Branded currency serves as a digital or physical medium issued by a company to encourage customer loyalty and enhance brand engagement through targeted rewards and redeemable value. Store credit, often provided after returns or exchanges, offers customers a flexible purchasing option strictly limited to the issuing retailer's products or services. Explore how branded currency and store credit influence consumer behavior and business growth strategies.

Why it is important

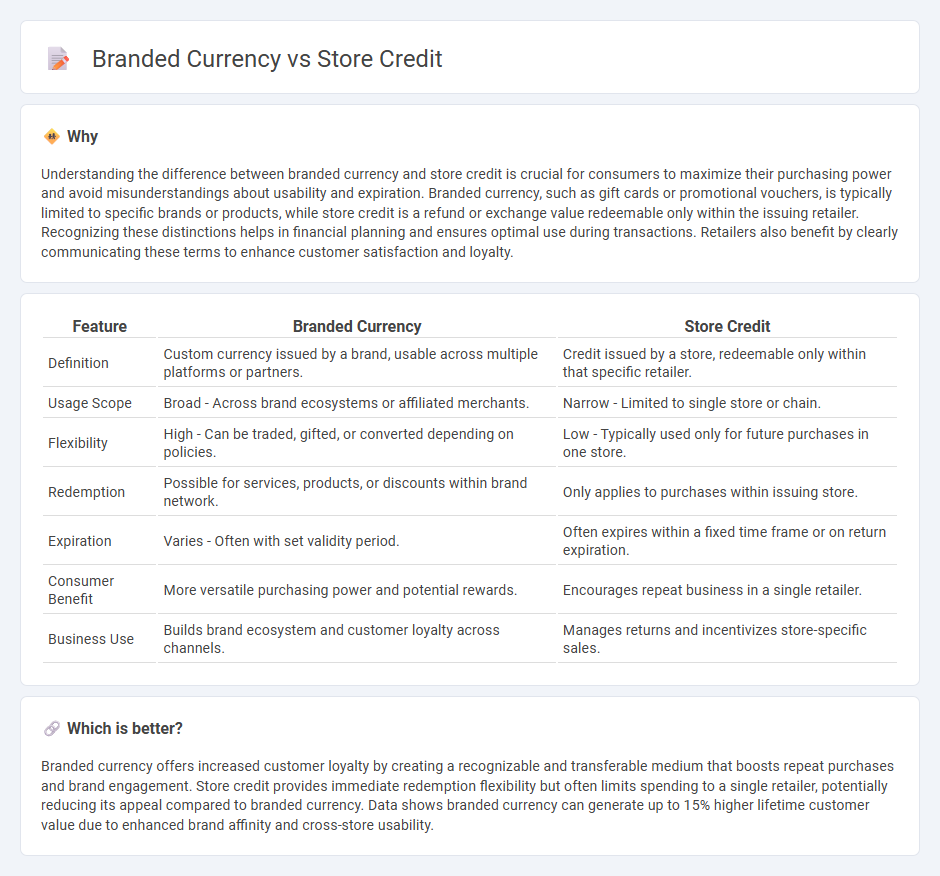

Understanding the difference between branded currency and store credit is crucial for consumers to maximize their purchasing power and avoid misunderstandings about usability and expiration. Branded currency, such as gift cards or promotional vouchers, is typically limited to specific brands or products, while store credit is a refund or exchange value redeemable only within the issuing retailer. Recognizing these distinctions helps in financial planning and ensures optimal use during transactions. Retailers also benefit by clearly communicating these terms to enhance customer satisfaction and loyalty.

Comparison Table

| Feature | Branded Currency | Store Credit |

|---|---|---|

| Definition | Custom currency issued by a brand, usable across multiple platforms or partners. | Credit issued by a store, redeemable only within that specific retailer. |

| Usage Scope | Broad - Across brand ecosystems or affiliated merchants. | Narrow - Limited to single store or chain. |

| Flexibility | High - Can be traded, gifted, or converted depending on policies. | Low - Typically used only for future purchases in one store. |

| Redemption | Possible for services, products, or discounts within brand network. | Only applies to purchases within issuing store. |

| Expiration | Varies - Often with set validity period. | Often expires within a fixed time frame or on return expiration. |

| Consumer Benefit | More versatile purchasing power and potential rewards. | Encourages repeat business in a single retailer. |

| Business Use | Builds brand ecosystem and customer loyalty across channels. | Manages returns and incentivizes store-specific sales. |

Which is better?

Branded currency offers increased customer loyalty by creating a recognizable and transferable medium that boosts repeat purchases and brand engagement. Store credit provides immediate redemption flexibility but often limits spending to a single retailer, potentially reducing its appeal compared to branded currency. Data shows branded currency can generate up to 15% higher lifetime customer value due to enhanced brand affinity and cross-store usability.

Connection

Branded currency and store credit both function as alternative payment methods that enhance customer loyalty within commerce. Branded currency represents a company-issued medium of exchange redeemable exclusively at the issuing brand's outlets, while store credit refers to pre-loaded funds or refunds that customers can use for future purchases. Both systems incentivize repeat business by restricting spending to the specific retailer, thereby increasing customer retention and driving sales growth.

Key Terms

Gift Cards

Store credit and branded currency both serve as flexible payment options, but store credit is typically issued by individual retailers, limiting its use to their products, while branded currency like gift cards can often be used across a variety of stores within a brand network or partnership. Gift cards provide a convenient way to manage budgets, offer personalized gifting options, and often come with promotional incentives that enhance their value. Explore the advantages and restrictions of each to maximize benefits in your shopping or gifting strategy.

Loyalty Points

Loyalty points serve as a strategic tool for enhancing customer retention by acting as a form of store credit redeemable exclusively within a specific brand, thereby increasing repeat purchases and customer engagement. Unlike branded currency, which can be designed to resemble traditional money with broader usability, loyalty points often carry restrictions that tie customers directly to the issuing retailer's ecosystem. Explore how leveraging loyalty points can maximize brand loyalty and drive long-term value for your business.

Refund Policy

Store credit is a refund option where returned items are exchanged for a specific retailer's internal currency, usable only within that store, enhancing customer retention and streamlined returns. Branded currency, often in the form of gift cards or digital wallets, provides more flexibility, allowing customers to shop across multiple outlets under the same brand umbrella while maintaining controlled refund scopes. Explore detailed differences and benefits to make informed decisions about refund policies in retail environments.

Source and External Links

What Is Store Credit? How To Use It To Sell More (2025) - Shopify - Store credit is money retailers give customers to use later exclusively at their store, often issued during returns instead of cash refunds, encouraging repeat business and customer loyalty by keeping funds within the store ecosystem.

What is Store Credit? - ReturnGO - Store credit is a form of refund usable only at the issuing retailer that encourages repeat business, reduces refund rates, and fosters customer retention through a store-specific credit balance rather than cash refunds.

Store credit - Wikipedia - Store credit is a special currency given instead of cash refunds or exchanges and can only be spent at that retailer, often equal to the returned item's price and used to increase customer loyalty and upselling opportunities.

dowidth.com

dowidth.com