Distributed ledger marketplaces leverage blockchain technology to facilitate transparent, secure, and decentralized transactions across various industries. Tokenized asset marketplaces enable fractional ownership and liquidity by converting physical or digital assets into tradable tokens on a blockchain. Explore the unique advantages and challenges of each marketplace model to understand their impact on the future of commerce.

Why it is important

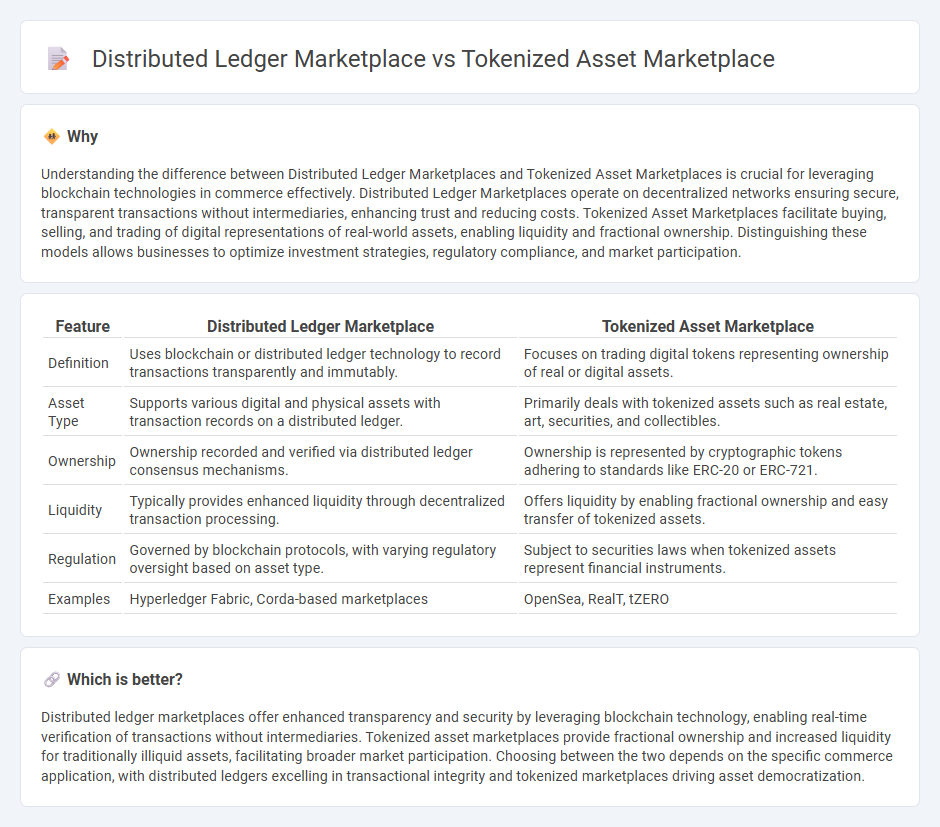

Understanding the difference between Distributed Ledger Marketplaces and Tokenized Asset Marketplaces is crucial for leveraging blockchain technologies in commerce effectively. Distributed Ledger Marketplaces operate on decentralized networks ensuring secure, transparent transactions without intermediaries, enhancing trust and reducing costs. Tokenized Asset Marketplaces facilitate buying, selling, and trading of digital representations of real-world assets, enabling liquidity and fractional ownership. Distinguishing these models allows businesses to optimize investment strategies, regulatory compliance, and market participation.

Comparison Table

| Feature | Distributed Ledger Marketplace | Tokenized Asset Marketplace |

|---|---|---|

| Definition | Uses blockchain or distributed ledger technology to record transactions transparently and immutably. | Focuses on trading digital tokens representing ownership of real or digital assets. |

| Asset Type | Supports various digital and physical assets with transaction records on a distributed ledger. | Primarily deals with tokenized assets such as real estate, art, securities, and collectibles. |

| Ownership | Ownership recorded and verified via distributed ledger consensus mechanisms. | Ownership is represented by cryptographic tokens adhering to standards like ERC-20 or ERC-721. |

| Liquidity | Typically provides enhanced liquidity through decentralized transaction processing. | Offers liquidity by enabling fractional ownership and easy transfer of tokenized assets. |

| Regulation | Governed by blockchain protocols, with varying regulatory oversight based on asset type. | Subject to securities laws when tokenized assets represent financial instruments. |

| Examples | Hyperledger Fabric, Corda-based marketplaces | OpenSea, RealT, tZERO |

Which is better?

Distributed ledger marketplaces offer enhanced transparency and security by leveraging blockchain technology, enabling real-time verification of transactions without intermediaries. Tokenized asset marketplaces provide fractional ownership and increased liquidity for traditionally illiquid assets, facilitating broader market participation. Choosing between the two depends on the specific commerce application, with distributed ledgers excelling in transactional integrity and tokenized marketplaces driving asset democratization.

Connection

Distributed ledger marketplaces enable secure, transparent transactions by recording asset exchanges on blockchain technology, which underpins tokenized asset marketplaces where physical and digital assets are represented as tokens. These tokenized assets facilitate fractional ownership, increased liquidity, and seamless cross-border trading within distributed ledger frameworks. The integration of distributed ledger technology with tokenized asset marketplaces revolutionizes commerce by enhancing trust, reducing intermediaries, and increasing market accessibility.

Key Terms

Asset Tokenization

Tokenized asset marketplaces enable fractional ownership and increased liquidity by converting physical and financial assets into digital tokens secured on blockchain platforms. Distributed ledger marketplaces leverage decentralized networks to enhance transparency, security, and immutability of transactions involving these tokenized assets. Explore the nuances and advantages of asset tokenization to better understand its transformative impact on modern marketplaces.

Smart Contracts

Tokenized asset marketplaces leverage smart contracts to automate asset issuance, transfer, and compliance, enabling seamless and trustless transactions on a blockchain. Distributed ledger marketplaces also use smart contracts but emphasize decentralized consensus mechanisms to ensure transparency and immutability across multiple nodes, enhancing security and reducing counterparty risk. Explore the intricate workings and benefits of smart contracts in both marketplace models to understand their impact on modern digital economies.

Ledger Consensus

Tokenized asset marketplaces utilize centralized ledger consensus mechanisms that validate transactions primarily through a trusted authority, ensuring faster settlements and regulatory compliance. Distributed ledger marketplaces rely on decentralized consensus protocols like Proof of Work or Proof of Stake, promoting transparency, security, and resistance to single points of failure. Explore further to understand how these consensus models impact transaction speed, security, and scalability in digital asset trading.

Source and External Links

Asset Tokenization: Digital Assets Explained - Chainlink - Asset tokenized marketplaces use blockchain to represent ownership rights of real-world assets as digital tokens, enabling permissionless liquidity, onchain transparency, and reduced transactional friction, with secure oracles critical for accurate offchain data integration.

Real-World Asset Tokenization - Hedera - Hedera offers a platform for seamless tokenization of real-world and digital assets at scale, providing security, compliance, and liquidity, thereby democratizing access to previously illiquid or restricted asset classes through tokenized marketplaces.

Asset tokenization now and in the future - State Street - Tokenized asset marketplaces promise faster, cheaper, and more transparent markets with 24/7 trading, atomic settlement, automated corporate actions through smart contracts, but require regulatory clarity and ecosystem modernization for broad adoption.

dowidth.com

dowidth.com