Diversity, equity, and inclusion (DEI) consulting focuses on creating equitable workplace cultures by addressing systemic biases and promoting representation across all organizational levels. Financial consulting centers on optimizing financial performance, managing risks, and advising on investments to drive business growth and profitability. Explore how specialized consulting services can transform your organization's strategy and impact.

Why it is important

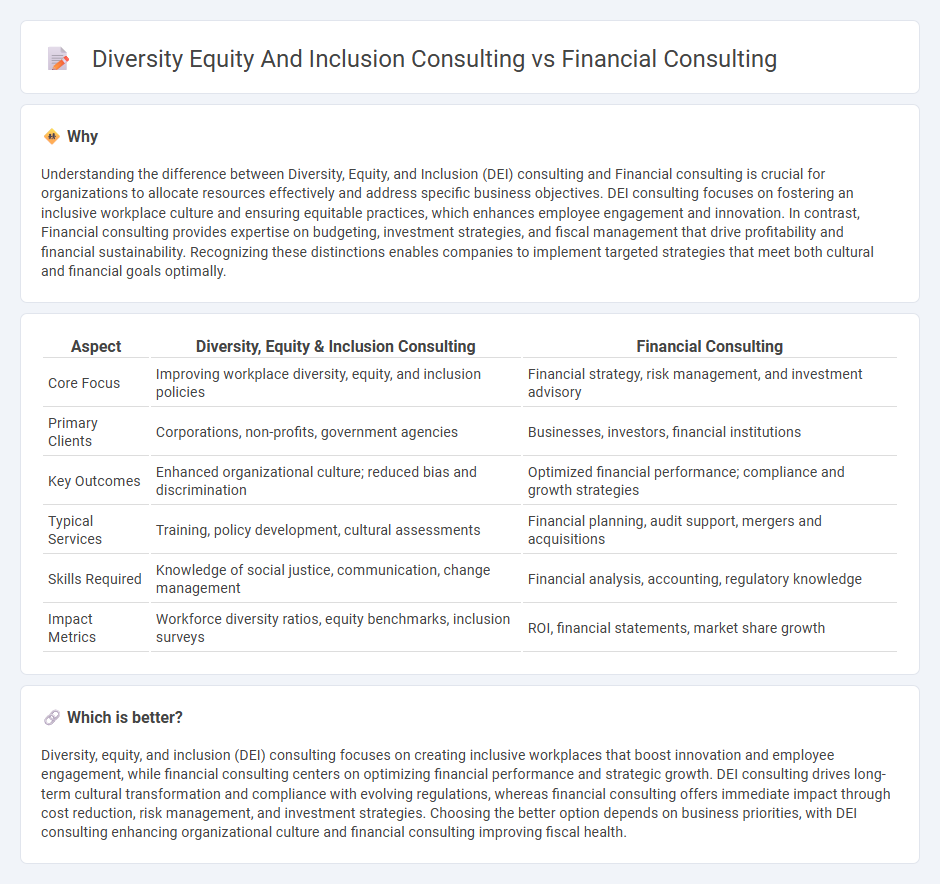

Understanding the difference between Diversity, Equity, and Inclusion (DEI) consulting and Financial consulting is crucial for organizations to allocate resources effectively and address specific business objectives. DEI consulting focuses on fostering an inclusive workplace culture and ensuring equitable practices, which enhances employee engagement and innovation. In contrast, Financial consulting provides expertise on budgeting, investment strategies, and fiscal management that drive profitability and financial sustainability. Recognizing these distinctions enables companies to implement targeted strategies that meet both cultural and financial goals optimally.

Comparison Table

| Aspect | Diversity, Equity & Inclusion Consulting | Financial Consulting |

|---|---|---|

| Core Focus | Improving workplace diversity, equity, and inclusion policies | Financial strategy, risk management, and investment advisory |

| Primary Clients | Corporations, non-profits, government agencies | Businesses, investors, financial institutions |

| Key Outcomes | Enhanced organizational culture; reduced bias and discrimination | Optimized financial performance; compliance and growth strategies |

| Typical Services | Training, policy development, cultural assessments | Financial planning, audit support, mergers and acquisitions |

| Skills Required | Knowledge of social justice, communication, change management | Financial analysis, accounting, regulatory knowledge |

| Impact Metrics | Workforce diversity ratios, equity benchmarks, inclusion surveys | ROI, financial statements, market share growth |

Which is better?

Diversity, equity, and inclusion (DEI) consulting focuses on creating inclusive workplaces that boost innovation and employee engagement, while financial consulting centers on optimizing financial performance and strategic growth. DEI consulting drives long-term cultural transformation and compliance with evolving regulations, whereas financial consulting offers immediate impact through cost reduction, risk management, and investment strategies. Choosing the better option depends on business priorities, with DEI consulting enhancing organizational culture and financial consulting improving fiscal health.

Connection

Diversity, equity, and inclusion (DEI) consulting is connected to financial consulting through strategic workforce planning and risk management, where diverse and inclusive teams drive better financial performance and innovation. Financial consulting leverages DEI principles to enhance organizational culture and compliance, reducing regulatory risks and improving investor relations. Integrating DEI frameworks with financial analytics fosters sustainable growth and maximizes shareholder value by aligning human capital with market trends.

Key Terms

**Financial consulting:**

Financial consulting specializes in providing expert advice on financial planning, investment strategies, risk management, and corporate finance to enhance business profitability and sustainability. This sector involves detailed analysis of market trends, accounting principles, tax regulations, and capital allocation to optimize financial performance. Explore more to understand how tailored financial consulting can drive strategic growth and competitive advantage.

Investment strategy

Financial consulting centers on optimizing investment strategy by analyzing market trends, risk management, and portfolio diversification to enhance financial performance. Diversity, equity, and inclusion (DEI) consulting within investment strategy prioritizes integrating equitable practices that foster diverse leadership and inclusive decision-making, which can improve long-term sustainability and stakeholder trust. Discover how combining financial and DEI consulting strategies can drive innovative investment outcomes.

Risk management

Financial consulting emphasizes identifying, assessing, and mitigating fiscal risks to ensure compliance and optimize investment strategies. Diversity, equity, and inclusion (DEI) consulting addresses organizational risks related to discrimination, workplace culture, and reputational damage by promoting inclusive policies and equitable practices. Explore how integrating both consulting services can strengthen risk management frameworks and foster sustainable business growth.

Source and External Links

Financial Consultants: What They Do And How To Find One Near You - Financial consultants develop comprehensive financial plans covering retirement, estate, tax strategies, and debt management by assessing your assets, liabilities, goals, and risk tolerance.

What Is a Financial Consultant? - NerdWallet - A financial consultant audits your current finances and strategizes a plan to help you achieve future goals, offering services like retirement savings, investment selection, and sometimes tax or insurance advice.

What Is a Financial Consultant and What Do They Do? - SmartAsset - Financial consultants provide personalized advice and big-picture analysis to help clients build wealth, create financial plans for major life milestones, and may specialize in areas like tax, retirement, or portfolio management depending on their credentials.

dowidth.com

dowidth.com