Sales teams often struggle to differentiate between ghost pipeline and forecast inflation, which can distort revenue predictions and hinder strategic planning. Ghost pipeline refers to deals that appear promising but lack genuine buyer interest, while forecast inflation occurs when sales projections are exaggerated beyond realistic expectations. Explore detailed strategies to identify these issues and improve forecast accuracy.

Why it is important

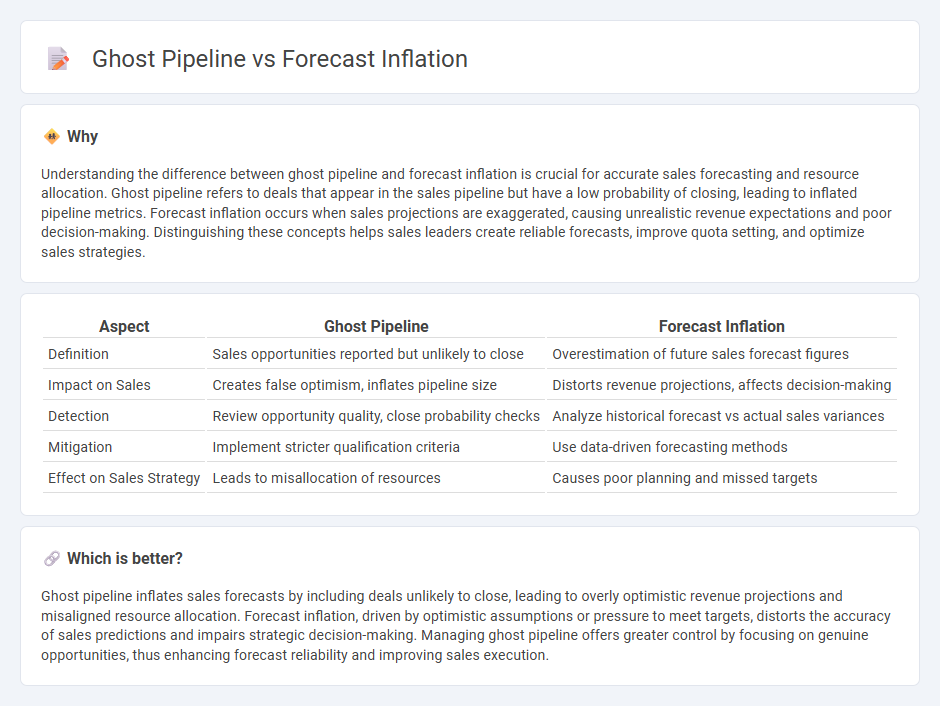

Understanding the difference between ghost pipeline and forecast inflation is crucial for accurate sales forecasting and resource allocation. Ghost pipeline refers to deals that appear in the sales pipeline but have a low probability of closing, leading to inflated pipeline metrics. Forecast inflation occurs when sales projections are exaggerated, causing unrealistic revenue expectations and poor decision-making. Distinguishing these concepts helps sales leaders create reliable forecasts, improve quota setting, and optimize sales strategies.

Comparison Table

| Aspect | Ghost Pipeline | Forecast Inflation |

|---|---|---|

| Definition | Sales opportunities reported but unlikely to close | Overestimation of future sales forecast figures |

| Impact on Sales | Creates false optimism, inflates pipeline size | Distorts revenue projections, affects decision-making |

| Detection | Review opportunity quality, close probability checks | Analyze historical forecast vs actual sales variances |

| Mitigation | Implement stricter qualification criteria | Use data-driven forecasting methods |

| Effect on Sales Strategy | Leads to misallocation of resources | Causes poor planning and missed targets |

Which is better?

Ghost pipeline inflates sales forecasts by including deals unlikely to close, leading to overly optimistic revenue projections and misaligned resource allocation. Forecast inflation, driven by optimistic assumptions or pressure to meet targets, distorts the accuracy of sales predictions and impairs strategic decision-making. Managing ghost pipeline offers greater control by focusing on genuine opportunities, thus enhancing forecast reliability and improving sales execution.

Connection

Ghost pipeline in sales refers to deals that appear promising but lack real buying intent, inflating the sales forecast inaccurately. Forecast inflation occurs when these phantom opportunities skew revenue projections, leading to overestimated performance expectations. Identifying and filtering out ghost pipeline entries is essential for reliable sales forecasting and effective resource allocation.

Key Terms

Sales Pipeline Accuracy

Forecast inflation often leads to inflated projections that obscure true sales potential, making it challenging to assess pipeline health accurately. Ghost pipeline, comprising deals unlikely to close or overstated opportunities, further distorts sales forecasting precision. Explore advanced strategies to enhance Sales Pipeline Accuracy and improve revenue predictability.

Revenue Forecasting

Accurate revenue forecasting requires analyzing inflation trends alongside potential disruptions in the sales pipeline, often referred to as the "ghost pipeline," which consists of overestimated or unlikely deals. Inflation impacts pricing strategies, procurement costs, and consumer spending behavior, making it critical to adjust forecasts to reflect economic changes. Explore strategies to enhance revenue forecasting accuracy by understanding the interplay between inflation and pipeline reliability.

Deal Qualification

Forecast inflation often leads to an overestimation of deals in the sales pipeline, creating a ghost pipeline filled with low-probability opportunities that distort revenue expectations. Accurate deal qualification through rigorous criteria such as buyer intent, budget alignment, and timeline clarity reduces forecast inflation and improves pipeline integrity. Explore advanced qualification techniques to enhance forecast accuracy and drive better sales performance.

Source and External Links

United States Inflation Rate - Trading Economics - The US inflation rate is projected to be around 2.4% in 2026 and 2.3% in 2027, with June 2025 inflation rising to 2.7%, driven by higher import costs and gasoline prices.

Inflation Nowcasting - Federal Reserve Bank of Cleveland - Daily nowcasts estimate July 2025 inflation at about 2.73% CPI and 3.04% core CPI, reflecting recent monthly upticks in inflation metrics.

us inflation (cpi-u) - forecast chart - Econforecasting - Consensus forecasts of US inflation use a combination of Treasury data, CPI inflation, and market expectations to update daily inflation rate projections.

dowidth.com

dowidth.com