Zero-based budgeting requires justifying every expense from scratch, ensuring all spending aligns with current business goals and eliminating outdated costs. Target-based budgeting sets specific financial goals and allocates resources to meet these predefined targets, focusing on achieving measurable objectives within set limits. Explore the differences and benefits of each approach to optimize your financial planning strategy.

Why it is important

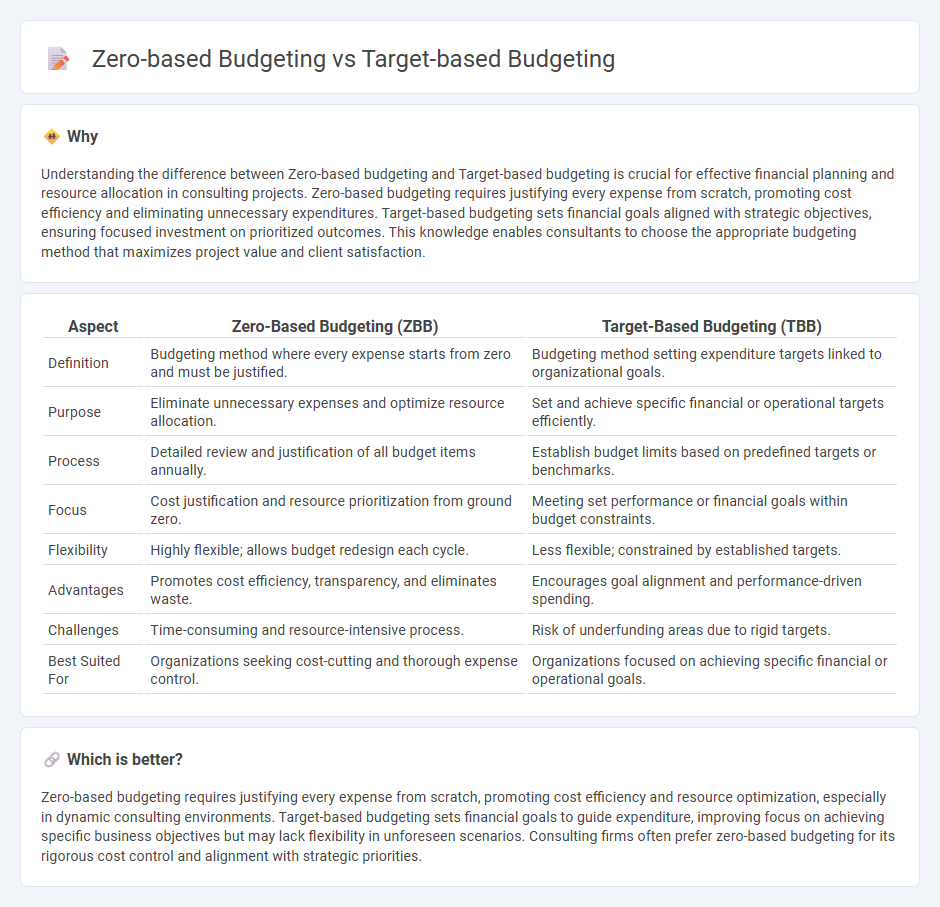

Understanding the difference between Zero-based budgeting and Target-based budgeting is crucial for effective financial planning and resource allocation in consulting projects. Zero-based budgeting requires justifying every expense from scratch, promoting cost efficiency and eliminating unnecessary expenditures. Target-based budgeting sets financial goals aligned with strategic objectives, ensuring focused investment on prioritized outcomes. This knowledge enables consultants to choose the appropriate budgeting method that maximizes project value and client satisfaction.

Comparison Table

| Aspect | Zero-Based Budgeting (ZBB) | Target-Based Budgeting (TBB) |

|---|---|---|

| Definition | Budgeting method where every expense starts from zero and must be justified. | Budgeting method setting expenditure targets linked to organizational goals. |

| Purpose | Eliminate unnecessary expenses and optimize resource allocation. | Set and achieve specific financial or operational targets efficiently. |

| Process | Detailed review and justification of all budget items annually. | Establish budget limits based on predefined targets or benchmarks. |

| Focus | Cost justification and resource prioritization from ground zero. | Meeting set performance or financial goals within budget constraints. |

| Flexibility | Highly flexible; allows budget redesign each cycle. | Less flexible; constrained by established targets. |

| Advantages | Promotes cost efficiency, transparency, and eliminates waste. | Encourages goal alignment and performance-driven spending. |

| Challenges | Time-consuming and resource-intensive process. | Risk of underfunding areas due to rigid targets. |

| Best Suited For | Organizations seeking cost-cutting and thorough expense control. | Organizations focused on achieving specific financial or operational goals. |

Which is better?

Zero-based budgeting requires justifying every expense from scratch, promoting cost efficiency and resource optimization, especially in dynamic consulting environments. Target-based budgeting sets financial goals to guide expenditure, improving focus on achieving specific business objectives but may lack flexibility in unforeseen scenarios. Consulting firms often prefer zero-based budgeting for its rigorous cost control and alignment with strategic priorities.

Connection

Zero-based budgeting and target-based budgeting connect through their focus on strategic resource allocation and cost control. Both methodologies require detailed analysis of expenses against organizational goals, with zero-based budgeting building budgets from scratch based on justifications, while target-based budgeting sets expenditure limits aligned with performance targets. This integration enhances financial efficiency and aligns spending with business objectives, crucial in consulting for optimizing client budgets.

Key Terms

Cost Drivers

Target-based budgeting prioritizes cost control by setting spending limits based on historical data and anticipated revenue, making it effective for stable organizations. Zero-based budgeting requires a detailed analysis of every expense from scratch, emphasizing identification and justification of cost drivers to optimize resource allocation. Explore these budgeting methods further to understand how effectively managing cost drivers can enhance financial performance.

Resource Allocation

Target-based budgeting allocates resources by setting predetermined financial goals, ensuring funds are directed towards achieving specific targets. Zero-based budgeting requires justifying every expense from scratch, promoting thorough evaluation and optimal resource utilization. Explore more to understand which budgeting strategy best enhances your resource allocation efficiency.

Baseline Assumptions

Target-based budgeting relies on historical financial data and predefined baseline assumptions to set spending limits aligned with strategic goals. Zero-based budgeting requires reevaluation of all expenses from a zero base, eliminating reliance on previous budgets and baseline assumptions. Explore the distinct impacts of baseline assumptions on budget efficiency and organizational financial planning.

Source and External Links

Target-Based Budgeting | Defining Public Administration - Target-based budgeting is a reform that shifts traditional functions between the budget office and departments, often setting expenditure ceilings as a percentage of a baseline budget, making it easier for political leaders to enforce spending cuts.

Budgeting, Target-Based | Encyclopedia of Public Administration - This method sets overall agency expenditures based on estimated government revenues, allowing centralized control at higher levels while offering flexibility and decentralization at departmental levels.

Target-Based Budgeting - GFOA - Governments use target-based budgeting to establish clear spending limits for core services, permitting departments to request additional funds for extra needs, which helps reduce waste and promotes collaboration and long-term financial stability.

dowidth.com

dowidth.com