Behavioral economics consulting focuses on understanding how psychological factors influence decision-making processes, helping organizations design strategies that align with human behavior patterns. Risk consulting, on the other hand, specializes in identifying, assessing, and mitigating potential threats to business operations, financial stability, and regulatory compliance. Explore how these distinct consulting approaches can transform your organization's decision-making and risk management strategies.

Why it is important

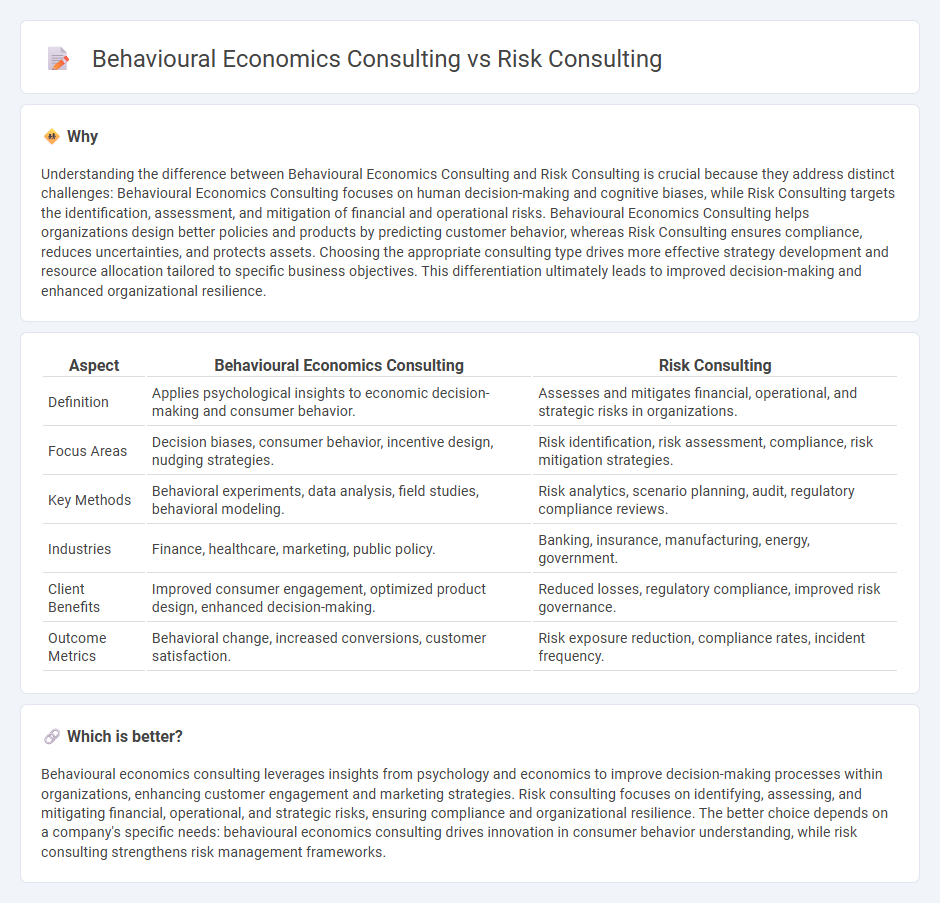

Understanding the difference between Behavioural Economics Consulting and Risk Consulting is crucial because they address distinct challenges: Behavioural Economics Consulting focuses on human decision-making and cognitive biases, while Risk Consulting targets the identification, assessment, and mitigation of financial and operational risks. Behavioural Economics Consulting helps organizations design better policies and products by predicting customer behavior, whereas Risk Consulting ensures compliance, reduces uncertainties, and protects assets. Choosing the appropriate consulting type drives more effective strategy development and resource allocation tailored to specific business objectives. This differentiation ultimately leads to improved decision-making and enhanced organizational resilience.

Comparison Table

| Aspect | Behavioural Economics Consulting | Risk Consulting |

|---|---|---|

| Definition | Applies psychological insights to economic decision-making and consumer behavior. | Assesses and mitigates financial, operational, and strategic risks in organizations. |

| Focus Areas | Decision biases, consumer behavior, incentive design, nudging strategies. | Risk identification, risk assessment, compliance, risk mitigation strategies. |

| Key Methods | Behavioral experiments, data analysis, field studies, behavioral modeling. | Risk analytics, scenario planning, audit, regulatory compliance reviews. |

| Industries | Finance, healthcare, marketing, public policy. | Banking, insurance, manufacturing, energy, government. |

| Client Benefits | Improved consumer engagement, optimized product design, enhanced decision-making. | Reduced losses, regulatory compliance, improved risk governance. |

| Outcome Metrics | Behavioral change, increased conversions, customer satisfaction. | Risk exposure reduction, compliance rates, incident frequency. |

Which is better?

Behavioural economics consulting leverages insights from psychology and economics to improve decision-making processes within organizations, enhancing customer engagement and marketing strategies. Risk consulting focuses on identifying, assessing, and mitigating financial, operational, and strategic risks, ensuring compliance and organizational resilience. The better choice depends on a company's specific needs: behavioural economics consulting drives innovation in consumer behavior understanding, while risk consulting strengthens risk management frameworks.

Connection

Behavioural economics consulting and risk consulting intersect through their shared focus on decision-making under uncertainty, leveraging psychological insights to improve risk assessment and management strategies. Behavioural economics provides empirical data on cognitive biases and heuristics that influence how individuals and organizations perceive and respond to risks. Integrating these behavioral patterns into risk consulting enhances predictive models and fosters more effective risk mitigation frameworks.

Key Terms

Risk consulting:

Risk consulting specializes in identifying, assessing, and mitigating financial, operational, and strategic risks for businesses across industries, using data analytics and compliance frameworks to enhance decision-making and safeguard assets. This consulting field employs quantitative risk models and scenario analysis to anticipate potential disruptions and develop robust risk management strategies. Explore more to understand how risk consulting can transform your organization's resilience and competitive advantage.

Risk Assessment

Risk consulting specializes in identifying, analyzing, and mitigating financial, operational, and strategic risks through quantitative models and industry-specific frameworks. Behavioural economics consulting integrates psychological insights with economic theory to understand how cognitive biases and decision-making patterns impact risk perception and management. Explore how these approaches complement each other to enhance comprehensive risk assessment strategies.

Compliance

Risk consulting prioritizes identifying, assessing, and mitigating regulatory compliance risks by implementing robust control frameworks and monitoring systems tailored to industry standards. Behavioural economics consulting leverages insights into human decision-making and cognitive biases to design compliance strategies that effectively influence employee behavior and enhance adherence to regulations. Explore further to understand how these distinct approaches can optimize your organization's compliance outcomes.

Source and External Links

Risk and strategic consulting - Wikipedia - Provides information, analysis, and services focused on the political and economic risks and opportunities faced by businesses, governments, and organizations, especially in developing countries and emerging markets.

Risk Advisory & Consulting Services - RSM US - Advises companies on governance, risk, and compliance models to manage emerging threats, prioritize risks, and integrate risk management as a strategic driver for long-term value.

TUV SUD Global Risk Consultants (GRC) - TUV Sud - Offers independent property risk engineering and consulting to help businesses minimize exposure, make strategic decisions, and enhance operational resilience through customized, data-driven solutions.

dowidth.com

dowidth.com