Peer-to-peer payments enable users to transfer funds directly between accounts using mobile apps or online platforms, offering convenience and speed without intermediaries. Prepaid cards provide a stored value option for spending, often used for budgeting, gifting, or for those without access to traditional banking services. Explore the key differences and benefits of these payment methods to optimize your financial transactions.

Why it is important

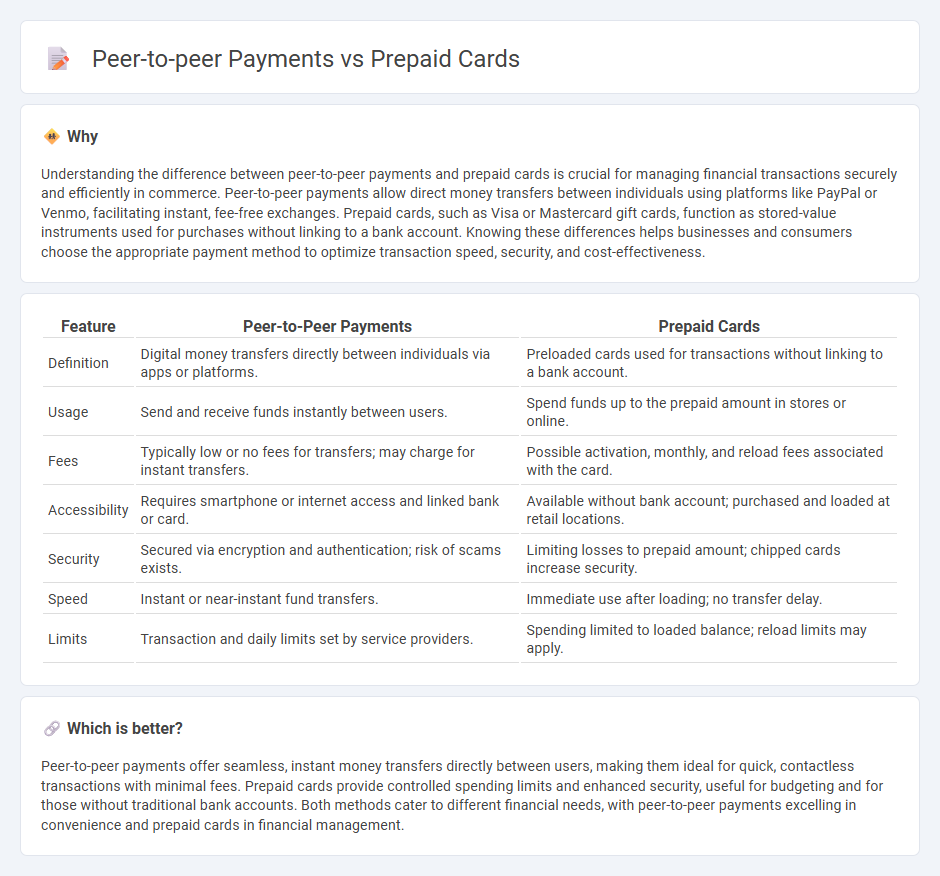

Understanding the difference between peer-to-peer payments and prepaid cards is crucial for managing financial transactions securely and efficiently in commerce. Peer-to-peer payments allow direct money transfers between individuals using platforms like PayPal or Venmo, facilitating instant, fee-free exchanges. Prepaid cards, such as Visa or Mastercard gift cards, function as stored-value instruments used for purchases without linking to a bank account. Knowing these differences helps businesses and consumers choose the appropriate payment method to optimize transaction speed, security, and cost-effectiveness.

Comparison Table

| Feature | Peer-to-Peer Payments | Prepaid Cards |

|---|---|---|

| Definition | Digital money transfers directly between individuals via apps or platforms. | Preloaded cards used for transactions without linking to a bank account. |

| Usage | Send and receive funds instantly between users. | Spend funds up to the prepaid amount in stores or online. |

| Fees | Typically low or no fees for transfers; may charge for instant transfers. | Possible activation, monthly, and reload fees associated with the card. |

| Accessibility | Requires smartphone or internet access and linked bank or card. | Available without bank account; purchased and loaded at retail locations. |

| Security | Secured via encryption and authentication; risk of scams exists. | Limiting losses to prepaid amount; chipped cards increase security. |

| Speed | Instant or near-instant fund transfers. | Immediate use after loading; no transfer delay. |

| Limits | Transaction and daily limits set by service providers. | Spending limited to loaded balance; reload limits may apply. |

Which is better?

Peer-to-peer payments offer seamless, instant money transfers directly between users, making them ideal for quick, contactless transactions with minimal fees. Prepaid cards provide controlled spending limits and enhanced security, useful for budgeting and for those without traditional bank accounts. Both methods cater to different financial needs, with peer-to-peer payments excelling in convenience and prepaid cards in financial management.

Connection

Peer-to-peer payments utilize prepaid cards as a secure and convenient funding source, enabling users to instantly transfer money without relying on traditional bank accounts. Prepaid cards enhance accessibility for unbanked or underbanked individuals, facilitating seamless transactions in digital commerce. This integration drives the growth of cashless economies by promoting faster, more inclusive, and cost-effective payment solutions.

Key Terms

Stored Value

Stored value in prepaid cards represents a fixed amount of money securely stored for future transactions, offering controlled spending without direct bank account access. Peer-to-peer payments leverage real-time fund transfers between users, often linked to bank accounts or mobile wallets, enabling flexible and instantaneous money exchange. Explore how each method's stored value mechanisms impact convenience, security, and usability.

Digital Wallet

Digital wallets offer seamless integration with prepaid cards, enabling users to load funds and make secure transactions without needing a bank account. Peer-to-peer payments through digital wallets facilitate instant money transfers using mobile numbers or email addresses, enhancing convenience and reducing transaction times. Explore how digital wallets revolutionize financial transactions for greater convenience and security.

Fund Transfer

Prepaid cards offer a secure and convenient method for fund transfer by enabling users to load a fixed amount of money, reducing the risk of overspending and providing easy tracking of transactions. Peer-to-peer (P2P) payments facilitate instant fund transfers directly between individuals via mobile apps or digital platforms, enhancing speed and accessibility without the need for physical cards. Explore further to understand which fund transfer method aligns best with your financial needs and lifestyle.

Source and External Links

Visa Prepaid Cards - Visa prepaid cards are reloadable, secure payment cards with no credit check required, usable in-person and online wherever Visa Debit is accepted, and they help manage money without overdraft risks.

Mastercard Prepaid Cards - Mastercard prepaid cards offer a flexible, convenient, and secure way to make purchases anywhere Mastercard is accepted, with no credit check or bank account needed, and protections against loss or theft of funds.

How are prepaid cards, debit cards, and credit cards different? - Prepaid cards are pre-loaded with funds and not linked to a bank account; they allow spending only up to the loaded balance, contrasting with debit cards tied to bank accounts and credit cards which involve borrowing money.

dowidth.com

dowidth.com