Peer-to-peer payments utilize digital platforms and mobile apps to transfer funds instantly between individuals, enhancing convenience and security compared to traditional cash transactions. Cash payments, though tangible and widely accepted, lack the efficiency and traceability provided by electronic methods, often leading to slower and less secure exchanges. Explore the benefits and drawbacks of each payment method to understand their impact on modern commerce.

Why it is important

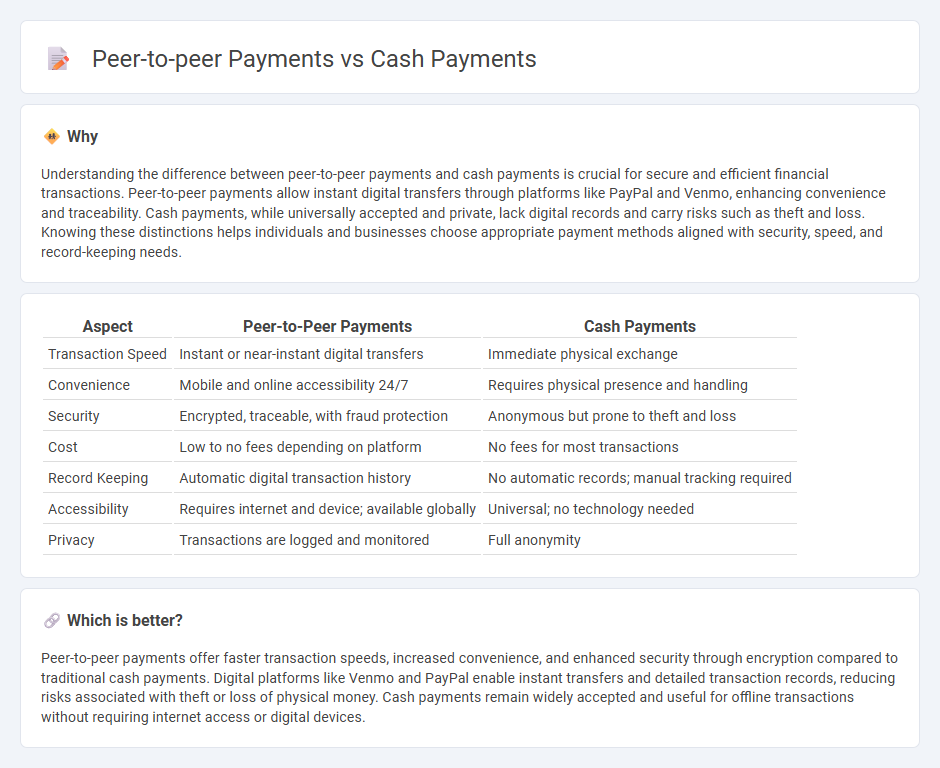

Understanding the difference between peer-to-peer payments and cash payments is crucial for secure and efficient financial transactions. Peer-to-peer payments allow instant digital transfers through platforms like PayPal and Venmo, enhancing convenience and traceability. Cash payments, while universally accepted and private, lack digital records and carry risks such as theft and loss. Knowing these distinctions helps individuals and businesses choose appropriate payment methods aligned with security, speed, and record-keeping needs.

Comparison Table

| Aspect | Peer-to-Peer Payments | Cash Payments |

|---|---|---|

| Transaction Speed | Instant or near-instant digital transfers | Immediate physical exchange |

| Convenience | Mobile and online accessibility 24/7 | Requires physical presence and handling |

| Security | Encrypted, traceable, with fraud protection | Anonymous but prone to theft and loss |

| Cost | Low to no fees depending on platform | No fees for most transactions |

| Record Keeping | Automatic digital transaction history | No automatic records; manual tracking required |

| Accessibility | Requires internet and device; available globally | Universal; no technology needed |

| Privacy | Transactions are logged and monitored | Full anonymity |

Which is better?

Peer-to-peer payments offer faster transaction speeds, increased convenience, and enhanced security through encryption compared to traditional cash payments. Digital platforms like Venmo and PayPal enable instant transfers and detailed transaction records, reducing risks associated with theft or loss of physical money. Cash payments remain widely accepted and useful for offline transactions without requiring internet access or digital devices.

Connection

Peer-to-peer payments and cash payments are connected through their shared role in facilitating direct, person-to-person financial transactions without intermediaries like banks. Both methods enable immediate settlement of payments, enhancing convenience and autonomy in commercial exchanges. The rise of digital peer-to-peer payment platforms reflects a shift from traditional cash usage while maintaining the core principle of direct value transfer.

Key Terms

Settlement

Cash payments offer immediate settlement as funds are exchanged directly between parties without intermediaries, ensuring instant finality in transactions. Peer-to-peer (P2P) payments typically rely on digital platforms and intermediaries, which may introduce settlement delays ranging from seconds to several business days depending on the network and regulatory frameworks involved. Explore deeper insights into settlement mechanisms and their impact on transaction efficiency and security.

Transaction fees

Cash payments involve no transaction fees, making them cost-effective for in-person exchanges, but they lack digital security and convenience. Peer-to-peer payments often incur transaction fees ranging from 1% to 3%, depending on the platform and payment method used, which covers processing and fraud protection services. Explore more about the cost dynamics of various payment methods to optimize your transaction strategy.

Transfer speed

Cash payments offer immediate transfer speed as funds change hands instantly without intermediaries. Peer-to-peer payments, facilitated by digital platforms, typically process within seconds to minutes, depending on the network and bank processing times. Explore the nuances of transfer speed differences to optimize your payment method.

Source and External Links

Cash payment definition - AccountingTools - A cash payment is the transfer of bills or coins for goods or services, offering benefits like immediate transaction completion, no fees, privacy, and reliability without dependence on electronic systems.

Cash Transaction: What is a Cash Payment and How it Works? - Cash transactions involve the direct exchange of physical currency at the time of purchase, suitable for small-value or immediate payments, contrasting with credit transactions that defer payment.

The Advantages and Disadvantages of Cash Payment - PayComplete - Cash payments are widely accepted, provide immediate settlement, and ensure privacy by avoiding electronic tracking or processing delays common in card payments.

dowidth.com

dowidth.com