Due diligence deep dive thoroughly examines a company's financial, legal, and operational aspects to identify risks and opportunities before transactions. Benchmarking compares these findings against industry standards and competitors to highlight performance gaps and best practices. Explore our consulting services to understand how due diligence deep dives and benchmarking can drive informed decision-making and strategic growth.

Why it is important

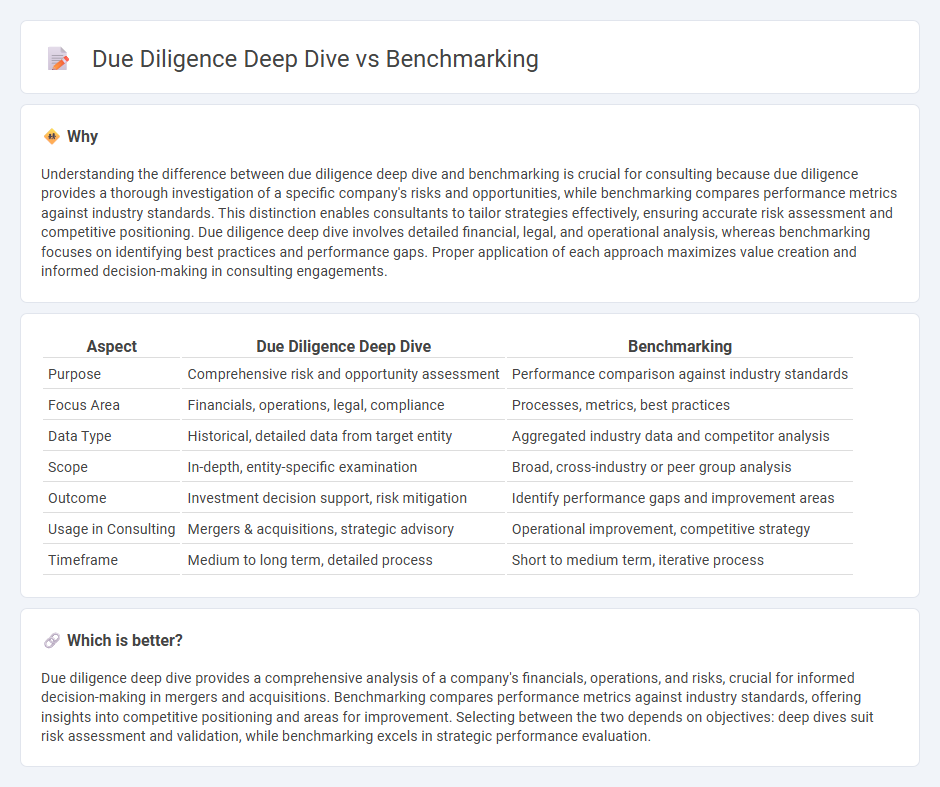

Understanding the difference between due diligence deep dive and benchmarking is crucial for consulting because due diligence provides a thorough investigation of a specific company's risks and opportunities, while benchmarking compares performance metrics against industry standards. This distinction enables consultants to tailor strategies effectively, ensuring accurate risk assessment and competitive positioning. Due diligence deep dive involves detailed financial, legal, and operational analysis, whereas benchmarking focuses on identifying best practices and performance gaps. Proper application of each approach maximizes value creation and informed decision-making in consulting engagements.

Comparison Table

| Aspect | Due Diligence Deep Dive | Benchmarking |

|---|---|---|

| Purpose | Comprehensive risk and opportunity assessment | Performance comparison against industry standards |

| Focus Area | Financials, operations, legal, compliance | Processes, metrics, best practices |

| Data Type | Historical, detailed data from target entity | Aggregated industry data and competitor analysis |

| Scope | In-depth, entity-specific examination | Broad, cross-industry or peer group analysis |

| Outcome | Investment decision support, risk mitigation | Identify performance gaps and improvement areas |

| Usage in Consulting | Mergers & acquisitions, strategic advisory | Operational improvement, competitive strategy |

| Timeframe | Medium to long term, detailed process | Short to medium term, iterative process |

Which is better?

Due diligence deep dive provides a comprehensive analysis of a company's financials, operations, and risks, crucial for informed decision-making in mergers and acquisitions. Benchmarking compares performance metrics against industry standards, offering insights into competitive positioning and areas for improvement. Selecting between the two depends on objectives: deep dives suit risk assessment and validation, while benchmarking excels in strategic performance evaluation.

Connection

Due diligence deep dive and benchmarking are interconnected processes in consulting that ensure comprehensive evaluation and strategic improvement. Due diligence deep dive involves rigorous analysis of a company's financials, operations, and risks, while benchmarking compares these insights against industry standards and competitors to identify performance gaps. This synergy enables consultants to deliver informed recommendations for optimizing business value and competitive positioning.

Key Terms

Performance Metrics (Benchmarking)

Benchmarking evaluates performance metrics by comparing an organization's key indicators like efficiency, productivity, and quality against industry leaders to identify gaps and opportunities for improvement. Common metrics include financial ratios, customer satisfaction scores, and operational benchmarks tailored to specific sectors. Explore further to understand how benchmarking drives strategic decisions and enhances competitive advantage.

Risk Assessment (Due Diligence Deep Dive)

Risk assessment within due diligence deep dive involves a comprehensive analysis of potential financial, operational, and compliance risks associated with a target company or investment opportunity. Benchmarking, by contrast, compares key risk metrics against industry standards or competitors to identify performance gaps and mitigate exposures. Explore further to understand how integrating these approaches enhances strategic decision-making and risk management.

Industry Standards (Benchmarking)

Benchmarking involves evaluating a company's performance metrics against established industry standards, enabling businesses to identify strengths and areas for improvement relative to competitors. This process includes analyzing key performance indicators (KPIs) such as productivity, quality, and customer satisfaction within the industry to drive strategic decision-making. Explore further insights into how industry standard benchmarking can optimize operational efficiency and competitive advantage.

Source and External Links

Benchmarking - Wikipedia - Benchmarking is the practice of comparing business processes and performance metrics to industry bests and best practices from other companies to identify improvement opportunities and enhance performance continuously.

What are the Four Types of Benchmarking? - APQC - Benchmarking is categorized into four types, including performance benchmarking that compares quantitative data and practice benchmarking that compares qualitative aspects like processes and technology to drive continuous improvement.

What is Benchmarking in Business? Process, Definition - Simpplr - Benchmarking measures and compares the performance, efficiency, or quality of products, services, or processes against recognized standards or competitors, enabling organizations to identify gaps and set goals for improved performance.

dowidth.com

dowidth.com