Branded currency offers a unique way for businesses to enhance customer loyalty by issuing store-specific money that can be spent only within their network. Prepaid cards provide a versatile payment solution, allowing users to load funds in advance and use them broadly across multiple merchants. Explore how these financial tools shape modern commerce and consumer behavior.

Why it is important

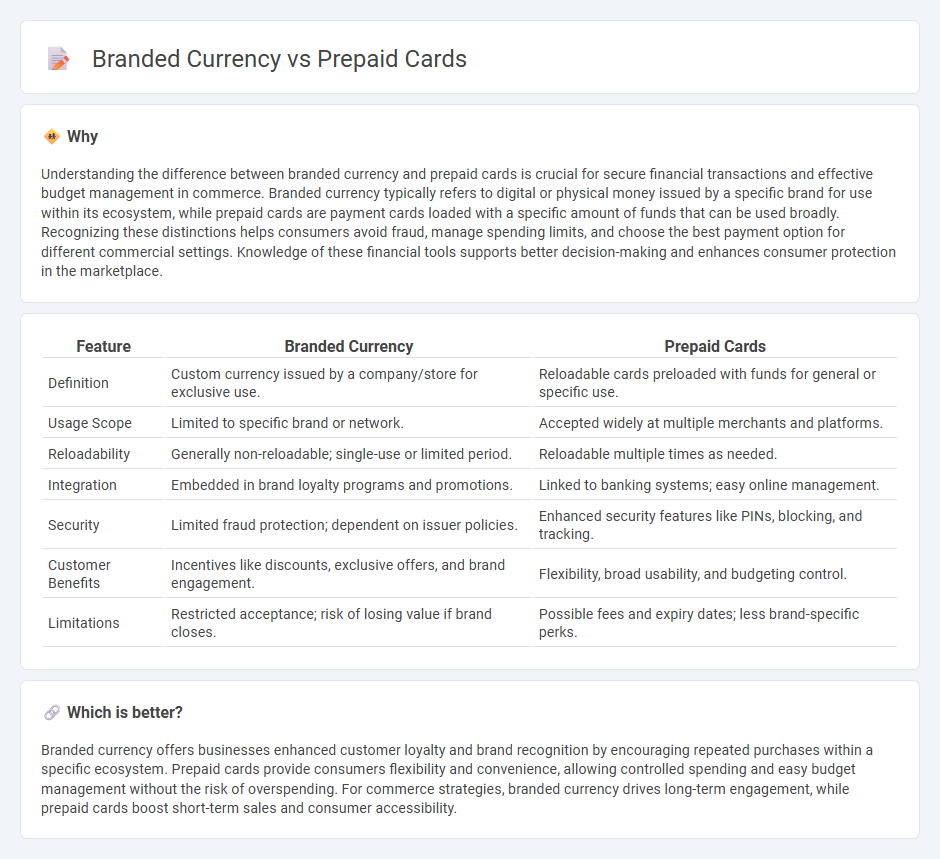

Understanding the difference between branded currency and prepaid cards is crucial for secure financial transactions and effective budget management in commerce. Branded currency typically refers to digital or physical money issued by a specific brand for use within its ecosystem, while prepaid cards are payment cards loaded with a specific amount of funds that can be used broadly. Recognizing these distinctions helps consumers avoid fraud, manage spending limits, and choose the best payment option for different commercial settings. Knowledge of these financial tools supports better decision-making and enhances consumer protection in the marketplace.

Comparison Table

| Feature | Branded Currency | Prepaid Cards |

|---|---|---|

| Definition | Custom currency issued by a company/store for exclusive use. | Reloadable cards preloaded with funds for general or specific use. |

| Usage Scope | Limited to specific brand or network. | Accepted widely at multiple merchants and platforms. |

| Reloadability | Generally non-reloadable; single-use or limited period. | Reloadable multiple times as needed. |

| Integration | Embedded in brand loyalty programs and promotions. | Linked to banking systems; easy online management. |

| Security | Limited fraud protection; dependent on issuer policies. | Enhanced security features like PINs, blocking, and tracking. |

| Customer Benefits | Incentives like discounts, exclusive offers, and brand engagement. | Flexibility, broad usability, and budgeting control. |

| Limitations | Restricted acceptance; risk of losing value if brand closes. | Possible fees and expiry dates; less brand-specific perks. |

Which is better?

Branded currency offers businesses enhanced customer loyalty and brand recognition by encouraging repeated purchases within a specific ecosystem. Prepaid cards provide consumers flexibility and convenience, allowing controlled spending and easy budget management without the risk of overspending. For commerce strategies, branded currency drives long-term engagement, while prepaid cards boost short-term sales and consumer accessibility.

Connection

Branded currency, often issued by companies as loyalty or reward points, enhances customer engagement by acting as a form of prepaid credit within a specific commercial ecosystem. Prepaid cards, linked to branded currency, allow consumers to seamlessly redeem accumulated points or funds for purchases, increasing the utility and appeal of the branded currency. This integration drives repeat business and strengthens brand loyalty by providing a convenient, cashless payment solution tied directly to consumer spending behavior.

Key Terms

Stored Value

Stored value in prepaid cards offers a secure and convenient way to manage funds for specific purposes, unlike branded currency which is limited to particular merchants or services. Prepaid cards are widely accepted, reloadable, and provide enhanced tracking and budgeting features compared to the fixed value and restricted use of branded currency. Explore the benefits of stored value solutions to determine the best fit for your financial needs.

Issuer

Prepaid cards issued by financial institutions offer controlled spending limits and enhanced security features compared to branded currency, which is typically managed by specific companies for limited use within their ecosystems. Issuers of prepaid cards provide consumer protections such as fraud monitoring, reload capabilities, and regulatory compliance that branded currency issuers may not consistently guarantee. Explore the nuances of card issuers and branded currency systems to understand their impact on financial security and user experience.

Source and External Links

Visa Prepaid Cards - Visa prepaid cards are reloadable, secure, require no credit check, and can be used anywhere Visa Debit cards are accepted without overdraft fees since spending is limited to the available balance.

Mastercard Prepaid Cards - Mastercard prepaid cards offer flexibility and security for purchases everywhere Mastercard is accepted, need no credit check or bank account, and allow users to manage funds easily both online and in person.

How are prepaid cards, debit cards, and credit cards different? - Prepaid cards are loaded with money before use and are not linked to bank accounts, allowing spending up to the loaded amount without borrowing, unlike credit cards which involve borrowing funds.

dowidth.com

dowidth.com