Automated valuation models (AVMs) use algorithms and large datasets to estimate property values quickly and with high accuracy, revolutionizing the real estate appraisal process. Mass appraisal, traditionally conducted by expert appraisers, evaluates multiple properties simultaneously for property tax assessments or portfolio analysis, often integrating market trends and local data. Explore how these valuation methods impact real estate decisions and market efficiency.

Why it is important

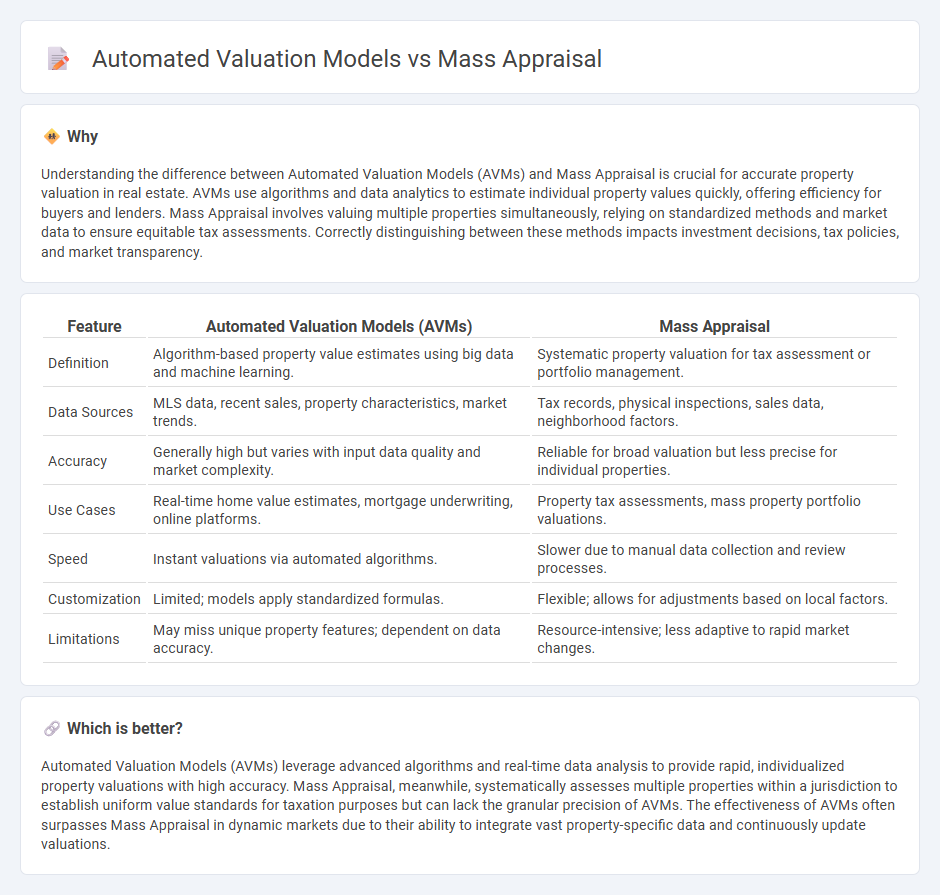

Understanding the difference between Automated Valuation Models (AVMs) and Mass Appraisal is crucial for accurate property valuation in real estate. AVMs use algorithms and data analytics to estimate individual property values quickly, offering efficiency for buyers and lenders. Mass Appraisal involves valuing multiple properties simultaneously, relying on standardized methods and market data to ensure equitable tax assessments. Correctly distinguishing between these methods impacts investment decisions, tax policies, and market transparency.

Comparison Table

| Feature | Automated Valuation Models (AVMs) | Mass Appraisal |

|---|---|---|

| Definition | Algorithm-based property value estimates using big data and machine learning. | Systematic property valuation for tax assessment or portfolio management. |

| Data Sources | MLS data, recent sales, property characteristics, market trends. | Tax records, physical inspections, sales data, neighborhood factors. |

| Accuracy | Generally high but varies with input data quality and market complexity. | Reliable for broad valuation but less precise for individual properties. |

| Use Cases | Real-time home value estimates, mortgage underwriting, online platforms. | Property tax assessments, mass property portfolio valuations. |

| Speed | Instant valuations via automated algorithms. | Slower due to manual data collection and review processes. |

| Customization | Limited; models apply standardized formulas. | Flexible; allows for adjustments based on local factors. |

| Limitations | May miss unique property features; dependent on data accuracy. | Resource-intensive; less adaptive to rapid market changes. |

Which is better?

Automated Valuation Models (AVMs) leverage advanced algorithms and real-time data analysis to provide rapid, individualized property valuations with high accuracy. Mass Appraisal, meanwhile, systematically assesses multiple properties within a jurisdiction to establish uniform value standards for taxation purposes but can lack the granular precision of AVMs. The effectiveness of AVMs often surpasses Mass Appraisal in dynamic markets due to their ability to integrate vast property-specific data and continuously update valuations.

Connection

Automated Valuation Models (AVMs) utilize algorithms and vast property data to estimate real estate values quickly and accurately, forming the backbone of Mass Appraisal processes. Mass Appraisal systematically assesses multiple properties simultaneously, relying heavily on AVMs to generate consistent, data-driven valuations for taxation and market analysis. Integration of AVMs enhances efficiency and objectivity in Mass Appraisal, enabling large-scale property assessments with reduced human error.

Key Terms

Valuation Methodology

Mass appraisal employs statistical analyses and algorithms to estimate property values across large geographic areas, integrating sales data, property characteristics, and market trends for consistent assessments. Automated valuation models (AVMs) utilize machine learning and real-time data inputs, including recent transactions and market fluctuations, delivering rapid and precise individual property valuations. Explore further to understand how these methodologies impact accuracy and efficiency in real estate valuation.

Data Analysis

Mass appraisal relies on extensive property data aggregation and statistically derived market trends to value multiple properties simultaneously, ensuring consistency across a region. Automated valuation models (AVMs) utilize machine learning algorithms and real-time data inputs to produce instant property value estimates, enhancing accuracy through continuous data refinement. Explore more about how advanced data analysis transforms valuation strategies in real estate.

Property Assessment

Mass appraisal systematically assesses property values across large regions using standardized data and statistical models, enabling efficient property taxation. Automated Valuation Models (AVMs) employ advanced algorithms, machine learning, and real-time market data to estimate property prices quickly and with improved accuracy. Discover how integrating mass appraisal and AVMs can revolutionize property assessment and valuation practices.

Source and External Links

Homeowner's Guide to Mass Appraisal - This guide outlines the use of mass appraisal in systematically valuing groups of properties using standardized procedures and statistical testing.

Demystifying Mass Appraisal: A Comprehensive Guide to Property Valuation - Mass appraisal is a scalable method for valuing multiple properties simultaneously, ensuring uniformity and consistency in assessments for tax purposes.

Mass Appraisal - Mass appraisers conduct valuations of all properties in a "universe" of properties, such as a city or county, which are used for property tax assessments.

dowidth.com

dowidth.com