Stakeholder capitalism advisory focuses on creating long-term value by aligning business strategies with the interests of employees, customers, communities, and shareholders, promoting sustainable growth and social responsibility. Risk management advisory centers on identifying, assessing, and mitigating potential threats to safeguard organizational assets and ensure regulatory compliance. Explore how each advisory service can empower your business to thrive in complex markets.

Why it is important

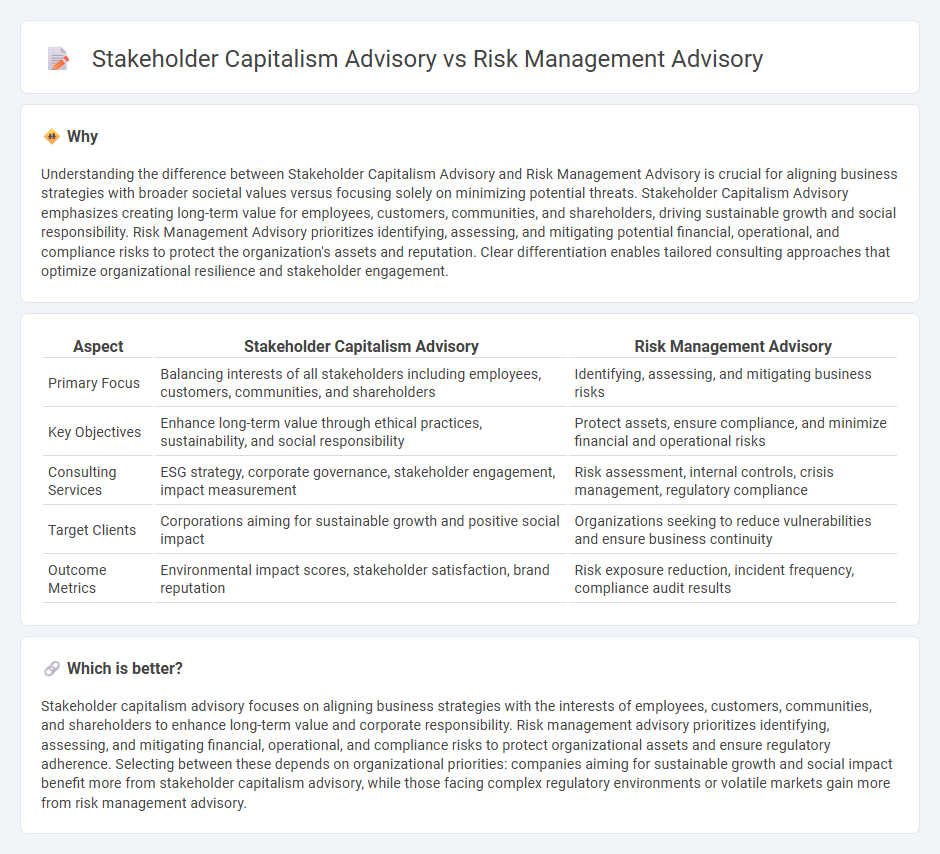

Understanding the difference between Stakeholder Capitalism Advisory and Risk Management Advisory is crucial for aligning business strategies with broader societal values versus focusing solely on minimizing potential threats. Stakeholder Capitalism Advisory emphasizes creating long-term value for employees, customers, communities, and shareholders, driving sustainable growth and social responsibility. Risk Management Advisory prioritizes identifying, assessing, and mitigating potential financial, operational, and compliance risks to protect the organization's assets and reputation. Clear differentiation enables tailored consulting approaches that optimize organizational resilience and stakeholder engagement.

Comparison Table

| Aspect | Stakeholder Capitalism Advisory | Risk Management Advisory |

|---|---|---|

| Primary Focus | Balancing interests of all stakeholders including employees, customers, communities, and shareholders | Identifying, assessing, and mitigating business risks |

| Key Objectives | Enhance long-term value through ethical practices, sustainability, and social responsibility | Protect assets, ensure compliance, and minimize financial and operational risks |

| Consulting Services | ESG strategy, corporate governance, stakeholder engagement, impact measurement | Risk assessment, internal controls, crisis management, regulatory compliance |

| Target Clients | Corporations aiming for sustainable growth and positive social impact | Organizations seeking to reduce vulnerabilities and ensure business continuity |

| Outcome Metrics | Environmental impact scores, stakeholder satisfaction, brand reputation | Risk exposure reduction, incident frequency, compliance audit results |

Which is better?

Stakeholder capitalism advisory focuses on aligning business strategies with the interests of employees, customers, communities, and shareholders to enhance long-term value and corporate responsibility. Risk management advisory prioritizes identifying, assessing, and mitigating financial, operational, and compliance risks to protect organizational assets and ensure regulatory adherence. Selecting between these depends on organizational priorities: companies aiming for sustainable growth and social impact benefit more from stakeholder capitalism advisory, while those facing complex regulatory environments or volatile markets gain more from risk management advisory.

Connection

Stakeholder capitalism advisory and risk management advisory are interconnected by their shared focus on aligning business strategies with broader societal and environmental responsibilities while mitigating potential operational and reputational risks. Both advisory areas emphasize the integration of Environmental, Social, and Governance (ESG) criteria to enhance long-term value creation and stakeholder trust. Effective risk management frameworks support stakeholder capitalism by identifying, assessing, and addressing risks that could impact diverse stakeholder groups, ensuring sustainable and ethical business practices.

Key Terms

**Risk management advisory:**

Risk management advisory focuses on identifying, assessing, and mitigating potential risks that could impact an organization's financial health, operations, or reputation. It leverages advanced analytics, regulatory compliance frameworks, and industry-specific risk protocols to create tailored strategies that safeguard assets and ensure business continuity. Explore more to understand how risk management advisory can protect and optimize your enterprise's resilience.

Risk Assessment

Risk management advisory specializes in identifying, evaluating, and mitigating financial, operational, and strategic risks to protect organizational assets and ensure regulatory compliance. Stakeholder capitalism advisory integrates risk assessment within a broader framework that considers environmental, social, and governance (ESG) factors, aligning risk strategies with the interests of employees, customers, communities, and shareholders. Explore more to understand how these advisory services can transform your approach to risk assessment and sustainable value creation.

Compliance

Risk management advisory prioritizes identifying, assessing, and mitigating potential threats to ensure regulatory compliance and safeguard organizational assets. Stakeholder capitalism advisory emphasizes integrating social, environmental, and governance (ESG) criteria into business strategies to align with broader stakeholder interests and regulatory frameworks. Explore our detailed insights to understand how these advisory services enhance compliance and corporate responsibility.

Source and External Links

Risk Advisory & Consulting Services - RSM US - RSM provides tailored risk advisory services that help businesses identify, prioritize, and proactively manage risks--turning risk management into a strategic driver for long-term value and confident decision-making.

Risk management advisory: Maximize understanding, options and value - Alvarez & Marsal - Alvarez & Marsal offers comprehensive risk management advisory, including outsourced risk management, cost benchmarking, and process improvement to reduce total cost of risk and align risk strategies with business opportunities.

Risk Advisory Services | Cherry Bekaert - Cherry Bekaert delivers scalable risk advisory solutions focused on financial, operational, and compliance risks, helping clients build resilience through mature internal controls and adaptable risk management plans.

dowidth.com

dowidth.com