Bootstrapping requires entrepreneurs to maximize personal savings, revenue reinvestment, and cost-efficiency, fostering complete control over business decisions without external influence. Venture capital resources provide significant funding, mentorship, and networking opportunities, accelerating growth but often diluting ownership and demanding equity shares. Explore comprehensive insights into choosing the optimal funding strategy for your entrepreneurial journey.

Why it is important

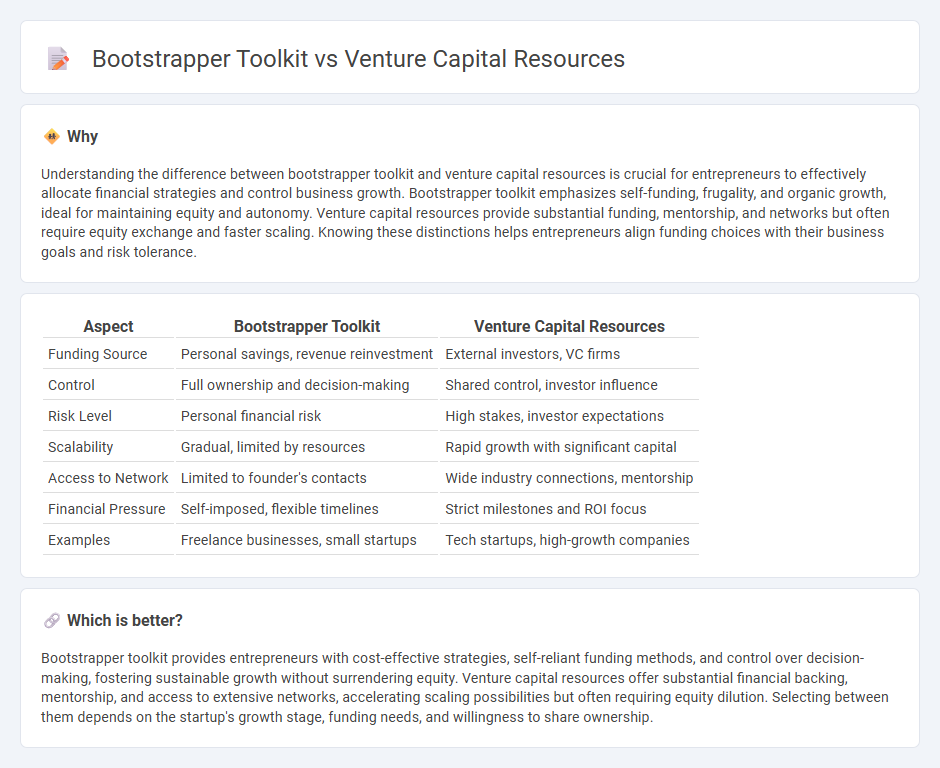

Understanding the difference between bootstrapper toolkit and venture capital resources is crucial for entrepreneurs to effectively allocate financial strategies and control business growth. Bootstrapper toolkit emphasizes self-funding, frugality, and organic growth, ideal for maintaining equity and autonomy. Venture capital resources provide substantial funding, mentorship, and networks but often require equity exchange and faster scaling. Knowing these distinctions helps entrepreneurs align funding choices with their business goals and risk tolerance.

Comparison Table

| Aspect | Bootstrapper Toolkit | Venture Capital Resources |

|---|---|---|

| Funding Source | Personal savings, revenue reinvestment | External investors, VC firms |

| Control | Full ownership and decision-making | Shared control, investor influence |

| Risk Level | Personal financial risk | High stakes, investor expectations |

| Scalability | Gradual, limited by resources | Rapid growth with significant capital |

| Access to Network | Limited to founder's contacts | Wide industry connections, mentorship |

| Financial Pressure | Self-imposed, flexible timelines | Strict milestones and ROI focus |

| Examples | Freelance businesses, small startups | Tech startups, high-growth companies |

Which is better?

Bootstrapper toolkit provides entrepreneurs with cost-effective strategies, self-reliant funding methods, and control over decision-making, fostering sustainable growth without surrendering equity. Venture capital resources offer substantial financial backing, mentorship, and access to extensive networks, accelerating scaling possibilities but often requiring equity dilution. Selecting between them depends on the startup's growth stage, funding needs, and willingness to share ownership.

Connection

Bootstrapper toolkit emphasizes leveraging personal savings, revenue, and creative problem-solving to grow a startup with minimal external funding. Venture capital resources provide substantial financial investment, mentorship, and industry connections essential for scaling businesses beyond initial bootstrapped stages. Entrepreneurs often integrate bootstrapper strategies initially to validate concepts before pursuing venture capital to accelerate growth and market expansion.

Key Terms

**Venture Capital Resources:**

Venture capital resources offer startups significant funding, mentorship, and access to extensive networks, enabling rapid scaling and market penetration. These resources typically include expert advisory, strategic partnerships, and follow-on financing rounds essential for high-growth companies. Explore how venture capital can accelerate your business journey and unlock industry-leading opportunities.

Equity Financing

Equity financing through venture capital resources provides startups with substantial funding and strategic networking opportunities, accelerating growth and market reach. In contrast, bootstrappers rely on personal savings and revenue reinvestment, prioritizing control and sustainable scaling without external equity dilution. Explore the advantages and challenges of each approach to determine the optimal funding strategy for your business.

Investor Due Diligence

Venture capital resources provide extensive investor due diligence support including access to financial experts, market analysts, and legal advisors ensuring comprehensive validation of business models and market potential. In contrast, bootstrapper toolkits rely heavily on founder-led research, self-assessment checklists, and peer feedback mechanisms which may limit depth but enhance agility and cost-efficiency. Explore detailed comparisons and best practices in investor due diligence to optimize your funding strategy.

Source and External Links

Venture Capital Resources for Investors & Aspiring VCs - Offers a comprehensive list of free resources including blogs, newsletters, podcasts, courses, and webinars designed to educate and inform about all facets of venture capital investing and deal evaluation.

The VC Investor's Toolkit: The Ultimate List of Must Have Apps and Resources - Provides a detailed toolkit of essential apps and platforms for venture capital professionals, covering CRM, deal flow, portfolio management, fund administration, and real-time investor reporting.

Resources - National Venture Capital Association - NVCA offers education programs, model legal documents, workshops, and advocacy efforts focused on enhancing VC investing skills, supporting emerging managers, and building strong portfolio companies.

dowidth.com

dowidth.com