Greedflation occurs when companies inflate prices excessively to boost profits beyond reasonable market expectations, often exploiting limited competition or consumer dependency. Profit-push inflation arises when firms raise prices primarily to maintain profit margins in the face of rising production costs, such as wages or raw materials. Explore the nuanced impacts and policy responses to greedflation versus profit-push inflation to understand their roles in modern economic dynamics.

Why it is important

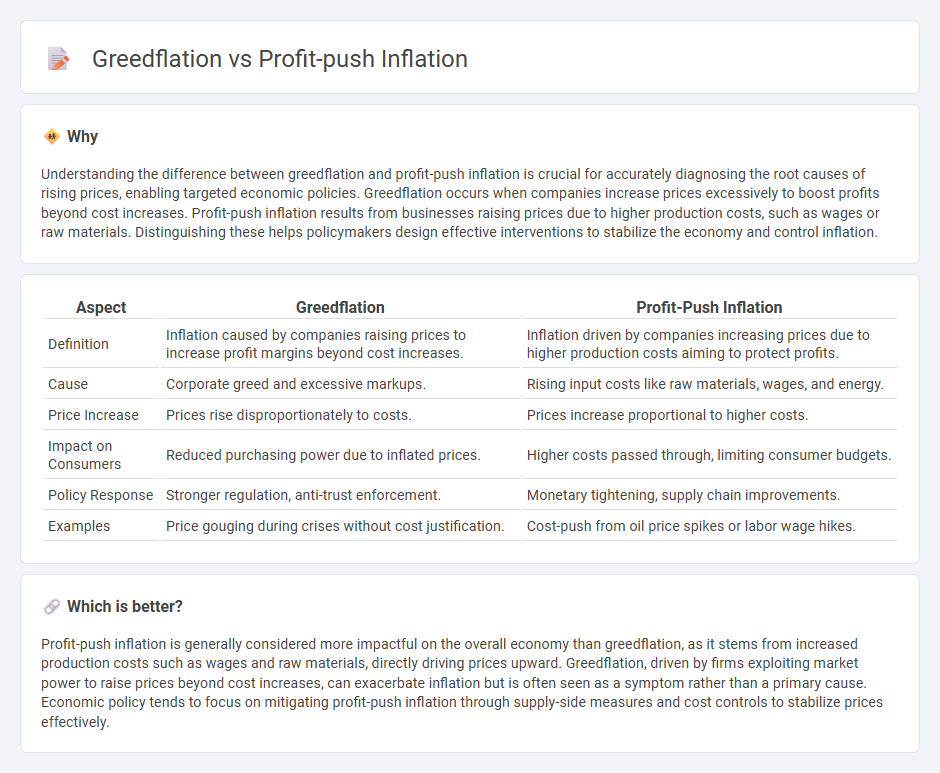

Understanding the difference between greedflation and profit-push inflation is crucial for accurately diagnosing the root causes of rising prices, enabling targeted economic policies. Greedflation occurs when companies increase prices excessively to boost profits beyond cost increases. Profit-push inflation results from businesses raising prices due to higher production costs, such as wages or raw materials. Distinguishing these helps policymakers design effective interventions to stabilize the economy and control inflation.

Comparison Table

| Aspect | Greedflation | Profit-Push Inflation |

|---|---|---|

| Definition | Inflation caused by companies raising prices to increase profit margins beyond cost increases. | Inflation driven by companies increasing prices due to higher production costs aiming to protect profits. |

| Cause | Corporate greed and excessive markups. | Rising input costs like raw materials, wages, and energy. |

| Price Increase | Prices rise disproportionately to costs. | Prices increase proportional to higher costs. |

| Impact on Consumers | Reduced purchasing power due to inflated prices. | Higher costs passed through, limiting consumer budgets. |

| Policy Response | Stronger regulation, anti-trust enforcement. | Monetary tightening, supply chain improvements. |

| Examples | Price gouging during crises without cost justification. | Cost-push from oil price spikes or labor wage hikes. |

Which is better?

Profit-push inflation is generally considered more impactful on the overall economy than greedflation, as it stems from increased production costs such as wages and raw materials, directly driving prices upward. Greedflation, driven by firms exploiting market power to raise prices beyond cost increases, can exacerbate inflation but is often seen as a symptom rather than a primary cause. Economic policy tends to focus on mitigating profit-push inflation through supply-side measures and cost controls to stabilize prices effectively.

Connection

Greedflation and profit-push inflation are interconnected as both involve increased corporate pricing strategies that drive overall inflation levels. Greedflation occurs when companies raise prices beyond cost increases to maximize profit margins, while profit-push inflation specifically refers to inflation driven by rising profit demands in production sectors. Both dynamics contribute to upward price pressures, impacting consumer purchasing power and economic stability.

Key Terms

Wages

Profit-push inflation occurs when companies increase prices to maintain profit margins despite rising production costs, often linked to higher wages driving up expenses. Greedflation, by contrast, involves firms deliberately raising prices beyond cost increases to boost profits, frequently exploiting wage growth as a justification. Explore the distinctions between these inflation drivers to understand their impact on the economy and wage dynamics.

Market Power

Profit-push inflation occurs when companies increase prices to maintain profit margins amid rising costs, reflecting their market power in setting prices above competitive levels. Greedflation describes firms exploiting strong market power to boost profits excessively, driving inflation beyond cost pressures by prioritizing shareholder returns over consumer welfare. Explore how varying degrees of market power distinctly influence inflationary dynamics in competitive versus concentrated industries.

Price Markup

Profit-push inflation occurs when firms increase price markups to maintain or enhance profit margins amid rising costs, leading to higher consumer prices. Greedflation specifically highlights the role of excessive price markups driven by corporate greed rather than cost pressures, resulting in inflated prices that surpass reasonable profit goals. Explore detailed analyses to understand the nuances and economic implications of price markups in profit-push inflation and greedflation.

Source and External Links

Profit-push inflation explained - Profit-push inflation occurs when firms use their market power to increase prices beyond rising costs, thereby expanding profit margins and contributing to inflation.

Profit shares and cost-push inflation - Empirical analysis shows that a rising share of profit in national output correlates with accelerating consumer price inflation, suggesting that firms' pursuit of higher profits can drive inflation independently of cost increases.

A "profit push" explanation for the current inflation - Evidence from major industries indicates that many large companies raised prices significantly more than their costs during recent inflationary periods, resulting in record profits and reinforcing the role of profit-push dynamics in inflation.

dowidth.com

dowidth.com