demands for sustainability reporting while integrating non-financial data into core business strategies. Explore how ESG reporting advisory can drive your company's sustainability goals and compliance efforts.

Materiality Assessment

ESG reporting advisory centers on comprehensive Materiality Assessments, identifying key environmental, social, and governance factors that impact business sustainability and stakeholder interests. Carbon accounting advisory specifically targets the quantification and management of greenhouse gas emissions, aligning with regulatory requirements and reducing carbon footprints. Explore how expert advisory services can refine your Materiality Assessment to enhance both ESG reporting and carbon accounting strategies.

Stakeholder Engagement

ESG reporting advisory emphasizes comprehensive stakeholder engagement by integrating environmental, social, and governance factors, fostering transparent communication between companies and investors, regulators, and communities. Carbon accounting advisory centers on quantifying and verifying greenhouse gas emissions, targeting primarily environmental stakeholders concerned with climate impact and regulatory compliance. Explore how tailored advisory services can enhance your organization's stakeholder engagement and sustainability strategies.

Source and External Links

ESG Reporting: A Complete Guide - AuditBoard - This guide explains the basic steps for developing an effective ESG reporting process, including identifying relevant metrics tailored to your industry, selecting appropriate reporting standards, and creating an audit-ready program to avoid greenwashing and build trust.

ESG & Sustainability Advisory | Greenomy - Greenomy offers expert ESG advisory services covering strategy development, compliance with evolving regulations like CSRD, EU Taxonomy, and double materiality assessments, coupled with AI-powered tools to streamline ESG data collection and reporting.

ESG Reporting Services | PwC - US - PwC provides ESG advisory focused on strategy, data validation, and independent assurance to help companies build credibility and meet increasing investor and regulatory expectations on sustainability reporting accuracy.

dowidth.com

dowidth.com