ESG reporting advisory focuses on guiding organizations to implement sustainable practices, ensuring compliance with environmental, social, and governance standards to enhance corporate responsibility and stakeholder trust. Tax advisory centers on optimizing tax strategies, ensuring regulatory compliance, and minimizing liabilities through tailored financial planning and risk management. Discover how specialized consulting services can drive your business forward in both sustainability and fiscal efficiency.

Why it is important

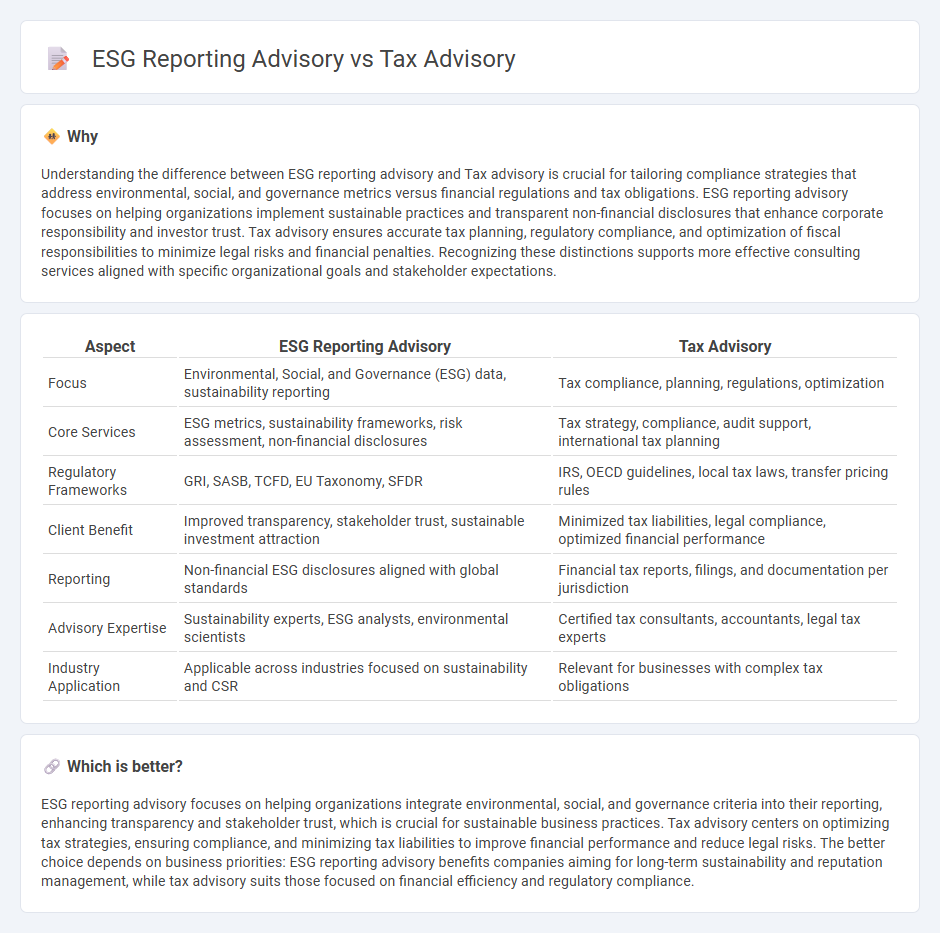

Understanding the difference between ESG reporting advisory and Tax advisory is crucial for tailoring compliance strategies that address environmental, social, and governance metrics versus financial regulations and tax obligations. ESG reporting advisory focuses on helping organizations implement sustainable practices and transparent non-financial disclosures that enhance corporate responsibility and investor trust. Tax advisory ensures accurate tax planning, regulatory compliance, and optimization of fiscal responsibilities to minimize legal risks and financial penalties. Recognizing these distinctions supports more effective consulting services aligned with specific organizational goals and stakeholder expectations.

Comparison Table

| Aspect | ESG Reporting Advisory | Tax Advisory |

|---|---|---|

| Focus | Environmental, Social, and Governance (ESG) data, sustainability reporting | Tax compliance, planning, regulations, optimization |

| Core Services | ESG metrics, sustainability frameworks, risk assessment, non-financial disclosures | Tax strategy, compliance, audit support, international tax planning |

| Regulatory Frameworks | GRI, SASB, TCFD, EU Taxonomy, SFDR | IRS, OECD guidelines, local tax laws, transfer pricing rules |

| Client Benefit | Improved transparency, stakeholder trust, sustainable investment attraction | Minimized tax liabilities, legal compliance, optimized financial performance |

| Reporting | Non-financial ESG disclosures aligned with global standards | Financial tax reports, filings, and documentation per jurisdiction |

| Advisory Expertise | Sustainability experts, ESG analysts, environmental scientists | Certified tax consultants, accountants, legal tax experts |

| Industry Application | Applicable across industries focused on sustainability and CSR | Relevant for businesses with complex tax obligations |

Which is better?

ESG reporting advisory focuses on helping organizations integrate environmental, social, and governance criteria into their reporting, enhancing transparency and stakeholder trust, which is crucial for sustainable business practices. Tax advisory centers on optimizing tax strategies, ensuring compliance, and minimizing tax liabilities to improve financial performance and reduce legal risks. The better choice depends on business priorities: ESG reporting advisory benefits companies aiming for long-term sustainability and reputation management, while tax advisory suits those focused on financial efficiency and regulatory compliance.

Connection

ESG reporting advisory and Tax advisory are interconnected through their shared goal of enhancing corporate transparency and compliance with evolving regulatory frameworks. ESG reporting advisory helps organizations disclose environmental, social, and governance risks that can impact tax strategies and liabilities. Tax advisory leverages insights from ESG disclosures to optimize tax planning, manage risks, and align financial reporting with sustainability objectives.

Key Terms

Compliance

Tax advisory ensures businesses adhere to complex regulatory tax frameworks, optimizing financial outcomes while minimizing risk of penalties. ESG reporting advisory emphasizes compliance with environmental, social, and governance standards, guiding companies to accurately disclose sustainable practices and meet stakeholder expectations. Explore how integrating both advisory services can strengthen regulatory compliance and drive corporate responsibility.

Risk Assessment

Tax advisory concentrates on compliance with tax laws and identifying financial risks related to tax liabilities, audits, and regulatory changes. ESG reporting advisory emphasizes evaluating environmental, social, and governance risks that impact corporate sustainability and stakeholder trust. Explore comprehensive insights into how risk assessment differs between tax advisory and ESG reporting advisory for strategic business decisions.

Stakeholder Engagement

Tax advisory primarily assists organizations in optimizing tax strategies to ensure compliance and financial efficiency, while ESG reporting advisory focuses on communicating environmental, social, and governance performance to stakeholders. Stakeholder engagement in tax advisory revolves around regulatory bodies and financial stakeholders to manage risks and leverage tax incentives. Explore how integrating stakeholder perspectives enhances transparency and drives sustainable business practices.

Source and External Links

What is Tax Advisory | Intuit Accountants - Tax advisory is a proactive service that involves collaborating with clients to achieve financial goals by implementing strategies to reduce tax liability throughout the year.

What is tax advisory? - Thomson Reuters tax - A tax advisor helps clients minimize tax risk and optimize financial decisions by leveraging their expertise in tax legislation to reduce overall taxes paid.

Tax Services, Planning & Preparation in Washington DC - This service involves creating long and short-term tax strategies to help businesses capitalize on the evolving tax code and reduce their annual tax liability.

dowidth.com

dowidth.com