Scan and go technology streamlines the retail checkout process by allowing customers to scan items with their smartphones as they shop, reducing wait times and enhancing convenience. Contactless payment methods, such as NFC-enabled credit cards and mobile wallets, enable secure, fast transactions without physical contact, promoting hygiene and efficiency. Explore the latest innovations transforming retail payment experiences to optimize customer satisfaction and operational efficiency.

Why it is important

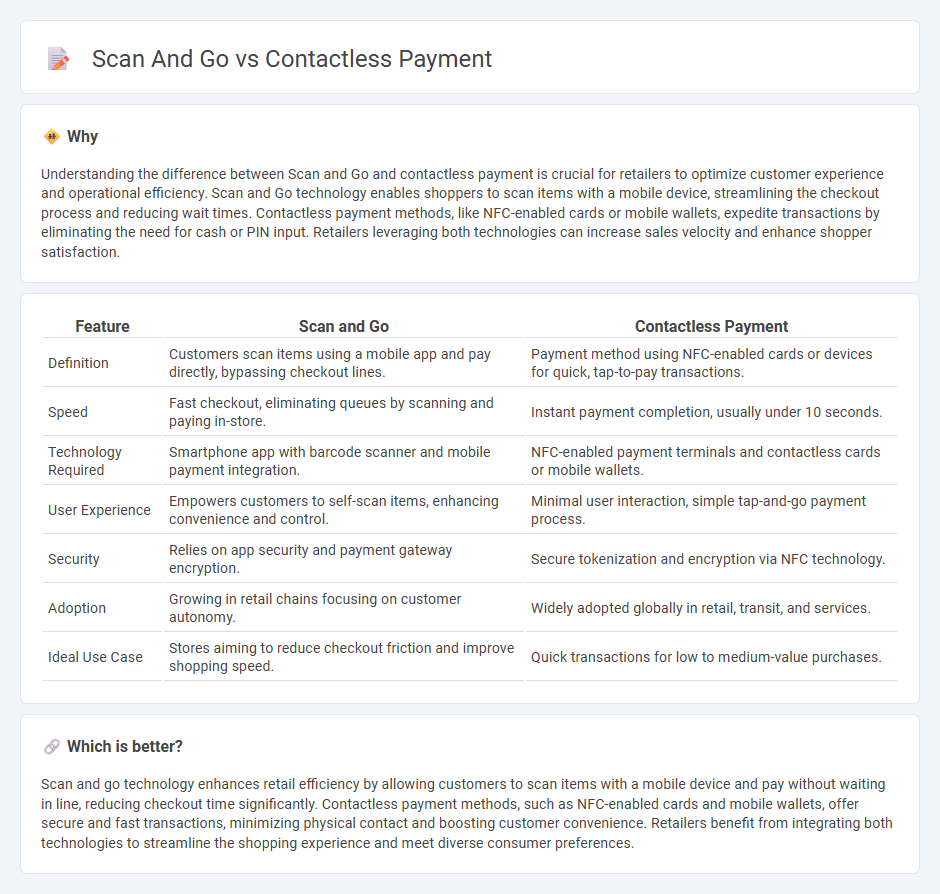

Understanding the difference between Scan and Go and contactless payment is crucial for retailers to optimize customer experience and operational efficiency. Scan and Go technology enables shoppers to scan items with a mobile device, streamlining the checkout process and reducing wait times. Contactless payment methods, like NFC-enabled cards or mobile wallets, expedite transactions by eliminating the need for cash or PIN input. Retailers leveraging both technologies can increase sales velocity and enhance shopper satisfaction.

Comparison Table

| Feature | Scan and Go | Contactless Payment |

|---|---|---|

| Definition | Customers scan items using a mobile app and pay directly, bypassing checkout lines. | Payment method using NFC-enabled cards or devices for quick, tap-to-pay transactions. |

| Speed | Fast checkout, eliminating queues by scanning and paying in-store. | Instant payment completion, usually under 10 seconds. |

| Technology Required | Smartphone app with barcode scanner and mobile payment integration. | NFC-enabled payment terminals and contactless cards or mobile wallets. |

| User Experience | Empowers customers to self-scan items, enhancing convenience and control. | Minimal user interaction, simple tap-and-go payment process. |

| Security | Relies on app security and payment gateway encryption. | Secure tokenization and encryption via NFC technology. |

| Adoption | Growing in retail chains focusing on customer autonomy. | Widely adopted globally in retail, transit, and services. |

| Ideal Use Case | Stores aiming to reduce checkout friction and improve shopping speed. | Quick transactions for low to medium-value purchases. |

Which is better?

Scan and go technology enhances retail efficiency by allowing customers to scan items with a mobile device and pay without waiting in line, reducing checkout time significantly. Contactless payment methods, such as NFC-enabled cards and mobile wallets, offer secure and fast transactions, minimizing physical contact and boosting customer convenience. Retailers benefit from integrating both technologies to streamline the shopping experience and meet diverse consumer preferences.

Connection

Scan and go technology streamlines the retail checkout process by allowing customers to scan items using their smartphones while shopping, reducing wait times and enhancing convenience. Contactless payment integrates seamlessly with scan and go systems, enabling swift, secure transactions through NFC-enabled cards or mobile wallets without the need for physical cash or swiping. Together, they create a frictionless retail experience that boosts customer satisfaction and operational efficiency.

Key Terms

NFC (Near Field Communication)

NFC (Near Field Communication) technology enables seamless contactless payments by allowing devices to communicate wirelessly within close proximity, facilitating quick and secure transactions via smartphones or contactless cards. Scan and go systems, while reliant on barcode scanning through mobile apps, lack NFC's instantaneous data exchange, leading to potentially slower checkout times. Explore how NFC-powered contactless payments are revolutionizing retail efficiency and consumer convenience.

Mobile App Integration

Contactless payment and Scan and Go systems both enhance convenience through mobile app integration, with contactless payment enabling near-field communication (NFC) technology for swift transactions via smartphones or wearables. Scan and Go apps allow users to scan product barcodes using their phones, streamlining the checkout process without traditional cashier interaction. Explore how mobile app integration transforms in-store experiences by improving speed, security, and user engagement in retail environments.

QR Code Scanning

Contactless payment typically uses NFC technology for tap-to-pay transactions, offering swift and secure payments without physical contact. Scan and go relies on QR code scanning, allowing customers to scan items with their smartphones for quick basket totals and faster checkout processes. Explore more about the benefits and technologies behind seamless QR code scanning for enhanced shopping experiences.

Source and External Links

What Is Contactless Payment and How Does it Work (2025) - Contactless payments allow customers to complete purchases securely by tapping a contactless card, phone, or wearable device using NFC technology without physical contact, offering faster and encrypted transactions.

What Is a Contactless Card & How Does It Work? - Contactless credit and debit cards enable payments by tapping or holding the card over a terminal, offering a faster, secure alternative to swiping or inserting cards.

Contactless payment - Contactless payments use RFID or NFC technology embedded in cards or devices to securely transmit payment data over short distances for seamless transactions, common in cards, smartphones, and smartwatches.

dowidth.com

dowidth.com