Native checkout offers seamless integration within e-commerce apps, providing faster transaction processing and enhanced user experience through saved payment details and personalized options. Mobile wallet checkout enables quick payments using digital wallets like Apple Pay or Google Wallet, ensuring security with tokenization and biometric authentication, reducing checkout friction. Explore the benefits of each method to optimize your commerce strategy effectively.

Why it is important

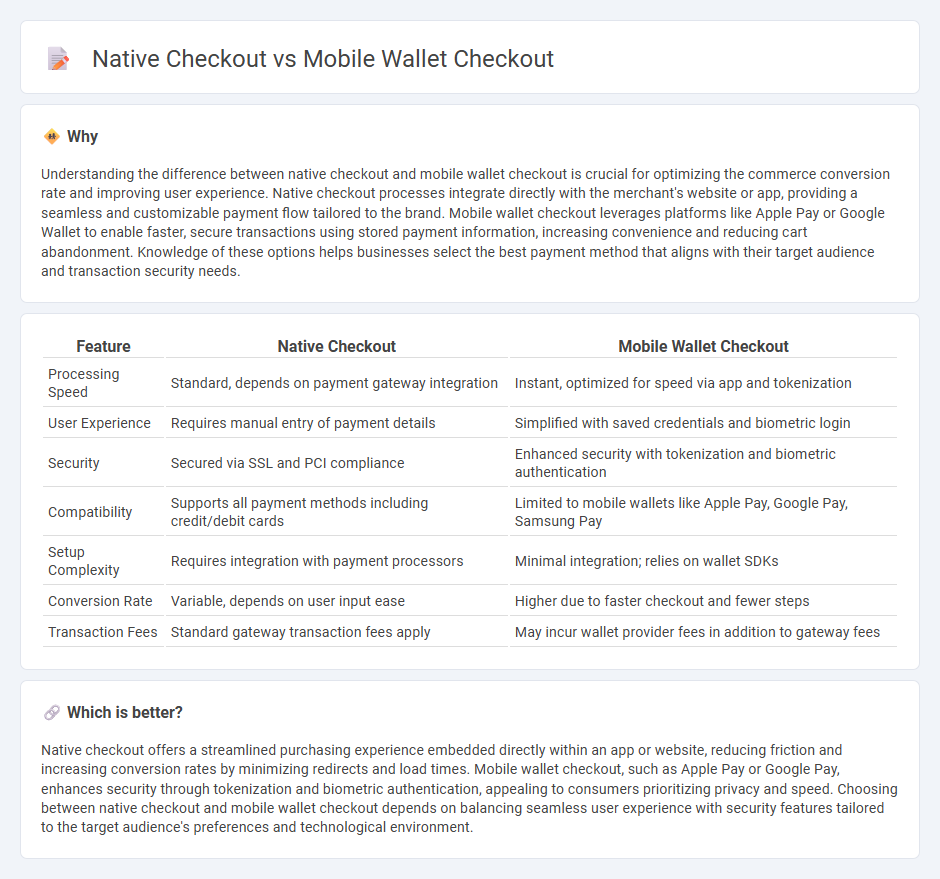

Understanding the difference between native checkout and mobile wallet checkout is crucial for optimizing the commerce conversion rate and improving user experience. Native checkout processes integrate directly with the merchant's website or app, providing a seamless and customizable payment flow tailored to the brand. Mobile wallet checkout leverages platforms like Apple Pay or Google Wallet to enable faster, secure transactions using stored payment information, increasing convenience and reducing cart abandonment. Knowledge of these options helps businesses select the best payment method that aligns with their target audience and transaction security needs.

Comparison Table

| Feature | Native Checkout | Mobile Wallet Checkout |

|---|---|---|

| Processing Speed | Standard, depends on payment gateway integration | Instant, optimized for speed via app and tokenization |

| User Experience | Requires manual entry of payment details | Simplified with saved credentials and biometric login |

| Security | Secured via SSL and PCI compliance | Enhanced security with tokenization and biometric authentication |

| Compatibility | Supports all payment methods including credit/debit cards | Limited to mobile wallets like Apple Pay, Google Pay, Samsung Pay |

| Setup Complexity | Requires integration with payment processors | Minimal integration; relies on wallet SDKs |

| Conversion Rate | Variable, depends on user input ease | Higher due to faster checkout and fewer steps |

| Transaction Fees | Standard gateway transaction fees apply | May incur wallet provider fees in addition to gateway fees |

Which is better?

Native checkout offers a streamlined purchasing experience embedded directly within an app or website, reducing friction and increasing conversion rates by minimizing redirects and load times. Mobile wallet checkout, such as Apple Pay or Google Pay, enhances security through tokenization and biometric authentication, appealing to consumers prioritizing privacy and speed. Choosing between native checkout and mobile wallet checkout depends on balancing seamless user experience with security features tailored to the target audience's preferences and technological environment.

Connection

Native checkout streamlines the purchasing process by integrating payment options directly within the app or website, enhancing user experience and reducing cart abandonment. Mobile wallet checkout leverages this by allowing consumers to complete transactions quickly using stored payment information on devices like Apple Pay, Google Pay, or Samsung Pay. Together, they create a seamless, secure, and efficient payment flow that boosts conversion rates in e-commerce platforms.

Key Terms

User Experience (UX)

Mobile wallet checkout offers a streamlined user experience by enabling fast, secure payments with biometric authentication and one-tap transactions, reducing cart abandonment rates significantly. Native checkout provides deeper integration with app features, customizable UI, and offline payment options, enhancing user control and trust. Discover how each payment method can transform your digital commerce strategy and boost customer satisfaction.

Payment Integration

Mobile wallet checkout simplifies payment integration by leveraging established platforms like Apple Pay, Google Pay, and Samsung Pay, ensuring quick transaction processing with minimal developer effort. Native checkout requires building and maintaining a custom payment gateway or integrating various third-party APIs, increasing complexity and control over user experience. Discover how choosing between mobile wallets and native checkout can optimize your business payment flow.

Conversion Rate

Mobile wallet checkout significantly boosts conversion rates by streamlining the payment process with stored payment data and biometric authentication, reducing friction at checkout. Native checkout often requires manual entry of payment details, increasing the likelihood of cart abandonment and lower conversion rates. Explore how integrating mobile wallet solutions can enhance your sales performance and customer experience.

Source and External Links

How digital wallets work and how to accept a digital wallet - Digital wallets enable mobile wallet checkout using NFC, MST, or QR codes, where users unlock their device, select a payment method, and hold it near a payment terminal to complete fast, contactless transactions on mobile or online.

Tap to pay with your phone - Google Wallet Help - Google Wallet allows users to tap to pay in stores by simply holding their phone near a payment reader and verifying the transaction with screen lock, without necessarily opening the wallet app first.

Mobile Wallet - WMATA supports mobile wallet checkout via contactless credit/debit cards or SmarTrip in mobile wallets, enabling fare payment for transit and parking by tapping the mobile device at fare gates or terminals.

dowidth.com

dowidth.com