Consulting in business model innovation focuses on redefining value creation and capturing new market opportunities through strategic design and agility. In contrast, mergers and acquisitions emphasize growth by combining existing assets, operations, and market presence to enhance competitive advantage. Explore the distinct approaches and benefits each strategy offers for corporate growth and transformation.

Why it is important

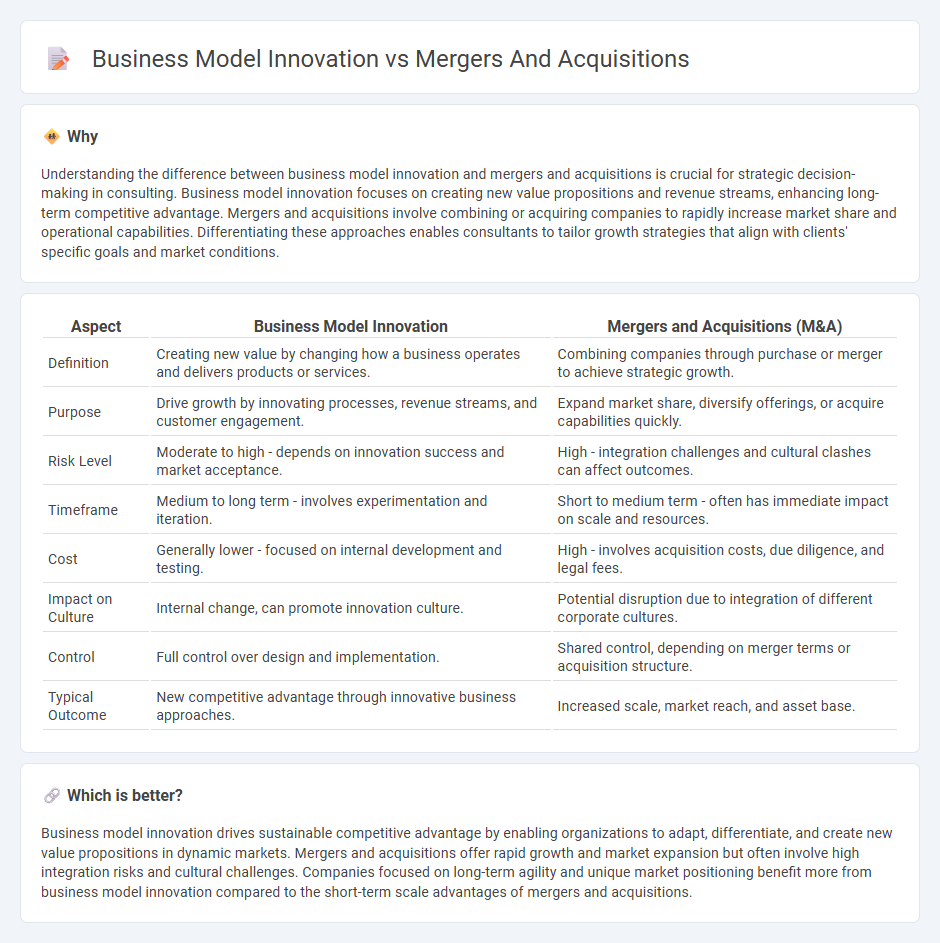

Understanding the difference between business model innovation and mergers and acquisitions is crucial for strategic decision-making in consulting. Business model innovation focuses on creating new value propositions and revenue streams, enhancing long-term competitive advantage. Mergers and acquisitions involve combining or acquiring companies to rapidly increase market share and operational capabilities. Differentiating these approaches enables consultants to tailor growth strategies that align with clients' specific goals and market conditions.

Comparison Table

| Aspect | Business Model Innovation | Mergers and Acquisitions (M&A) |

|---|---|---|

| Definition | Creating new value by changing how a business operates and delivers products or services. | Combining companies through purchase or merger to achieve strategic growth. |

| Purpose | Drive growth by innovating processes, revenue streams, and customer engagement. | Expand market share, diversify offerings, or acquire capabilities quickly. |

| Risk Level | Moderate to high - depends on innovation success and market acceptance. | High - integration challenges and cultural clashes can affect outcomes. |

| Timeframe | Medium to long term - involves experimentation and iteration. | Short to medium term - often has immediate impact on scale and resources. |

| Cost | Generally lower - focused on internal development and testing. | High - involves acquisition costs, due diligence, and legal fees. |

| Impact on Culture | Internal change, can promote innovation culture. | Potential disruption due to integration of different corporate cultures. |

| Control | Full control over design and implementation. | Shared control, depending on merger terms or acquisition structure. |

| Typical Outcome | New competitive advantage through innovative business approaches. | Increased scale, market reach, and asset base. |

Which is better?

Business model innovation drives sustainable competitive advantage by enabling organizations to adapt, differentiate, and create new value propositions in dynamic markets. Mergers and acquisitions offer rapid growth and market expansion but often involve high integration risks and cultural challenges. Companies focused on long-term agility and unique market positioning benefit more from business model innovation compared to the short-term scale advantages of mergers and acquisitions.

Connection

Business model innovation drives competitive advantage by enabling firms to create unique value propositions, which often becomes a key consideration during mergers and acquisitions to enhance market positioning. Mergers and acquisitions facilitate the rapid integration of innovative business models, accelerating growth and operational synergy across combined entities. Firms leverage these strategic moves to realign business models, optimize resource allocation, and capture new market opportunities efficiently.

Key Terms

Mergers and Acquisitions:

Mergers and acquisitions (M&A) are strategic corporate actions involving the consolidation of companies to enhance competitive advantage, market share, and operational efficiency. Key metrics analyzed in M&A include valuation multiples, synergy potential, and integration risks, which directly impact shareholder value and long-term growth. Explore deeper insights on how M&A can reshape industries and drive business transformation.

Due Diligence

Due diligence in mergers and acquisitions (M&A) emphasizes evaluating financial health, legal compliance, and operational risks to ensure a successful transaction. In business model innovation, due diligence focuses on assessing market fit, value proposition viability, and scalability potential to validate strategic transformation. Explore further to understand how due diligence adapts to different growth strategies.

Synergy

Mergers and acquisitions create synergy by combining resources, expertise, and market share to enhance competitive advantage rapidly. Business model innovation achieves synergy through reimagining value creation and operational processes, fostering long-term adaptability and growth. Explore how these strategies drive synergy to optimize your business transformation.

Source and External Links

Mergers and acquisitions - Wikipedia - Mergers and acquisitions (M&A) are business transactions combining companies, including types like "acqui-hire" for talent acquisition or "merger of equals" where similar sized firms merge to form a new entity.

Mergers & Acquisitions (M&A) - Corporate Finance Institute - M&A involves transactions combining companies either by merger (two companies forming a new entity of similar size) or acquisition (one company absorbing another), with types like horizontal, vertical, and statutory mergers.

Mergers & Acquisitions - The Middle Market - A leading source providing news, analysis, and market trends on M&A including how AI is used by dealmakers to identify targets and current examples of significant M&A transactions.

dowidth.com

dowidth.com