Digital collectibles leverage blockchain technology to provide unique, verifiable assets that entrepreneurs use for funding and engaging communities. Crowdfunding platforms aggregate contributions from diverse backers, enabling startups to raise capital through equity, rewards, or donations. Explore the distinctive features and benefits of digital collectibles versus crowdfunding platforms to enhance your entrepreneurial strategy.

Why it is important

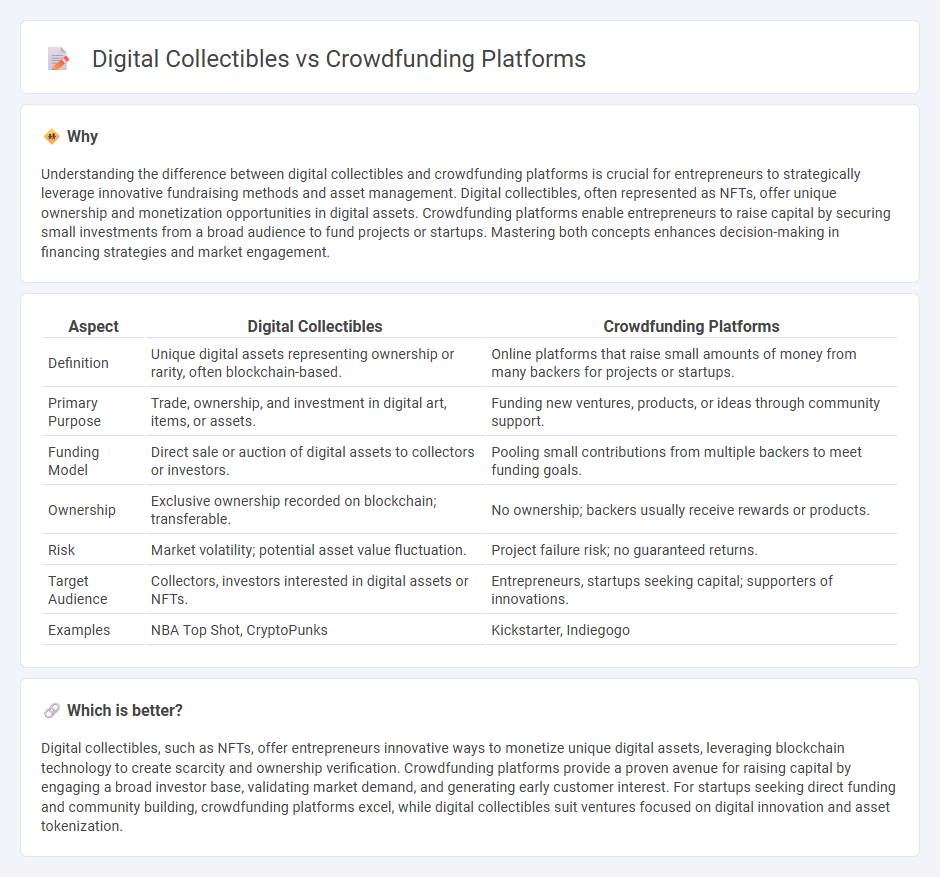

Understanding the difference between digital collectibles and crowdfunding platforms is crucial for entrepreneurs to strategically leverage innovative fundraising methods and asset management. Digital collectibles, often represented as NFTs, offer unique ownership and monetization opportunities in digital assets. Crowdfunding platforms enable entrepreneurs to raise capital by securing small investments from a broad audience to fund projects or startups. Mastering both concepts enhances decision-making in financing strategies and market engagement.

Comparison Table

| Aspect | Digital Collectibles | Crowdfunding Platforms |

|---|---|---|

| Definition | Unique digital assets representing ownership or rarity, often blockchain-based. | Online platforms that raise small amounts of money from many backers for projects or startups. |

| Primary Purpose | Trade, ownership, and investment in digital art, items, or assets. | Funding new ventures, products, or ideas through community support. |

| Funding Model | Direct sale or auction of digital assets to collectors or investors. | Pooling small contributions from multiple backers to meet funding goals. |

| Ownership | Exclusive ownership recorded on blockchain; transferable. | No ownership; backers usually receive rewards or products. |

| Risk | Market volatility; potential asset value fluctuation. | Project failure risk; no guaranteed returns. |

| Target Audience | Collectors, investors interested in digital assets or NFTs. | Entrepreneurs, startups seeking capital; supporters of innovations. |

| Examples | NBA Top Shot, CryptoPunks | Kickstarter, Indiegogo |

Which is better?

Digital collectibles, such as NFTs, offer entrepreneurs innovative ways to monetize unique digital assets, leveraging blockchain technology to create scarcity and ownership verification. Crowdfunding platforms provide a proven avenue for raising capital by engaging a broad investor base, validating market demand, and generating early customer interest. For startups seeking direct funding and community building, crowdfunding platforms excel, while digital collectibles suit ventures focused on digital innovation and asset tokenization.

Connection

Digital collectibles, such as NFTs, provide entrepreneurs with innovative funding opportunities by leveraging unique digital assets to attract backers. Crowdfunding platforms integrate these assets as incentives or rewards, enhancing engagement and driving campaign success. This synergy transforms traditional fundraising by offering verifiable ownership and community-driven support.

Key Terms

Crowdfunding platforms:

Crowdfunding platforms such as Kickstarter and Indiegogo enable creators to raise capital by engaging a broad base of backers, leveraging project visibility and community support. These platforms offer various funding models, including all-or-nothing and flexible funding, catering to diverse project needs, with transparent goal tracking and reward systems to incentivize contributions. Explore our detailed analysis to understand how crowdfunding platforms drive innovation and empower creators worldwide.

Backers

Crowdfunding platforms empower backers to directly fund innovative projects, often receiving exclusive rewards or early access in return, fostering a strong community engagement. Digital collectibles leverage blockchain technology to offer backers provable ownership, unique assets, and potential resale value, enhancing their participation in the project's ecosystem. Discover deeper insights on how backers can benefit from both crowdfunding platforms and digital collectibles.

Campaign

Crowdfunding platforms enable campaign creators to raise funds from a large audience by offering rewards or equity, while digital collectibles campaign focus on selling unique, blockchain-verified assets like NFTs to attract backers. Campaign success on crowdfunding sites depends on clear value propositions and reward structures, whereas digital collectibles campaigns leverage rarity and digital ownership to drive engagement. Explore how each platform's campaign strategies can maximize fundraising potential and community impact.

Source and External Links

How to Choose the Best Crowdfunding Website for Your Next ... - GoFundMe is a leading personal fundraising platform with no starting fees and a transaction fee of 2.9% + $0.30 per donation, featuring donor protection and community support; it also offers GoFundMe Pro for nonprofits with tailored pricing and advanced tools.

Top 10 US Crowdfunding Platforms (Reward and Equity) - Kickstarter is the largest reward-based crowdfunding platform known for higher success rates, while Indiegogo offers flexible funding options with a higher commission if goals are unmet; Patreon specializes in recurring support for creators and artists with tier-based fees.

Crowdfunding - Crowdfunding platforms enable fundraising by collecting donations widely via social media, with major platforms including GoFundMe, Indiegogo, Kickstarter, and Fundly, each differing in fees, features, and user bases to meet various fundraising needs.

dowidth.com

dowidth.com