Due diligence deep dive involves a comprehensive analysis of financial, legal, and operational aspects to identify risks and validate assumptions during mergers and acquisitions. Strategic assessment focuses on evaluating market positioning, competitive landscape, and long-term growth opportunities to inform business decisions. Explore how these approaches can enhance your consulting outcomes and drive informed decision-making.

Why it is important

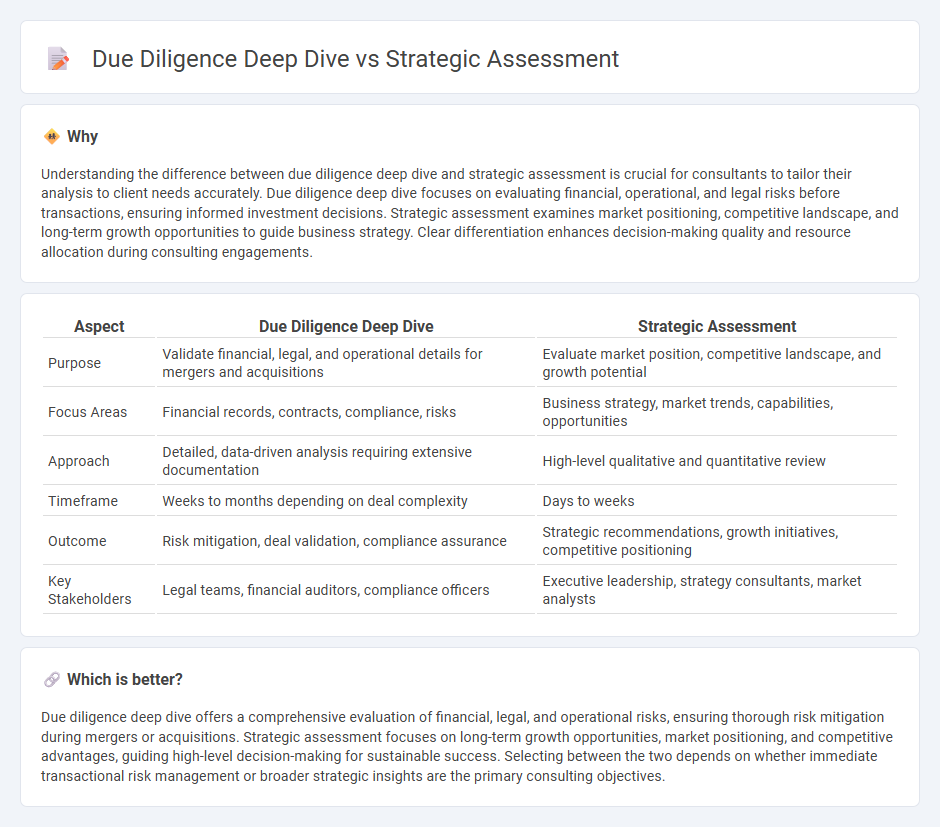

Understanding the difference between due diligence deep dive and strategic assessment is crucial for consultants to tailor their analysis to client needs accurately. Due diligence deep dive focuses on evaluating financial, operational, and legal risks before transactions, ensuring informed investment decisions. Strategic assessment examines market positioning, competitive landscape, and long-term growth opportunities to guide business strategy. Clear differentiation enhances decision-making quality and resource allocation during consulting engagements.

Comparison Table

| Aspect | Due Diligence Deep Dive | Strategic Assessment |

|---|---|---|

| Purpose | Validate financial, legal, and operational details for mergers and acquisitions | Evaluate market position, competitive landscape, and growth potential |

| Focus Areas | Financial records, contracts, compliance, risks | Business strategy, market trends, capabilities, opportunities |

| Approach | Detailed, data-driven analysis requiring extensive documentation | High-level qualitative and quantitative review |

| Timeframe | Weeks to months depending on deal complexity | Days to weeks |

| Outcome | Risk mitigation, deal validation, compliance assurance | Strategic recommendations, growth initiatives, competitive positioning |

| Key Stakeholders | Legal teams, financial auditors, compliance officers | Executive leadership, strategy consultants, market analysts |

Which is better?

Due diligence deep dive offers a comprehensive evaluation of financial, legal, and operational risks, ensuring thorough risk mitigation during mergers or acquisitions. Strategic assessment focuses on long-term growth opportunities, market positioning, and competitive advantages, guiding high-level decision-making for sustainable success. Selecting between the two depends on whether immediate transactional risk management or broader strategic insights are the primary consulting objectives.

Connection

Due diligence deep dive and strategic assessment are interconnected processes essential in consulting for evaluating potential investments or business decisions. The due diligence deep dive provides a comprehensive analysis of financial, legal, and operational risks, while strategic assessment aligns these findings with the company's long-term goals and competitive positioning. Together, they enable consultants to recommend informed strategies that optimize value creation and mitigate risks.

Key Terms

**Strategic Assessment:**

Strategic assessment evaluates a company's long-term goals, market position, competitive landscape, and growth potential, offering a comprehensive view of strategic fit and value creation opportunities. It emphasizes high-level analysis of business models, industry trends, and potential synergies rather than detailed operational or financial scrutiny. Explore the nuances of strategic assessment to enhance decision-making and investment strategies.

Market Analysis

Strategic assessment emphasizes evaluating market trends, competitive landscape, and growth opportunities to align with long-term business objectives. Due diligence deep dive focuses on verifying market data accuracy, assessing customer segments, and validating revenue projections to mitigate investment risks. Explore detailed methodologies and best practices to enhance market analysis effectiveness.

Competitive Positioning

Strategic assessment evaluates a company's competitive positioning by analyzing market trends, competitor strengths, and customer segments to determine long-term advantages and potential risks. Due diligence deep dive rigorously examines financial records, operational processes, and compliance factors, providing a granular view of business health and competitive capabilities before a transaction. Explore more to understand how these approaches complement each other for informed decision-making in competitive landscapes.

Source and External Links

How to Write a Strategic Assessment? - Quantive - A strategic assessment evaluates strengths, weaknesses, opportunities, and threats (SWOT) along with market trends and competitive landscape, including key components like environmental scanning, vision and mission analysis, SWOT, and strategic goal setting to guide focused business actions.

What is a Strategic Risk Assessment? (+ Risk Examples) - A strategic risk assessment identifies, evaluates, and manages risks that could impact an organization's long-term goals, involving ongoing risk identification, prioritization, mitigation strategies, and continuous monitoring.

The Importance of Strategic Assessment - Intrafocus - Strategic assessment transforms an organization's vision and purpose into achievable priorities using proven techniques like SWOT, benchmarking, and gap analysis to develop manageable strategic objectives guiding organizational direction.

dowidth.com

dowidth.com