Returnless refunds eliminate the cost and inconvenience of product returns by issuing refunds without requiring customers to send items back, enhancing customer satisfaction while reducing logistical expenses. Restocking fees, typically a percentage of the item's price, are charged when returned products are accepted, helping merchants offset the costs related to processing and reselling returned goods. Discover how these strategies impact ecommerce profitability and customer loyalty.

Why it is important

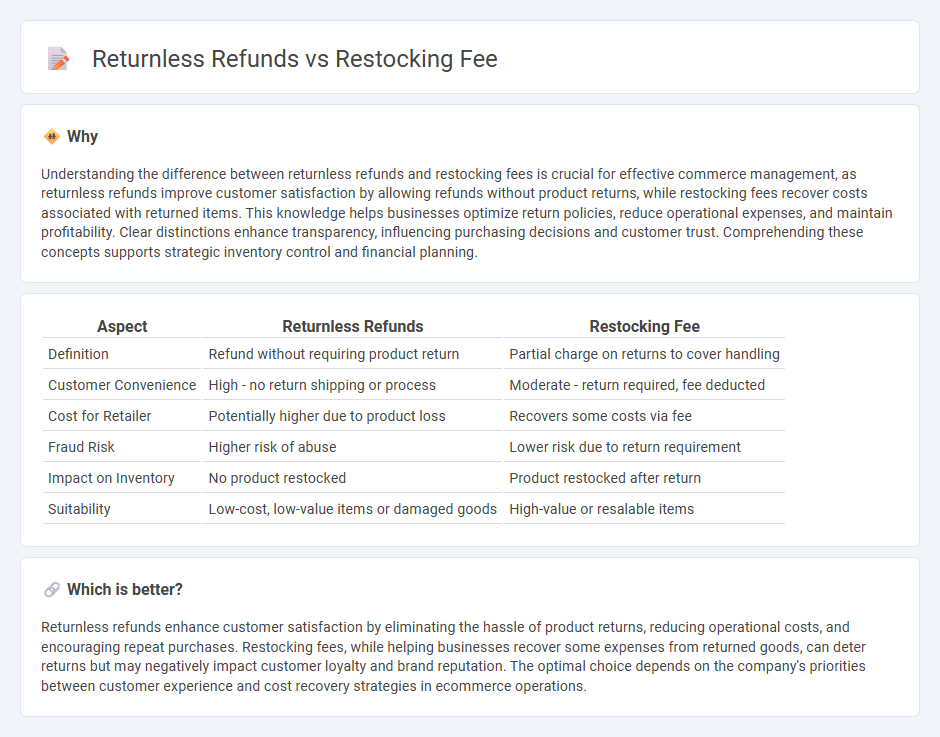

Understanding the difference between returnless refunds and restocking fees is crucial for effective commerce management, as returnless refunds improve customer satisfaction by allowing refunds without product returns, while restocking fees recover costs associated with returned items. This knowledge helps businesses optimize return policies, reduce operational expenses, and maintain profitability. Clear distinctions enhance transparency, influencing purchasing decisions and customer trust. Comprehending these concepts supports strategic inventory control and financial planning.

Comparison Table

| Aspect | Returnless Refunds | Restocking Fee |

|---|---|---|

| Definition | Refund without requiring product return | Partial charge on returns to cover handling |

| Customer Convenience | High - no return shipping or process | Moderate - return required, fee deducted |

| Cost for Retailer | Potentially higher due to product loss | Recovers some costs via fee |

| Fraud Risk | Higher risk of abuse | Lower risk due to return requirement |

| Impact on Inventory | No product restocked | Product restocked after return |

| Suitability | Low-cost, low-value items or damaged goods | High-value or resalable items |

Which is better?

Returnless refunds enhance customer satisfaction by eliminating the hassle of product returns, reducing operational costs, and encouraging repeat purchases. Restocking fees, while helping businesses recover some expenses from returned goods, can deter returns but may negatively impact customer loyalty and brand reputation. The optimal choice depends on the company's priorities between customer experience and cost recovery strategies in ecommerce operations.

Connection

Returnless refunds help e-commerce businesses reduce logistics costs by allowing customers to keep unwanted items while receiving refunds, which directly impacts inventory management. This approach is often paired with restocking fees to offset losses from returned merchandise, ensuring partial cost recovery without the full expense of restocking. Balancing returnless refunds and restocking fees enhances customer satisfaction while maintaining profitability in retail operations.

Key Terms

Inventory Management

Restocking fees help recover costs associated with inspecting, repackaging, and managing returned inventory, directly impacting inventory turnover rates and storage expenses. Returnless refunds eliminate the need for physical returns, reducing handling time and preventing returned items from re-entering inventory, which simplifies stock management but may increase loss on unsold goods. Explore effective inventory management strategies by understanding how restocking fees and returnless refunds influence your supply chain efficiency.

Customer Satisfaction

Restocking fees often discourage returns by charging customers a percentage of the purchase price, potentially reducing customer satisfaction and repeat business. Returnless refunds enhance customer experience by waiving return requirements, leading to increased trust and loyalty, especially in e-commerce industries. Explore how implementing returnless refunds can transform your customer service strategy and boost long-term satisfaction.

Profit Margin

Restocking fees can help maintain a higher profit margin by offsetting the costs associated with returned items, while returnless refunds often reduce operational expenses and improve customer satisfaction but may lower overall profitability. Businesses must analyze return rates, product value, and customer behavior to determine the optimal strategy for maximizing profit margins. Explore detailed comparisons and data-driven insights to choose the best approach for your retail model.

Source and External Links

What is a Re-Stocking Fee and how does it work? - Bay Supply - A restocking fee is a charge by the seller to cover the cost of putting returned goods back into inventory, usually deducted as a percentage of the original purchase price from the refund amount.

What is a Restocking Fee, And Alternative Options - Cahoot.ai - Restocking fees typically range from 10% to 25% of the product price and compensate retailers for costs like handling, inspecting, and repackaging returned items.

What are restocking fees and when should they be enforced? - Reverb Help - A restocking fee offsets the seller's expenses for inspection, repackaging, and value loss on returned items and must be disclosed explicitly in the return policy before purchase.

dowidth.com

dowidth.com