Stakeholder capitalism advisory focuses on aligning business strategies with the interests of all stakeholders, including employees, customers, communities, and shareholders, to drive sustainable long-term value. Impact investing advisory guides investors in deploying capital to generate measurable social and environmental benefits alongside financial returns. Discover how each advisory approach can transform your organization's strategy and investment outcomes.

Why it is important

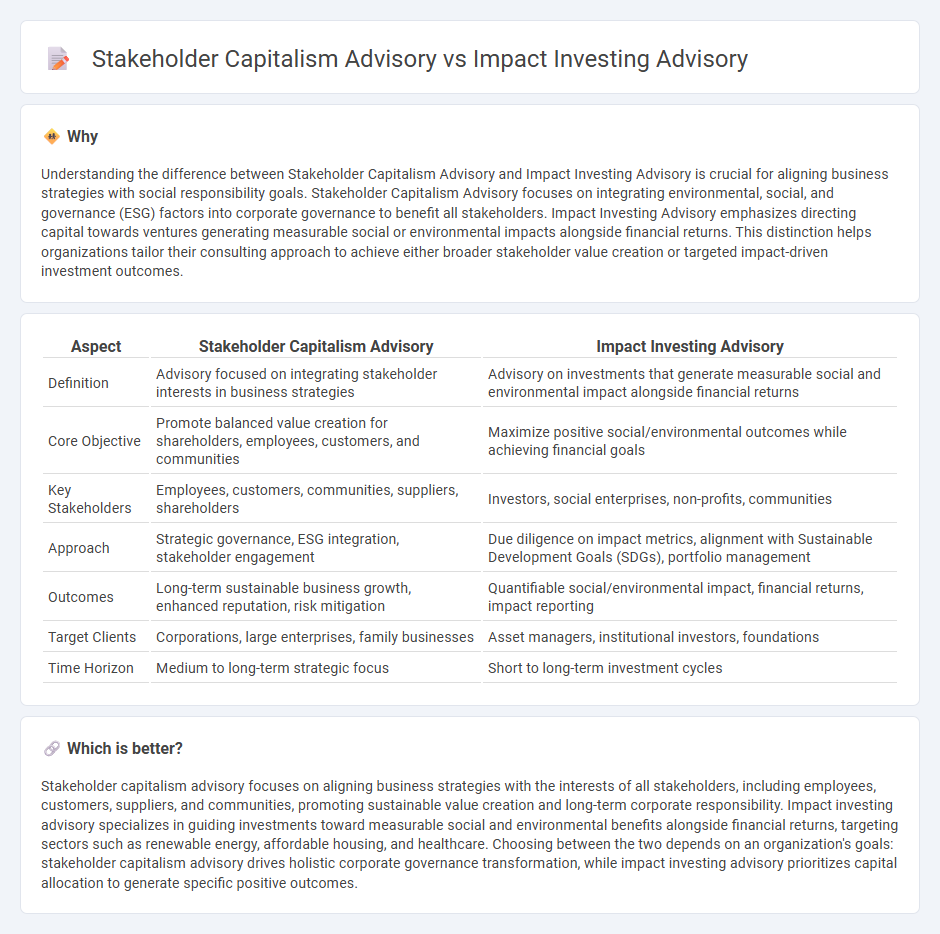

Understanding the difference between Stakeholder Capitalism Advisory and Impact Investing Advisory is crucial for aligning business strategies with social responsibility goals. Stakeholder Capitalism Advisory focuses on integrating environmental, social, and governance (ESG) factors into corporate governance to benefit all stakeholders. Impact Investing Advisory emphasizes directing capital towards ventures generating measurable social or environmental impacts alongside financial returns. This distinction helps organizations tailor their consulting approach to achieve either broader stakeholder value creation or targeted impact-driven investment outcomes.

