Fractional C-suite executives deliver specialized leadership on a part-time basis, optimizing startup operations without the financial burden of full-time salaries, while venture partners leverage extensive industry networks to identify and nurture promising investments within venture capital firms. Both roles offer strategic advantages, tailoring expertise and resources to accelerate business growth and innovation. Explore how combining fractional C-suite roles with venture partnership can transform entrepreneurial success.

Why it is important

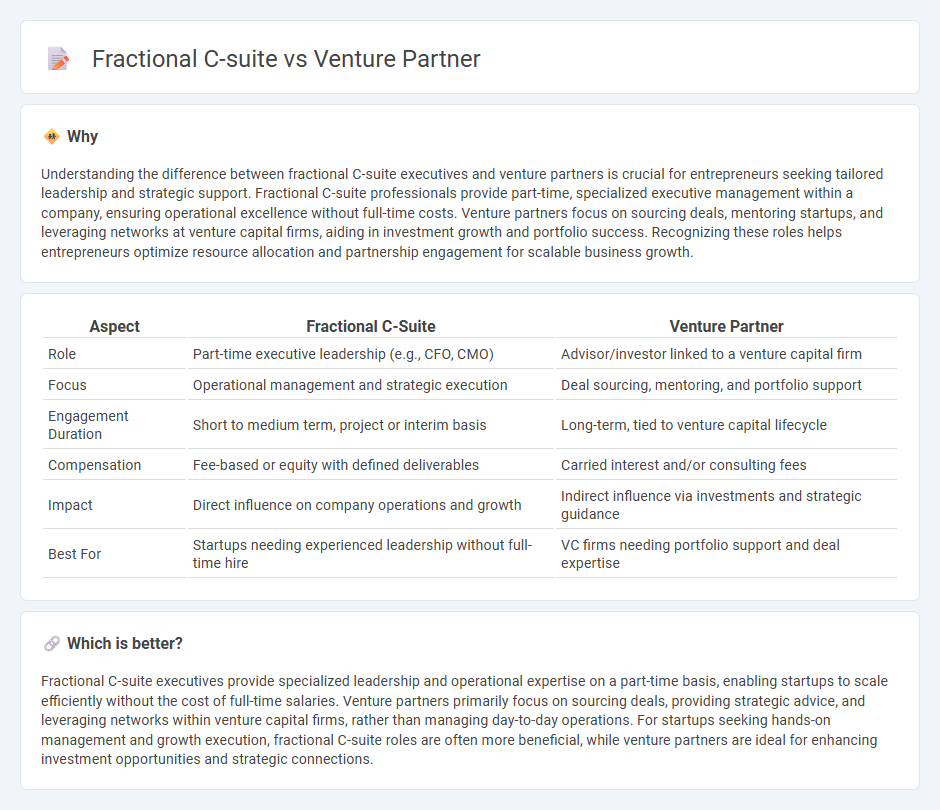

Understanding the difference between fractional C-suite executives and venture partners is crucial for entrepreneurs seeking tailored leadership and strategic support. Fractional C-suite professionals provide part-time, specialized executive management within a company, ensuring operational excellence without full-time costs. Venture partners focus on sourcing deals, mentoring startups, and leveraging networks at venture capital firms, aiding in investment growth and portfolio success. Recognizing these roles helps entrepreneurs optimize resource allocation and partnership engagement for scalable business growth.

Comparison Table

| Aspect | Fractional C-Suite | Venture Partner |

|---|---|---|

| Role | Part-time executive leadership (e.g., CFO, CMO) | Advisor/investor linked to a venture capital firm |

| Focus | Operational management and strategic execution | Deal sourcing, mentoring, and portfolio support |

| Engagement Duration | Short to medium term, project or interim basis | Long-term, tied to venture capital lifecycle |

| Compensation | Fee-based or equity with defined deliverables | Carried interest and/or consulting fees |

| Impact | Direct influence on company operations and growth | Indirect influence via investments and strategic guidance |

| Best For | Startups needing experienced leadership without full-time hire | VC firms needing portfolio support and deal expertise |

Which is better?

Fractional C-suite executives provide specialized leadership and operational expertise on a part-time basis, enabling startups to scale efficiently without the cost of full-time salaries. Venture partners primarily focus on sourcing deals, providing strategic advice, and leveraging networks within venture capital firms, rather than managing day-to-day operations. For startups seeking hands-on management and growth execution, fractional C-suite roles are often more beneficial, while venture partners are ideal for enhancing investment opportunities and strategic connections.

Connection

Fractional C-suite executives and venture partners share a strategic role in entrepreneurship by providing specialized expertise and resources to early-stage companies without the commitment of full-time positions. Fractional C-suite leaders offer critical operational guidance and leadership on a part-time basis, while venture partners leverage their networks and investment experience to drive business growth and fundraising initiatives. Both roles accelerate startup development by aligning executive skillsets with capital and market opportunities efficiently.

Key Terms

Equity stake

Venture partners typically hold equity stakes tied to the success of startups or venture capital firms, aligning their incentives with long-term growth and exit events. Fractional C-suite executives may receive equity as part of their compensation package, but their focus is more on delivering immediate operational expertise without full-time commitment. Explore the strategic benefits and equity structures of both roles to determine the optimal choice for your business needs.

Strategic involvement

Venture partners primarily engage in high-level strategic involvement by advising startups on growth, fundraising, and market positioning, leveraging their industry expertise without day-to-day operational responsibilities. Fractional C-suite executives, such as fractional CEOs or CFOs, take on active, hands-on roles steering company strategy while managing specific operational functions on a part-time basis. Explore the distinct strategic benefits of venture partners versus fractional C-suite leaders to determine the best fit for your organization's needs.

Time commitment

Venture partners typically commit limited hours per week, focusing on strategic guidance and deal sourcing without full-time operational responsibilities. Fractional C-suite executives dedicate a defined portion of their time--often 10 to 50%--to managing specific company functions like finance or marketing on a part-time but hands-on basis. Explore the distinctions in time commitment and role impact to find the best fit for your business needs.

Source and External Links

Venture Partner - Superscout - A venture partner is an experienced investor or advisor who works with startups and venture capital firms by providing financial and strategic advice, helping with fundraising, strategy, and portfolio management, while acting as a bridge between entrepreneurs and venture capitalists.

Understanding the Role of a Venture Partner in Startups - Visible.vc - Venture partners are seasoned professionals collaborating with VC firms flexibly, focused on sourcing investment opportunities, leveraging expertise and networks, and guiding startups, often without full-time involvement or voting rights on investment decisions.

VC Venture Partner: In-Depth Guide - Superscout - Venture partners mainly focus on deal sourcing, due diligence, and strategic advice but usually do not have authority to finalize investments, and their involvement can be part-time or full-time depending on the agreement with the firm.

dowidth.com

dowidth.com