Operational due diligence focuses on assessing a company's internal processes, management efficiency, and financial health to ensure successful investment outcomes. Environmental due diligence examines potential environmental risks and compliance issues related to a property or business, identifying liabilities that could impact long-term value. Discover how integrating both operational and environmental due diligence can safeguard your investment decisions.

Why it is important

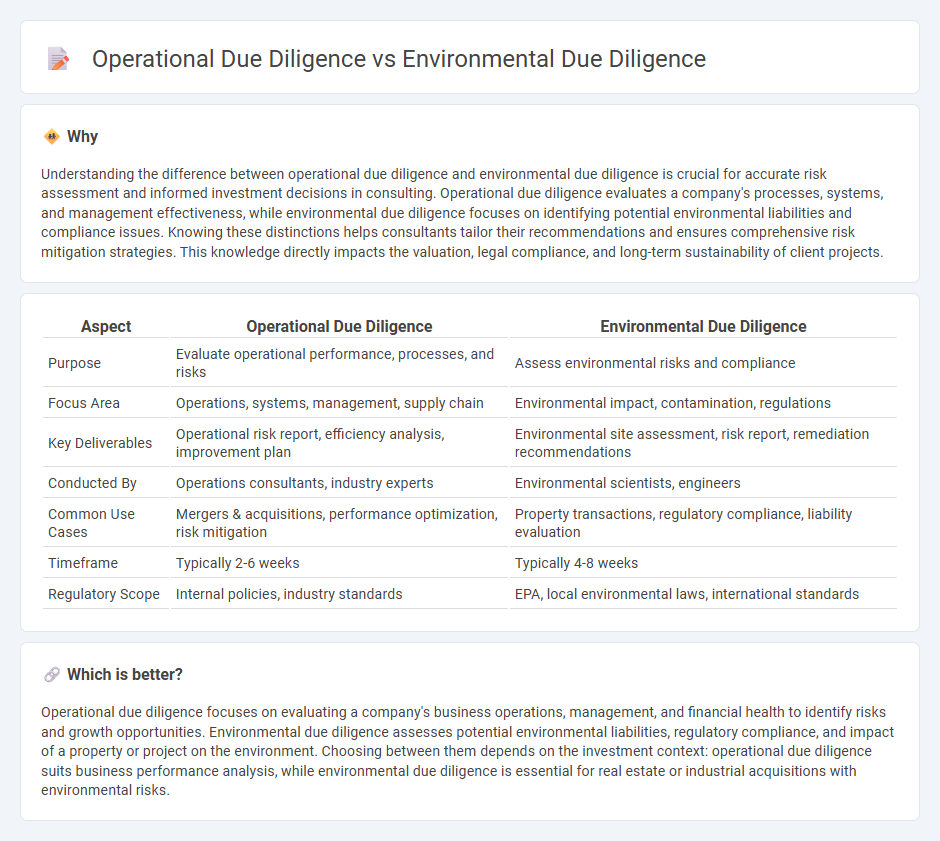

Understanding the difference between operational due diligence and environmental due diligence is crucial for accurate risk assessment and informed investment decisions in consulting. Operational due diligence evaluates a company's processes, systems, and management effectiveness, while environmental due diligence focuses on identifying potential environmental liabilities and compliance issues. Knowing these distinctions helps consultants tailor their recommendations and ensures comprehensive risk mitigation strategies. This knowledge directly impacts the valuation, legal compliance, and long-term sustainability of client projects.

Comparison Table

| Aspect | Operational Due Diligence | Environmental Due Diligence |

|---|---|---|

| Purpose | Evaluate operational performance, processes, and risks | Assess environmental risks and compliance |

| Focus Area | Operations, systems, management, supply chain | Environmental impact, contamination, regulations |

| Key Deliverables | Operational risk report, efficiency analysis, improvement plan | Environmental site assessment, risk report, remediation recommendations |

| Conducted By | Operations consultants, industry experts | Environmental scientists, engineers |

| Common Use Cases | Mergers & acquisitions, performance optimization, risk mitigation | Property transactions, regulatory compliance, liability evaluation |

| Timeframe | Typically 2-6 weeks | Typically 4-8 weeks |

| Regulatory Scope | Internal policies, industry standards | EPA, local environmental laws, international standards |

Which is better?

Operational due diligence focuses on evaluating a company's business operations, management, and financial health to identify risks and growth opportunities. Environmental due diligence assesses potential environmental liabilities, regulatory compliance, and impact of a property or project on the environment. Choosing between them depends on the investment context: operational due diligence suits business performance analysis, while environmental due diligence is essential for real estate or industrial acquisitions with environmental risks.

Connection

Operational due diligence evaluates a company's internal processes, management effectiveness, and risk factors to ensure smooth business performance. Environmental due diligence assesses compliance with environmental regulations, potential liabilities, and sustainability practices that could impact operational continuity. Both types of due diligence are connected through their shared goal of identifying risks that affect a company's value and long-term operational resilience during mergers, acquisitions, or investments.

Key Terms

Risk Assessment

Environmental due diligence centers on identifying and evaluating ecological risks such as contamination, regulatory compliance, and potential liabilities associated with land, water, and air quality. Operational due diligence assesses risks linked to a company's internal processes, labor practices, supply chain, and operational efficiency that impact overall business performance. Explore our detailed analysis to understand how these risk assessments influence investment decisions and corporate responsibility.

Compliance

Environmental due diligence assesses a company's compliance with environmental laws, regulations, and potential liabilities related to hazardous materials, waste management, and pollution controls. Operational due diligence evaluates compliance with operational standards, workplace safety, and industry-specific regulations to ensure business processes align with legal and regulatory requirements. Explore more to understand how these distinct compliance assessments impact risk management and transaction decisions.

Process Evaluation

Environmental due diligence primarily evaluates compliance with environmental laws, assessing potential liabilities related to soil contamination, water quality, air emissions, and waste management during the acquisition or operation of a property. Operational due diligence focuses on the efficiency and effectiveness of business processes, including production workflows, supply chain management, and operational risk identification. Explore deeper insights into how these evaluations impact strategic decision-making and risk management.

Source and External Links

What is Environmental Due Diligence? A Step-by-Step Guide - Environmental due diligence is a process to identify and address environmental liabilities in property or business transactions by examining reports, hazardous materials, soil and water quality, regulatory compliance, and site-specific risks to minimize risks and protect investments.

Environmental Due Diligence - Overview, Triggers, Phases - It is a systematic procedure that evaluates a property for possible contamination risks through Phase I environmental site assessments, guided by regulations like CERCLA, to determine liability and inform owners or lenders about environmental pollution affecting property value.

Environmental Due Diligence: A Guide for Land Developers | Transect - Different types of environmental due diligence include wetland determinations and habitat assessments, which assess and document ecological features to comply with regulations and help land developers plan and mitigate environmental impacts on property development.

dowidth.com

dowidth.com