Exit planning focuses on preparing a business for a smooth transition of ownership, ensuring maximum value and minimal disruption. Acquisition strategy involves identifying potential buyers or merging with another company to achieve growth or liquidity objectives. Explore key differences and benefits between exit planning and acquisition strategy to strengthen your entrepreneurial journey.

Why it is important

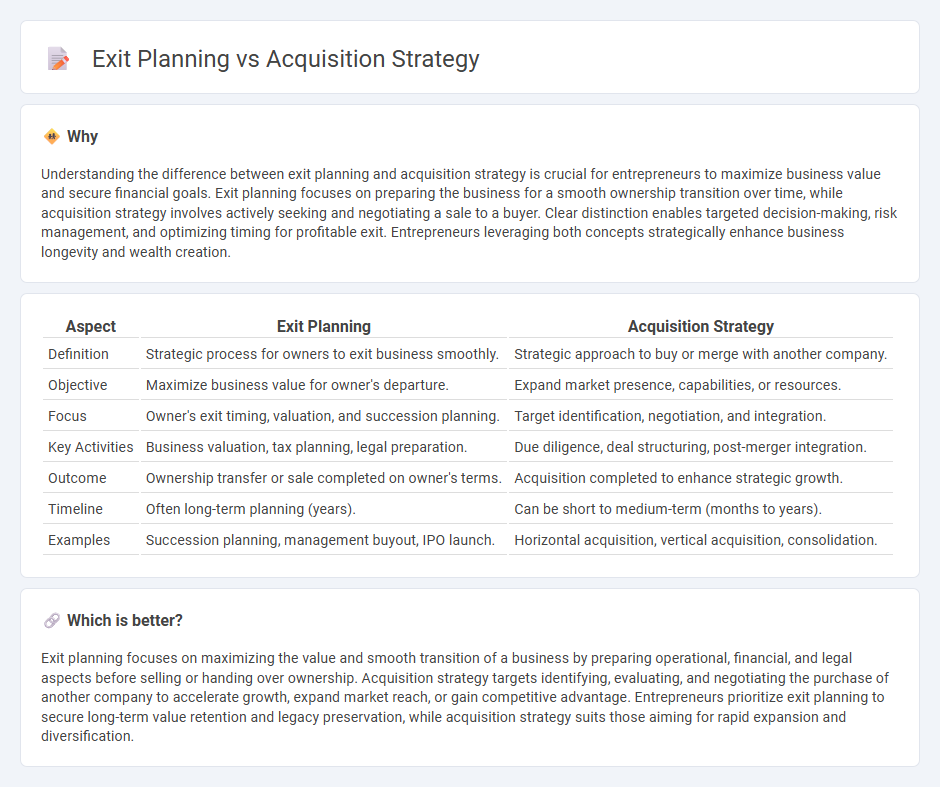

Understanding the difference between exit planning and acquisition strategy is crucial for entrepreneurs to maximize business value and secure financial goals. Exit planning focuses on preparing the business for a smooth ownership transition over time, while acquisition strategy involves actively seeking and negotiating a sale to a buyer. Clear distinction enables targeted decision-making, risk management, and optimizing timing for profitable exit. Entrepreneurs leveraging both concepts strategically enhance business longevity and wealth creation.

Comparison Table

| Aspect | Exit Planning | Acquisition Strategy |

|---|---|---|

| Definition | Strategic process for owners to exit business smoothly. | Strategic approach to buy or merge with another company. |

| Objective | Maximize business value for owner's departure. | Expand market presence, capabilities, or resources. |

| Focus | Owner's exit timing, valuation, and succession planning. | Target identification, negotiation, and integration. |

| Key Activities | Business valuation, tax planning, legal preparation. | Due diligence, deal structuring, post-merger integration. |

| Outcome | Ownership transfer or sale completed on owner's terms. | Acquisition completed to enhance strategic growth. |

| Timeline | Often long-term planning (years). | Can be short to medium-term (months to years). |

| Examples | Succession planning, management buyout, IPO launch. | Horizontal acquisition, vertical acquisition, consolidation. |

Which is better?

Exit planning focuses on maximizing the value and smooth transition of a business by preparing operational, financial, and legal aspects before selling or handing over ownership. Acquisition strategy targets identifying, evaluating, and negotiating the purchase of another company to accelerate growth, expand market reach, or gain competitive advantage. Entrepreneurs prioritize exit planning to secure long-term value retention and legacy preservation, while acquisition strategy suits those aiming for rapid expansion and diversification.

Connection

Exit planning and acquisition strategy are interconnected processes that enable business owners to maximize value during a transition. Effective exit planning involves preparing the company's financial, operational, and strategic elements to attract potential acquirers and facilitate a smooth sale. Acquisition strategy focuses on identifying suitable buyers and structuring deals that align with exit goals, ensuring optimal timing and profitability for entrepreneurs.

Key Terms

Synergy

Acquisition strategy centers on identifying and leveraging synergies to maximize value by combining complementary resources, capabilities, and market presence. Exit planning focuses on enhancing synergy realization to increase business attractiveness and achieve optimal valuation during sale or succession. Explore deeper insights to master synergy-driven growth and exit approaches.

Valuation

Valuation plays a critical role in both acquisition strategy and exit planning, determining the financial feasibility of acquiring or selling a business. Accurate valuation involves analyzing market trends, financial performance, and asset worth to maximize shareholder value and negotiate favorable terms. Explore detailed insights on valuation techniques to enhance your acquisition or exit strategy effectiveness.

Liquidity event

Acquisition strategy centers on identifying and executing growth opportunities through mergers or purchases to enhance company value, while exit planning prepares business owners for a liquidity event, such as selling or merging the business to realize financial gains. Effective exit planning ensures maximum return during liquidity events by aligning timing, valuation, and buyer readiness. Explore detailed strategies to optimize your liquidity event and secure financial success.

Source and External Links

What is an Acquisition Strategy? - SuperfastCPA CPA Review - An acquisition strategy is a comprehensive plan outlining a company's approach to acquiring other businesses or assets, including analysis of targets, evaluation criteria, financing, integration, and risk management to achieve growth, diversification, or market expansion.

7 Steps for Developing an Acquisition Strategy (Easy) - DealRoom.net - The process of developing an acquisition strategy involves creating a mission statement, setting parameters for target companies, timelines, responsibilities, target searches, outreach strategies, and pre-negotiation meetings to ensure alignment and success.

Acquisition Strategy - AcqNotes - An acquisition strategy is a comprehensive, integrated plan that identifies the acquisition approach to manage program risks and meet objectives throughout the program lifecycle, with updates at key decision milestones by authorities.

dowidth.com

dowidth.com