Climate risk advisory focuses on identifying, assessing, and managing environmental threats to business operations and assets, ensuring compliance with evolving regulations and reducing exposure to climate-related financial risks. Corporate governance advisory enhances organizational structures by promoting transparency, regulatory compliance, and stakeholder accountability to drive sustainable business performance. Explore how tailored consulting services can help your organization navigate these critical challenges effectively.

Why it is important

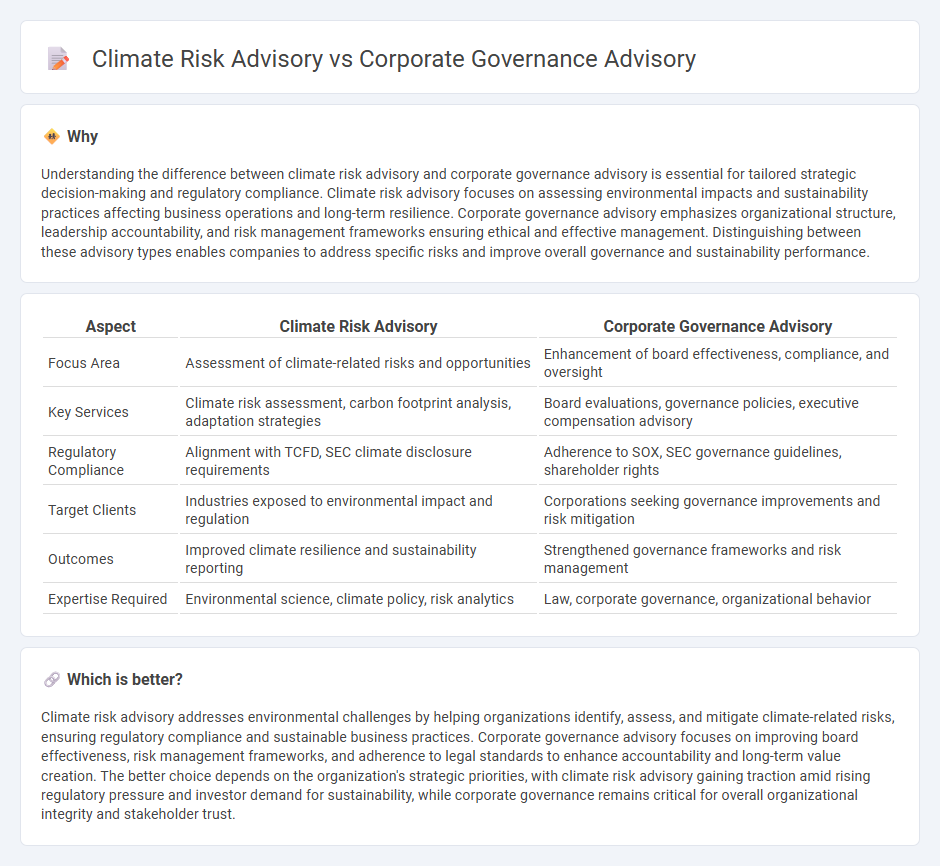

Understanding the difference between climate risk advisory and corporate governance advisory is essential for tailored strategic decision-making and regulatory compliance. Climate risk advisory focuses on assessing environmental impacts and sustainability practices affecting business operations and long-term resilience. Corporate governance advisory emphasizes organizational structure, leadership accountability, and risk management frameworks ensuring ethical and effective management. Distinguishing between these advisory types enables companies to address specific risks and improve overall governance and sustainability performance.

Comparison Table

| Aspect | Climate Risk Advisory | Corporate Governance Advisory |

|---|---|---|

| Focus Area | Assessment of climate-related risks and opportunities | Enhancement of board effectiveness, compliance, and oversight |

| Key Services | Climate risk assessment, carbon footprint analysis, adaptation strategies | Board evaluations, governance policies, executive compensation advisory |

| Regulatory Compliance | Alignment with TCFD, SEC climate disclosure requirements | Adherence to SOX, SEC governance guidelines, shareholder rights |

| Target Clients | Industries exposed to environmental impact and regulation | Corporations seeking governance improvements and risk mitigation |

| Outcomes | Improved climate resilience and sustainability reporting | Strengthened governance frameworks and risk management |

| Expertise Required | Environmental science, climate policy, risk analytics | Law, corporate governance, organizational behavior |

Which is better?

Climate risk advisory addresses environmental challenges by helping organizations identify, assess, and mitigate climate-related risks, ensuring regulatory compliance and sustainable business practices. Corporate governance advisory focuses on improving board effectiveness, risk management frameworks, and adherence to legal standards to enhance accountability and long-term value creation. The better choice depends on the organization's strategic priorities, with climate risk advisory gaining traction amid rising regulatory pressure and investor demand for sustainability, while corporate governance remains critical for overall organizational integrity and stakeholder trust.

Connection

Climate risk advisory and corporate governance advisory are interconnected through their shared focus on enhancing organizational resilience and accountability in the face of environmental challenges. Effective corporate governance frameworks integrate climate risk assessments to influence strategic decision-making, risk management, and regulatory compliance, ensuring sustainable value creation. By aligning governance practices with climate-related disclosures and risk mitigation strategies, companies can improve transparency and stakeholder trust while addressing long-term environmental and financial risks.

Key Terms

**Corporate governance advisory:**

Corporate governance advisory centers on improving board effectiveness, enhancing shareholder value, and ensuring regulatory compliance through tailored strategies and best practices. Key areas include risk management frameworks, executive compensation alignment, and stakeholder engagement to promote transparency and accountability. Explore how expert corporate governance advisory services can strengthen your organization's leadership and long-term success.

Board Structure

Corporate governance advisory emphasizes optimizing Board structure to enhance oversight, risk management, and strategic decision-making aligned with shareholder interests. Climate risk advisory integrates environmental factors into Board responsibilities, ensuring resilience and compliance with emerging regulations on climate-related financial disclosures. Explore how tailored advisory services can optimize Board structures for sustainable corporate governance and climate risk management.

Compliance

Corporate governance advisory emphasizes compliance with regulatory frameworks, ethical standards, and shareholder rights to ensure transparent decision-making and risk management. Climate risk advisory focuses on identifying, assessing, and mitigating climate-related risks while adhering to evolving environmental regulations and sustainability reporting requirements. Explore our insights to understand how tailored compliance strategies can enhance both corporate governance and climate risk management.

Source and External Links

Corporate Governance Advisory - Alliance Advisors - Provides public companies with advice on navigating and enhancing governance structures, practices, and compliance, including proxy review, shareholder analysis, and benchmarking against peers.

CII Corporate Governance Advisory Council - Offers expert input to promote effective corporate governance and enhance member value, consisting of representatives from major asset managers and owners.

Corporate Governance Consulting & Solutions | EQ - Equiniti - Delivers strategic counsel on governance challenges, risk mitigation, investor communications, and vote projections with specialized expert teams.

dowidth.com

dowidth.com