Algorithmic auditing evaluates the fairness, transparency, and compliance of automated decision-making systems by systematically examining algorithms and their outputs for bias, accuracy, and ethical considerations. Risk analysis identifies potential threats and vulnerabilities in business processes or technology implementations, quantifying impacts to inform mitigation strategies. Discover more about how integrating these approaches strengthens organizational decision-making and regulatory adherence.

Why it is important

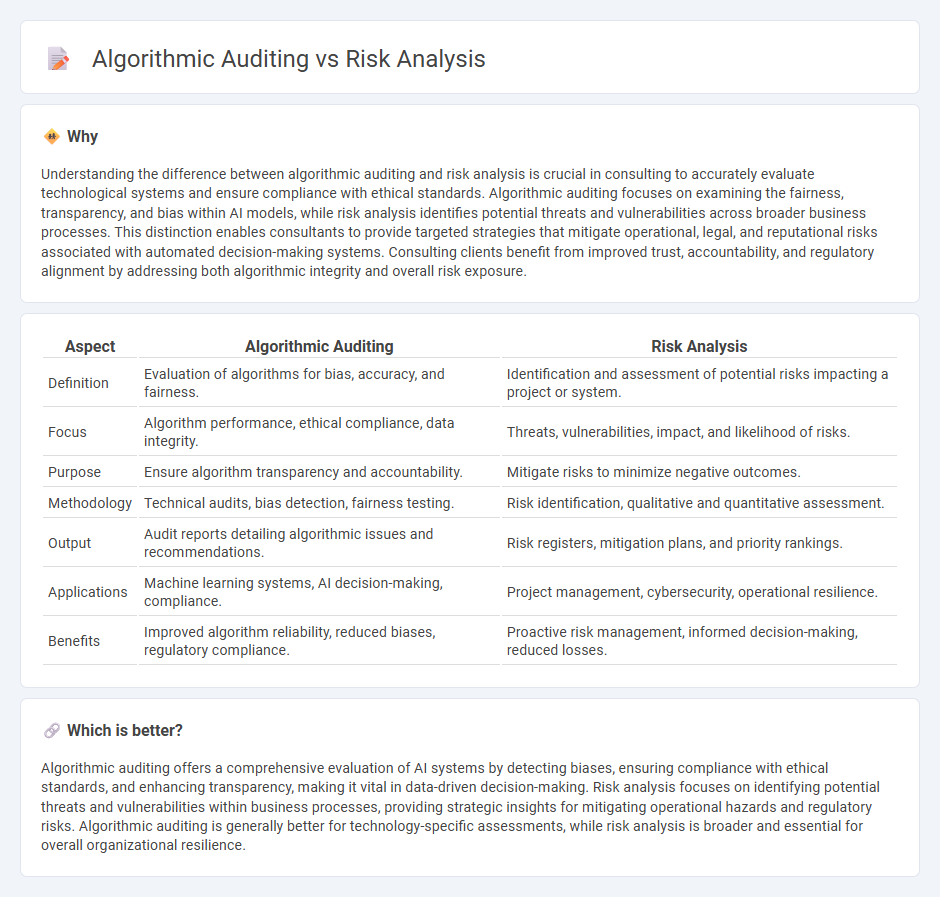

Understanding the difference between algorithmic auditing and risk analysis is crucial in consulting to accurately evaluate technological systems and ensure compliance with ethical standards. Algorithmic auditing focuses on examining the fairness, transparency, and bias within AI models, while risk analysis identifies potential threats and vulnerabilities across broader business processes. This distinction enables consultants to provide targeted strategies that mitigate operational, legal, and reputational risks associated with automated decision-making systems. Consulting clients benefit from improved trust, accountability, and regulatory alignment by addressing both algorithmic integrity and overall risk exposure.

Comparison Table

| Aspect | Algorithmic Auditing | Risk Analysis |

|---|---|---|

| Definition | Evaluation of algorithms for bias, accuracy, and fairness. | Identification and assessment of potential risks impacting a project or system. |

| Focus | Algorithm performance, ethical compliance, data integrity. | Threats, vulnerabilities, impact, and likelihood of risks. |

| Purpose | Ensure algorithm transparency and accountability. | Mitigate risks to minimize negative outcomes. |

| Methodology | Technical audits, bias detection, fairness testing. | Risk identification, qualitative and quantitative assessment. |

| Output | Audit reports detailing algorithmic issues and recommendations. | Risk registers, mitigation plans, and priority rankings. |

| Applications | Machine learning systems, AI decision-making, compliance. | Project management, cybersecurity, operational resilience. |

| Benefits | Improved algorithm reliability, reduced biases, regulatory compliance. | Proactive risk management, informed decision-making, reduced losses. |

Which is better?

Algorithmic auditing offers a comprehensive evaluation of AI systems by detecting biases, ensuring compliance with ethical standards, and enhancing transparency, making it vital in data-driven decision-making. Risk analysis focuses on identifying potential threats and vulnerabilities within business processes, providing strategic insights for mitigating operational hazards and regulatory risks. Algorithmic auditing is generally better for technology-specific assessments, while risk analysis is broader and essential for overall organizational resilience.

Connection

Algorithmic auditing systematically evaluates algorithms to identify biases, errors, and compliance issues while risk analysis assesses potential harms and operational vulnerabilities associated with those algorithms. By combining these approaches, organizations can proactively detect algorithmic risks, ensuring transparency and regulatory adherence in automated decision-making processes. Effective consulting integrates algorithmic auditing findings with comprehensive risk analysis to develop robust mitigation strategies and enhance AI governance frameworks.

Key Terms

Risk Assessment

Risk analysis involves identifying potential threats and vulnerabilities within a system to evaluate their impact and likelihood, enabling effective risk management strategies. Algorithmic auditing focuses specifically on examining algorithms to detect biases, errors, and compliance issues, ensuring fairness and transparency in automated decision-making processes. Discover deeper insights into how risk assessment techniques differ from algorithmic auditing methodologies.

Bias Detection

Risk analysis in bias detection evaluates potential vulnerabilities and the likelihood of unfair outcomes within AI systems by examining historical data and decision patterns. Algorithmic auditing goes deeper by systematically reviewing algorithms, their training data, and model behaviors to identify bias sources and disparities in predictions. Explore comprehensive methods and tools to enhance fairness and transparency in AI through dedicated algorithmic auditing frameworks.

Compliance Evaluation

Risk analysis evaluates potential compliance gaps by identifying, assessing, and prioritizing risks related to regulatory standards. Algorithmic auditing systematically examines algorithms for fairness, transparency, and adherence to legal frameworks, ensuring compliance with data protection and anti-discrimination laws. Explore detailed strategies to enhance your compliance evaluation through advanced risk analysis and algorithmic auditing.

Source and External Links

What is Risk Analysis? | Definition from TechTarget - Risk analysis is the process of identifying and analyzing potential issues that could negatively affect key business initiatives or projects, helping organizations avoid or mitigate those risks by assessing the likelihood and potential harm of adverse events, both natural and human-made.

A Guide to Risk Analysis: Example & Methods | SafetyCulture - Risk analysis involves various approaches such as risk-benefit analysis, needs assessment, business impact analysis, failure mode and effect analysis (FMEA), and root cause analysis to identify, evaluate, and mitigate risks in a structured way.

What is risk analysis? An overview - Thomson Reuters Legal Solutions - Risk analysis defines and prioritizes risks based on their likelihood and potential impact to support informed decision-making, resource planning, regulatory compliance, organizational continuity, and increased stakeholder confidence.

dowidth.com

dowidth.com