Innovation audits evaluate a company's ability to generate, develop, and implement new ideas by assessing strategies, culture, and processes that drive creativity and growth. Risk management audits focus on identifying, analyzing, and mitigating potential threats to safeguard assets, ensure compliance, and maintain operational continuity. Discover how these audits can uniquely enhance your organization's performance and resilience.

Why it is important

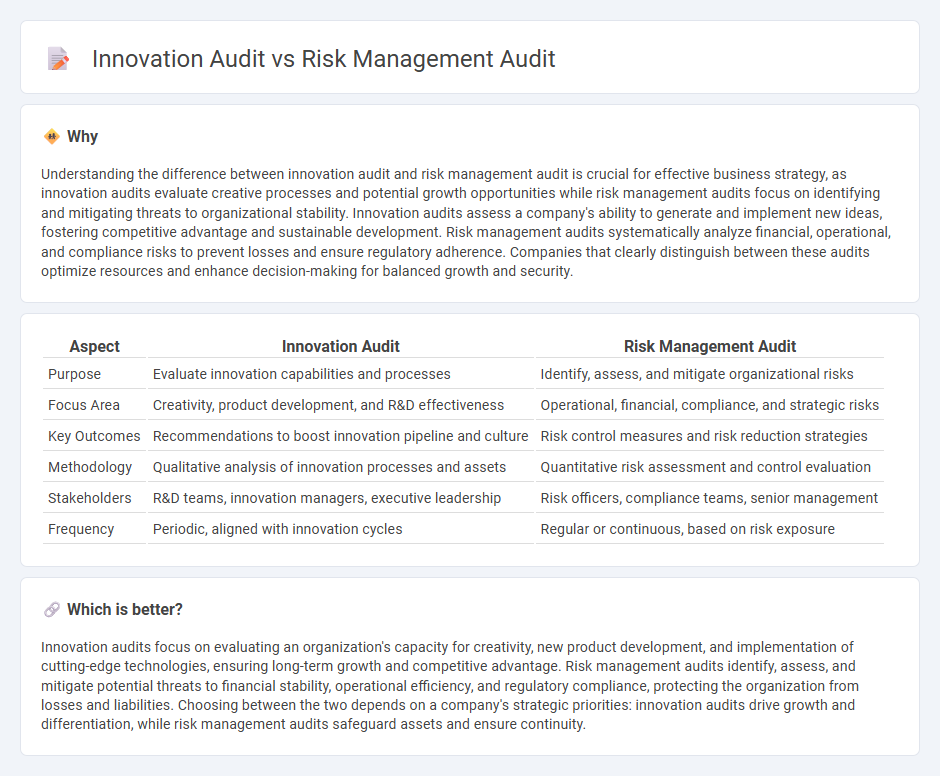

Understanding the difference between innovation audit and risk management audit is crucial for effective business strategy, as innovation audits evaluate creative processes and potential growth opportunities while risk management audits focus on identifying and mitigating threats to organizational stability. Innovation audits assess a company's ability to generate and implement new ideas, fostering competitive advantage and sustainable development. Risk management audits systematically analyze financial, operational, and compliance risks to prevent losses and ensure regulatory adherence. Companies that clearly distinguish between these audits optimize resources and enhance decision-making for balanced growth and security.

Comparison Table

| Aspect | Innovation Audit | Risk Management Audit |

|---|---|---|

| Purpose | Evaluate innovation capabilities and processes | Identify, assess, and mitigate organizational risks |

| Focus Area | Creativity, product development, and R&D effectiveness | Operational, financial, compliance, and strategic risks |

| Key Outcomes | Recommendations to boost innovation pipeline and culture | Risk control measures and risk reduction strategies |

| Methodology | Qualitative analysis of innovation processes and assets | Quantitative risk assessment and control evaluation |

| Stakeholders | R&D teams, innovation managers, executive leadership | Risk officers, compliance teams, senior management |

| Frequency | Periodic, aligned with innovation cycles | Regular or continuous, based on risk exposure |

Which is better?

Innovation audits focus on evaluating an organization's capacity for creativity, new product development, and implementation of cutting-edge technologies, ensuring long-term growth and competitive advantage. Risk management audits identify, assess, and mitigate potential threats to financial stability, operational efficiency, and regulatory compliance, protecting the organization from losses and liabilities. Choosing between the two depends on a company's strategic priorities: innovation audits drive growth and differentiation, while risk management audits safeguard assets and ensure continuity.

Connection

Innovation audit evaluates an organization's ability to develop and implement new ideas, while risk management audit assesses potential threats that could impact those initiatives. Both audits are connected by identifying gaps and vulnerabilities that may hinder innovation success and affect business continuity. Integrating these audits helps organizations foster sustainable growth by balancing creativity with proactive risk mitigation.

Key Terms

Risk assessment

Risk management audits prioritize identifying, evaluating, and mitigating potential threats to an organization's assets, ensuring compliance and minimizing financial losses through systematic risk assessment frameworks. Innovation audits emphasize the evaluation of risk associated with new ideas, technologies, and processes by assessing potential market, technical, and operational uncertainties that could impact the success of innovation initiatives. Explore further to understand how targeted risk assessments differ between protecting existing operations and fostering innovation-driven growth.

Compliance review

Risk management audits emphasize identifying and mitigating potential compliance breaches to safeguard organizational assets and ensure regulatory adherence. Innovation audits evaluate compliance by examining how new processes and products align with existing regulatory frameworks and internal policies. Explore more insights to balance compliance and innovation effectively within your audit practices.

Opportunity identification

Risk management audits concentrate on identifying potential threats and vulnerabilities to safeguard assets, ensuring compliance with regulatory standards and minimizing financial losses. Innovation audits focus on uncovering untapped opportunities, evaluating the organization's capacity to develop new products, services, or processes that drive growth and competitive advantage. Explore how combining these audit types can enhance both risk mitigation and opportunity identification for sustainable success.

Source and External Links

Conducting a Risk Management Audit: Best Practices and Guidelines - A risk management audit evaluates how well an organization identifies, assesses, and mitigates risks by reviewing mitigation plans, assessing effectiveness, analyzing resource allocation, and ensuring continuous improvement through validation methods like interviews and testing.

What Is a Risk Audit? (Plus How To Conduct One in 7 Steps) - A risk audit is a process to identify potential safety and operational threats, assess their causes, and evaluate the effectiveness of existing risk management processes to reduce harm and improve strategies.

What is Risk Management in Internal Audit - In internal audit, risk management involves understanding an organization's risk profile, identifying controls to mitigate risks, testing control effectiveness, and reporting findings with recommendations to management.

dowidth.com

dowidth.com