Job stacking involves holding multiple part-time or freelance positions simultaneously to maximize total earnings without depending on a single employer. Multiple income streams encompass broader revenue sources such as investments, side businesses, and rental properties alongside regular employment. Explore strategies to optimize your financial stability by understanding the differences between job stacking and diversified income streams.

Why it is important

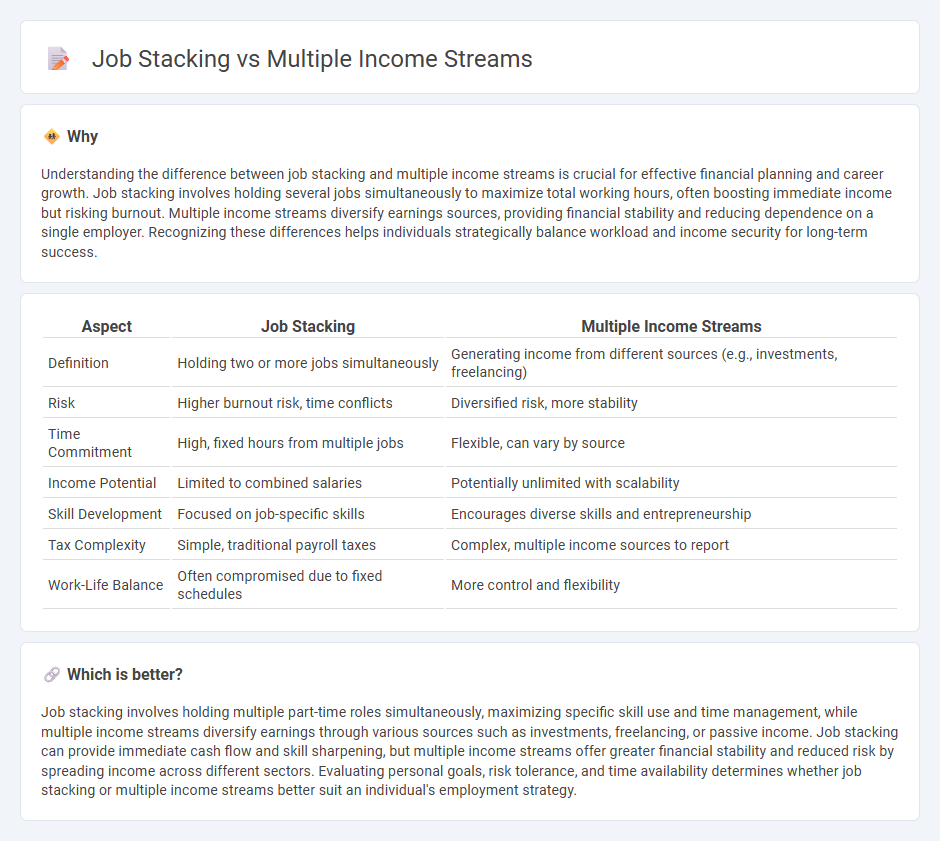

Understanding the difference between job stacking and multiple income streams is crucial for effective financial planning and career growth. Job stacking involves holding several jobs simultaneously to maximize total working hours, often boosting immediate income but risking burnout. Multiple income streams diversify earnings sources, providing financial stability and reducing dependence on a single employer. Recognizing these differences helps individuals strategically balance workload and income security for long-term success.

Comparison Table

| Aspect | Job Stacking | Multiple Income Streams |

|---|---|---|

| Definition | Holding two or more jobs simultaneously | Generating income from different sources (e.g., investments, freelancing) |

| Risk | Higher burnout risk, time conflicts | Diversified risk, more stability |

| Time Commitment | High, fixed hours from multiple jobs | Flexible, can vary by source |

| Income Potential | Limited to combined salaries | Potentially unlimited with scalability |

| Skill Development | Focused on job-specific skills | Encourages diverse skills and entrepreneurship |

| Tax Complexity | Simple, traditional payroll taxes | Complex, multiple income sources to report |

| Work-Life Balance | Often compromised due to fixed schedules | More control and flexibility |

Which is better?

Job stacking involves holding multiple part-time roles simultaneously, maximizing specific skill use and time management, while multiple income streams diversify earnings through various sources such as investments, freelancing, or passive income. Job stacking can provide immediate cash flow and skill sharpening, but multiple income streams offer greater financial stability and reduced risk by spreading income across different sectors. Evaluating personal goals, risk tolerance, and time availability determines whether job stacking or multiple income streams better suit an individual's employment strategy.

Connection

Job stacking involves holding multiple part-time jobs or gigs simultaneously to increase overall earnings, directly supporting the creation of multiple income streams. This strategy diversifies financial sources, reducing dependence on a single employer and enhancing income stability. By leveraging varied skill sets across different roles, individuals maximize earning potential and mitigate employment risks.

Key Terms

Diversification

Multiple income streams involve generating revenue from varied sources such as investments, freelance work, and passive earnings, providing financial stability through diversification. Job stacking refers to holding multiple part-time jobs or gigs simultaneously, focusing on maximizing earned wages while managing time efficiently. Explore strategies to optimize your income diversification and secure financial resilience.

Time management

Multiple income streams diversify earnings by generating revenue from various sources, reducing dependence on a single job and enhancing financial security. Job stacking involves simultaneously managing several part-time jobs or roles, requiring rigorous time management skills to balance schedules and avoid burnout. Explore effective strategies to optimize your time management and maximize income from both approaches.

Income stability

Multiple income streams enhance income stability by diversifying sources, reducing reliance on a single paycheck, and mitigating financial risks associated with job loss or market changes. Job stacking increases overall earnings by simultaneously managing several jobs, which can boost cash flow but may pose sustainability challenges due to time and energy constraints. Explore more strategies to optimize income stability and financial resilience.

Source and External Links

How to Create Multiple Streams of Income - This article provides insights into creating multiple income streams by consulting, authoring books, and starting a podcast or blog.

15 Passive Income Ideas to Help You Generate Cash Flow - This article offers ideas on passive income streams, including index funds, ETFs, and rental properties.

The Multi-Income Career: What It Is and How It Can Work for You - This resource discusses the concept of a multi-income career, emphasizing the use of multiple skill sets for diverse income streams.

25 Passive Income Ideas To Make Extra Money In 2025 - This article lists various passive income ideas, such as creating an app, selling photography, and starting a blog or YouTube channel.

15 Passive Income Ideas to Help You Generate Cash Flow - Offers ideas on passive income streams, including index funds, ETFs, and high-yield savings accounts.

Passive Income Ideas for Beginners - Discusses simple passive income strategies like high-yield savings accounts and certificates of deposit.

How to Create Multiple Streams of Income - Suggests strategies like consulting, book authoring, and professional speaking for additional income.

15 Passive Income Ideas to Help You Generate Cash Flow - Highlights real estate investment trusts (REITs) as a passive income option.

25 Passive Income Ideas To Make Extra Money In 2025 - Recommends selling designs online and creating digital products as passive income streams.

dowidth.com

dowidth.com