Sustainability benchmarking evaluates a company's environmental, social, and governance (ESG) performance against industry standards or competitors, highlighting areas for improvement to achieve best practices. Sustainability risk analysis identifies and assesses potential environmental and social risks that could impact business operations, regulatory compliance, and long-term value. Explore how integrating both approaches can enhance your organization's sustainability strategy and resilience.

Why it is important

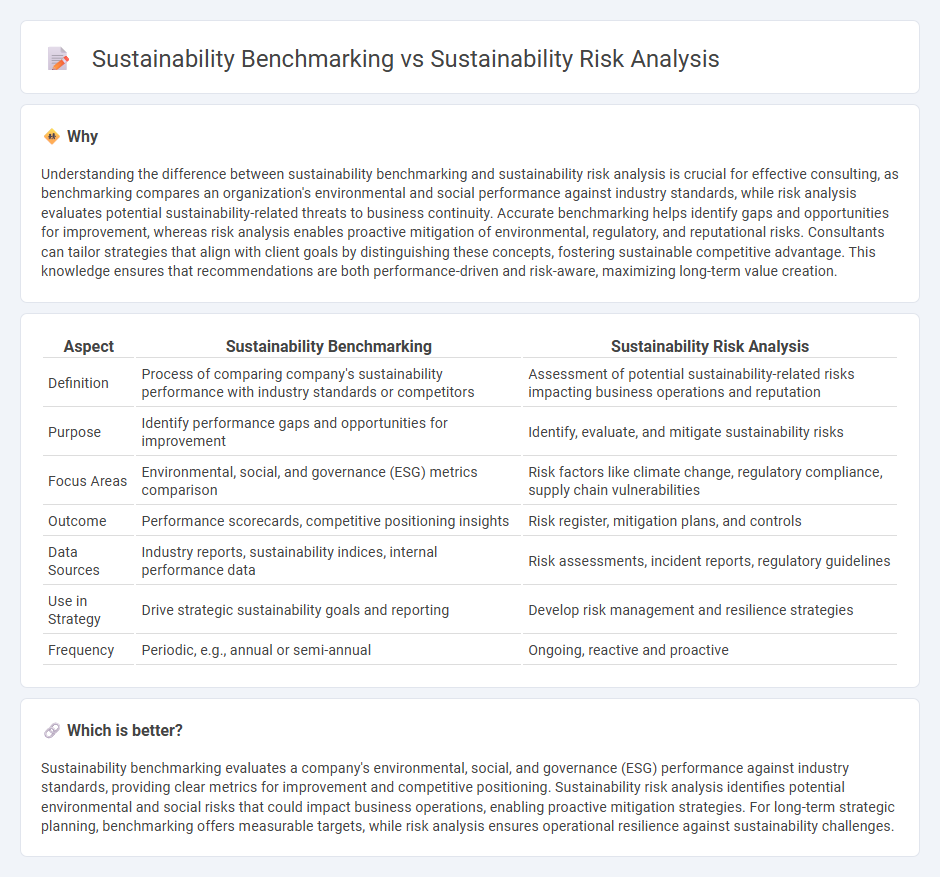

Understanding the difference between sustainability benchmarking and sustainability risk analysis is crucial for effective consulting, as benchmarking compares an organization's environmental and social performance against industry standards, while risk analysis evaluates potential sustainability-related threats to business continuity. Accurate benchmarking helps identify gaps and opportunities for improvement, whereas risk analysis enables proactive mitigation of environmental, regulatory, and reputational risks. Consultants can tailor strategies that align with client goals by distinguishing these concepts, fostering sustainable competitive advantage. This knowledge ensures that recommendations are both performance-driven and risk-aware, maximizing long-term value creation.

Comparison Table

| Aspect | Sustainability Benchmarking | Sustainability Risk Analysis |

|---|---|---|

| Definition | Process of comparing company's sustainability performance with industry standards or competitors | Assessment of potential sustainability-related risks impacting business operations and reputation |

| Purpose | Identify performance gaps and opportunities for improvement | Identify, evaluate, and mitigate sustainability risks |

| Focus Areas | Environmental, social, and governance (ESG) metrics comparison | Risk factors like climate change, regulatory compliance, supply chain vulnerabilities |

| Outcome | Performance scorecards, competitive positioning insights | Risk register, mitigation plans, and controls |

| Data Sources | Industry reports, sustainability indices, internal performance data | Risk assessments, incident reports, regulatory guidelines |

| Use in Strategy | Drive strategic sustainability goals and reporting | Develop risk management and resilience strategies |

| Frequency | Periodic, e.g., annual or semi-annual | Ongoing, reactive and proactive |

Which is better?

Sustainability benchmarking evaluates a company's environmental, social, and governance (ESG) performance against industry standards, providing clear metrics for improvement and competitive positioning. Sustainability risk analysis identifies potential environmental and social risks that could impact business operations, enabling proactive mitigation strategies. For long-term strategic planning, benchmarking offers measurable targets, while risk analysis ensures operational resilience against sustainability challenges.

Connection

Sustainability benchmarking establishes performance standards by comparing environmental, social, and governance (ESG) metrics across industries, while sustainability risk analysis identifies potential threats to these metrics within a company's operations. Together, they enable organizations to pinpoint gaps in sustainability practices and assess vulnerabilities related to climate change, resource depletion, and regulatory compliance. This integrated approach supports strategic decision-making that enhances resilience and drives long-term sustainable growth.

Key Terms

Sustainability Risk Analysis:

Sustainability risk analysis identifies and evaluates potential environmental, social, and governance (ESG) risks that could negatively impact a company's operations or reputation. This process involves assessing factors such as climate change vulnerabilities, regulatory compliance, and supply chain disruptions to mitigate financial and operational risks. Explore more insights on effective sustainability risk analysis methodologies and tools.

Materiality Assessment

Sustainability risk analysis identifies potential environmental, social, and governance (ESG) risks that could impact a company's value chain, while sustainability benchmarking compares a company's ESG performance against industry standards and competitors. Materiality assessment plays a crucial role in both processes by highlighting the most significant sustainability issues that affect financial performance and stakeholder interests. Explore how integrating materiality assessment enhances strategic decision-making in sustainability initiatives.

Scenario Analysis

Sustainability risk analysis involves evaluating potential environmental, social, and governance (ESG) risks through scenario analysis to anticipate future impacts on business operations and investments. Sustainability benchmarking compares an organization's ESG performance against industry standards or peers, identifying gaps and areas for improvement. Explore how integrating scenario analysis enhances risk assessment and strategic decision-making in sustainable practices.

Source and External Links

Sustainability Risk Assessments - A Complete Guide - Purple Griffon - A sustainability risk assessment involves identifying, analyzing, and prioritizing environmental, social, and governance risks to help organizations manage potential impacts on operations and stakeholders effectively.

What is sustainability risk management (SRM)? - TechTarget - Sustainability risk management is a strategic business approach aligning profit goals with environmental, social, and governance (ESG) policies to address risks and seize opportunities related to sustainability within risk management frameworks.

Strategies for Sustainability Risk Management - KEY ESG - Effective sustainability risk management includes conducting double materiality assessments, engaging stakeholders, and integrating ESG risks into strategic planning and enterprise risk management to foster innovation and competitive advantage.

dowidth.com

dowidth.com