Consulting plays a crucial role in navigating the complex dynamics between stakeholder capitalism, which emphasizes the interests of employees, communities, and the environment, and shareholder primacy, focused primarily on maximizing shareholder value. Organizations increasingly seek expert advice to balance long-term sustainability with financial performance, driving strategic decisions that align with evolving societal expectations. Discover how consulting shapes the future of corporate governance by integrating these contrasting economic models.

Why it is important

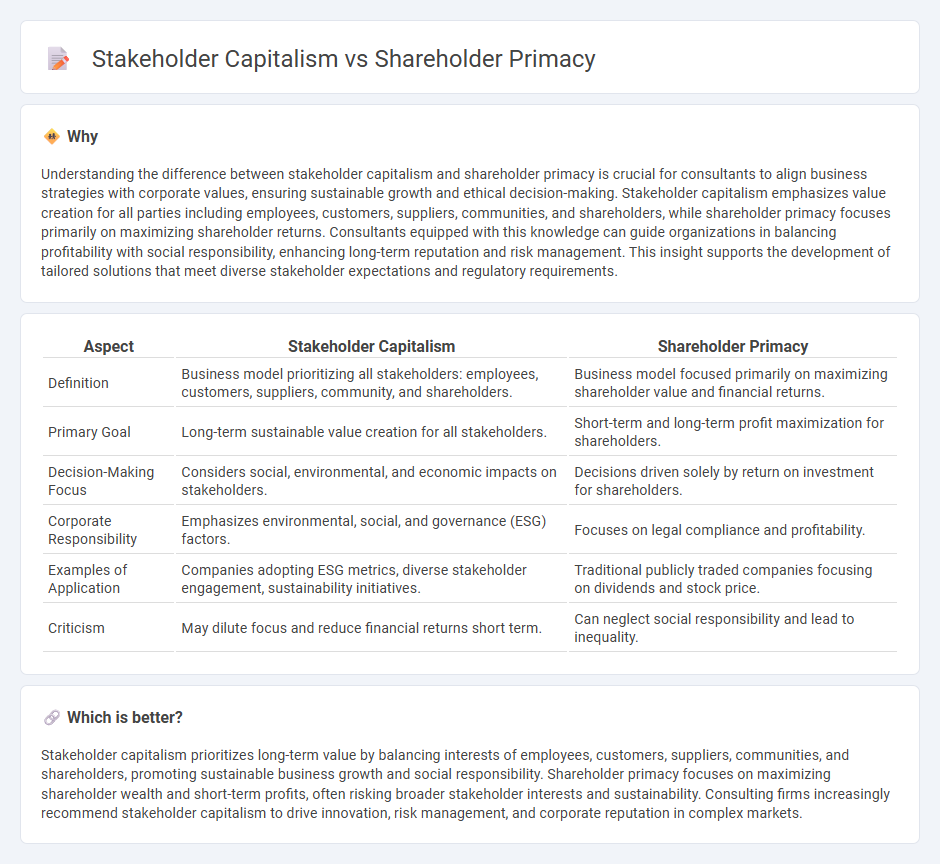

Understanding the difference between stakeholder capitalism and shareholder primacy is crucial for consultants to align business strategies with corporate values, ensuring sustainable growth and ethical decision-making. Stakeholder capitalism emphasizes value creation for all parties including employees, customers, suppliers, communities, and shareholders, while shareholder primacy focuses primarily on maximizing shareholder returns. Consultants equipped with this knowledge can guide organizations in balancing profitability with social responsibility, enhancing long-term reputation and risk management. This insight supports the development of tailored solutions that meet diverse stakeholder expectations and regulatory requirements.

Comparison Table

| Aspect | Stakeholder Capitalism | Shareholder Primacy |

|---|---|---|

| Definition | Business model prioritizing all stakeholders: employees, customers, suppliers, community, and shareholders. | Business model focused primarily on maximizing shareholder value and financial returns. |

| Primary Goal | Long-term sustainable value creation for all stakeholders. | Short-term and long-term profit maximization for shareholders. |

| Decision-Making Focus | Considers social, environmental, and economic impacts on stakeholders. | Decisions driven solely by return on investment for shareholders. |

| Corporate Responsibility | Emphasizes environmental, social, and governance (ESG) factors. | Focuses on legal compliance and profitability. |

| Examples of Application | Companies adopting ESG metrics, diverse stakeholder engagement, sustainability initiatives. | Traditional publicly traded companies focusing on dividends and stock price. |

| Criticism | May dilute focus and reduce financial returns short term. | Can neglect social responsibility and lead to inequality. |

Which is better?

Stakeholder capitalism prioritizes long-term value by balancing interests of employees, customers, suppliers, communities, and shareholders, promoting sustainable business growth and social responsibility. Shareholder primacy focuses on maximizing shareholder wealth and short-term profits, often risking broader stakeholder interests and sustainability. Consulting firms increasingly recommend stakeholder capitalism to drive innovation, risk management, and corporate reputation in complex markets.

Connection

Stakeholder capitalism and shareholder primacy intersect through their divergent focuses on corporate value creation, where stakeholder capitalism prioritizes long-term value for employees, customers, suppliers, and communities, while shareholder primacy emphasizes maximizing short-term shareholder returns. Consulting firms often navigate these paradigms to advise clients on balancing sustainable business practices with financial performance metrics, integrating ESG (Environmental, Social, and Governance) principles alongside profit-driven strategies. This dual approach enhances corporate resilience, stakeholder trust, and competitive advantage in complex market environments.

Key Terms

Fiduciary Duty

Fiduciary duty in shareholder primacy emphasizes maximizing shareholder value as the paramount responsibility of corporate directors, ensuring decisions prioritize financial returns to owners above other interests. In stakeholder capitalism, fiduciary duty broadens to encompass responsibilities toward employees, customers, suppliers, and communities, balancing profit with social and environmental impacts. Explore the evolving interpretations of fiduciary duty to understand how corporate governance adapts to societal demands.

ESG (Environmental, Social, and Governance)

Shareholder primacy prioritizes maximizing shareholder returns often at the expense of broader social and environmental considerations, whereas stakeholder capitalism integrates ESG (Environmental, Social, and Governance) criteria to balance the interests of investors, employees, communities, and the environment. Companies adopting stakeholder capitalism report improved ESG metrics, enhance long-term sustainability, and mitigate risks related to social and regulatory pressures. Explore how ESG-driven strategies reshape corporate governance and drive value beyond traditional shareholder focus.

Value Creation

Shareholder primacy emphasizes maximizing returns for shareholders as the core objective of corporate management, driving value creation through profit optimization and stock price appreciation. Stakeholder capitalism expands this focus to include employees, customers, suppliers, and communities, fostering long-term sustainable value by balancing diverse interests and promoting social responsibility. Explore how these competing frameworks impact corporate strategies and financial performance in modern business landscapes.

Source and External Links

Shareholder primacy - Wikipedia - Shareholder primacy is a corporate governance theory stating that the interests of shareholders should take priority over those of all other stakeholders in a corporation.

Shareholder Primacy - Definition, Criticisms - Shareholder primacy advocates for maximizing shareholder value above the interests of employees, consumers, and society, often arguing that shareholders, as owners, should have the greatest control over corporate decisions.

A Legal Theory of Shareholder Primacy - This legal perspective holds that corporate boards should manage companies solely to maximize shareholder wealth, viewing shareholders as the principals in the principal-agent relationship of corporate governance.

dowidth.com

dowidth.com