Comparison Table

| Aspect | Stakeholder Capitalism Advisory | Impact Investing Advisory |

|---|---|---|

| Definition | Advisory focused on integrating stakeholder interests in business strategies | Advisory on investments that generate measurable social and environmental impact alongside financial returns |

| Core Objective | Promote balanced value creation for shareholders, employees, customers, and communities | Maximize positive social/environmental outcomes while achieving financial goals |

| Key Stakeholders | Employees, customers, communities, suppliers, shareholders | Investors, social enterprises, non-profits, communities |

| Approach | Strategic governance, ESG integration, stakeholder engagement | Due diligence on impact metrics, alignment with Sustainable Development Goals (SDGs), portfolio management |

| Outcomes | Long-term sustainable business growth, enhanced reputation, risk mitigation | Quantifiable social/environmental impact, financial returns, impact reporting |

| Target Clients | Corporations, large enterprises, family businesses | Asset managers, institutional investors, foundations |

| Time Horizon | Medium to long-term strategic focus | Short to long-term investment cycles |

Which is better?

Stakeholder capitalism advisory focuses on aligning business strategies with the interests of all stakeholders, including employees, customers, suppliers, and communities, promoting sustainable value creation and long-term corporate responsibility. Impact investing advisory specializes in guiding investments toward measurable social and environmental benefits alongside financial returns, targeting sectors such as renewable energy, affordable housing, and healthcare. Choosing between the two depends on an organization's goals: stakeholder capitalism advisory drives holistic corporate governance transformation, while impact investing advisory prioritizes capital allocation to generate specific positive outcomes.

Connection

Stakeholder capitalism advisory focuses on integrating environmental, social, and governance (ESG) principles into corporate strategies, aligning business goals with broader societal interests. Impact investing advisory guides investors in deploying capital toward projects that generate measurable social and environmental benefits alongside financial returns. Both advisory services collaborate to help organizations create sustainable value by balancing stakeholder needs with impactful investment decisions.

Key Terms

**Impact Investing Advisory:**

Impact investing advisory specializes in guiding investors to allocate capital in projects and companies that generate measurable social and environmental benefits alongside financial returns, leveraging tools such as ESG metrics, impact measurement frameworks, and sustainable finance strategies. Stakeholder capitalism advisory, by contrast, emphasizes balancing the interests of all stakeholders including employees, customers, suppliers, communities, and shareholders to foster long-term value creation and corporate responsibility. Explore how impact investing advisory can align your portfolio with global sustainability goals and drive positive change.

Social Return on Investment (SROI)

Impact investing advisory emphasizes measurable financial returns alongside positive social and environmental outcomes, utilizing Social Return on Investment (SROI) metrics to quantify value creation for communities and investors. Stakeholder capitalism advisory centers on creating long-term value for all stakeholders, including employees, customers, and society, often integrating qualitative and quantitative SROI assessments to enhance corporate responsibility and sustainable growth. Explore further to understand how tailored advisory approaches maximize impact through precise SROI analysis and stakeholder engagement strategies.

Theory of Change

Impact investing advisory centers on deploying capital to generate measurable social and environmental benefits alongside financial returns, leveraging a Theory of Change that maps specific investment activities to targeted outcomes. Stakeholder capitalism advisory emphasizes integrating broader stakeholder interests--employees, communities, suppliers, and the environment--into corporate strategies, using a Theory of Change framework to align business operations with sustainable social value creation. Discover how both advisory approaches utilize tailored Theories of Change to advance purpose-driven growth and measurable impact.

Source and External Links

Impact Investing - Rockefeller Philanthropy Advisors - Provides tailored advisory services to individuals, families, foundations, and corporations including strategy development, portfolio alignment with mission and values, investment sourcing, due diligence, and implementation guidance supported by educational resources and a practitioner's handbook.

Impact Investing - Arabella Advisors - Offers comprehensive impact investing advisory services such as education, strategy facilitation, governance structuring, sourcing and due diligence of investments, and impact evaluation and monitoring for foundations, corporations, families, and individuals.

Phenix Capital Group l Impact Investment Advisor - A dedicated impact investment advisory firm providing global services in impact investing and impact measurement, focusing on scalable solutions with strong financial and impact performance, aiming to direct significant capital towards sustainable development goals.

dowidth.com

dowidth.com