Diversity sourcing consulting focuses on enhancing organizational inclusion by developing strategies to recruit and retain talent from varied demographic backgrounds, fostering innovation and competitive advantage. Mergers and acquisitions consulting centers on advising companies through complex transactions, ensuring thorough due diligence, valuation, and integration to maximize shareholder value. Explore how specialized consulting services can drive your business success in dynamic markets.

Why it is important

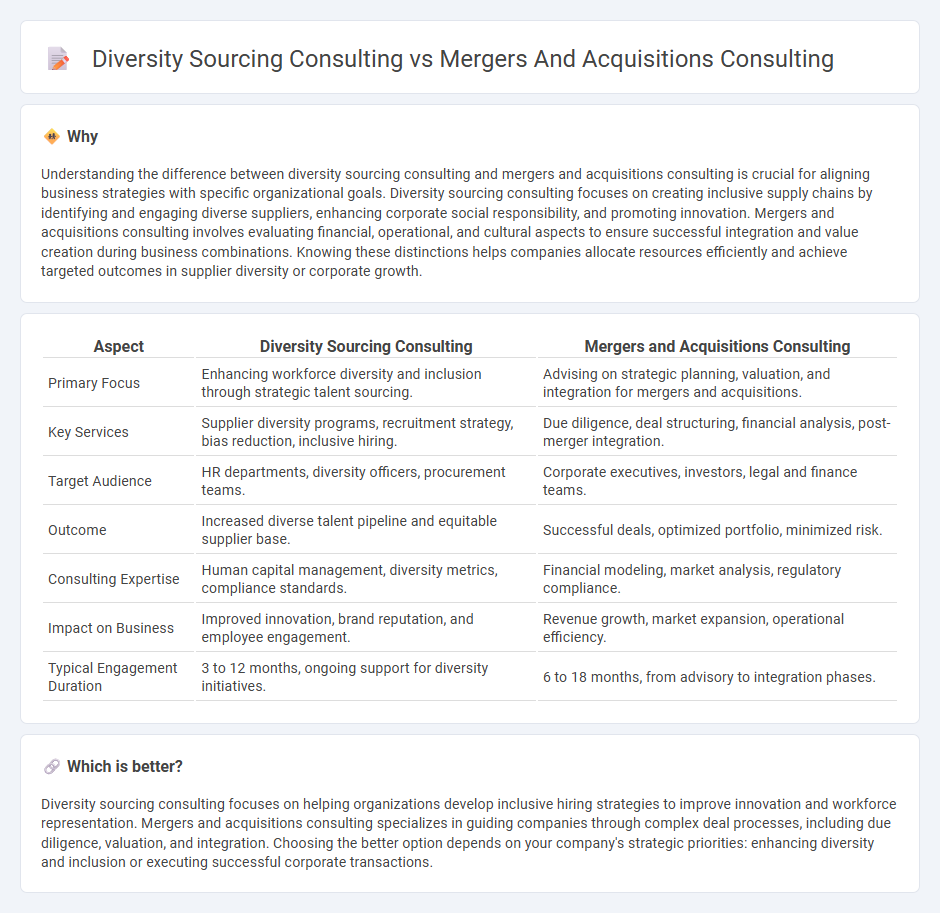

Understanding the difference between diversity sourcing consulting and mergers and acquisitions consulting is crucial for aligning business strategies with specific organizational goals. Diversity sourcing consulting focuses on creating inclusive supply chains by identifying and engaging diverse suppliers, enhancing corporate social responsibility, and promoting innovation. Mergers and acquisitions consulting involves evaluating financial, operational, and cultural aspects to ensure successful integration and value creation during business combinations. Knowing these distinctions helps companies allocate resources efficiently and achieve targeted outcomes in supplier diversity or corporate growth.

Comparison Table

| Aspect | Diversity Sourcing Consulting | Mergers and Acquisitions Consulting |

|---|---|---|

| Primary Focus | Enhancing workforce diversity and inclusion through strategic talent sourcing. | Advising on strategic planning, valuation, and integration for mergers and acquisitions. |

| Key Services | Supplier diversity programs, recruitment strategy, bias reduction, inclusive hiring. | Due diligence, deal structuring, financial analysis, post-merger integration. |

| Target Audience | HR departments, diversity officers, procurement teams. | Corporate executives, investors, legal and finance teams. |

| Outcome | Increased diverse talent pipeline and equitable supplier base. | Successful deals, optimized portfolio, minimized risk. |

| Consulting Expertise | Human capital management, diversity metrics, compliance standards. | Financial modeling, market analysis, regulatory compliance. |

| Impact on Business | Improved innovation, brand reputation, and employee engagement. | Revenue growth, market expansion, operational efficiency. |

| Typical Engagement Duration | 3 to 12 months, ongoing support for diversity initiatives. | 6 to 18 months, from advisory to integration phases. |

Which is better?

Diversity sourcing consulting focuses on helping organizations develop inclusive hiring strategies to improve innovation and workforce representation. Mergers and acquisitions consulting specializes in guiding companies through complex deal processes, including due diligence, valuation, and integration. Choosing the better option depends on your company's strategic priorities: enhancing diversity and inclusion or executing successful corporate transactions.

Connection

Diversity sourcing consulting enhances mergers and acquisitions consulting by ensuring that talent acquisition strategies prioritize diverse candidate pools, which can increase innovation and improve post-merger integration outcomes. Incorporating diversity-focused approaches in mergers and acquisitions consulting helps organizations better navigate cultural differences and leverage varied perspectives for strategic growth. Effective diversity sourcing directly supports due diligence and change management processes within mergers and acquisitions, driving long-term value creation.

Key Terms

**Mergers and Acquisitions Consulting:**

Mergers and acquisitions consulting specializes in guiding companies through complex transactions, including due diligence, valuation, and integration strategies to maximize shareholder value. Experts leverage financial modeling, regulatory compliance, and market analysis to ensure seamless mergers and acquisitions that drive growth and competitive advantage. Discover how targeted M&A consulting can transform your business strategy and operational success.

Due Diligence

Due diligence in mergers and acquisitions consulting centers on evaluating financial records, legal risks, and operational synergies to ensure informed decision-making and transaction success. Diversity sourcing consulting's due diligence prioritizes assessing supplier diversity, inclusion metrics, and compliance with corporate social responsibility standards to enhance equitable procurement strategies. Explore how tailored due diligence approaches optimize outcomes in both consulting domains.

Valuation

Mergers and acquisitions consulting prioritizes valuation by thoroughly assessing financial metrics, market positioning, and potential synergies to determine the fair market value of target companies. Diversity sourcing consulting emphasizes the business value of diverse supplier inclusion, enhancing organizational innovation and compliance while quantifying impact on procurement costs and supplier performance. Explore deeper insights on how valuation methodologies differ in these consulting domains.

Source and External Links

M&A (Mergers & Acquisitions) Strategy Consulting | BCG - BCG offers strategic, value-driven M&A consulting from transaction strategy through post-merger integration, emphasizing tailored approaches, strategic fit assessment, synergy validation, and negotiation support to avoid common M&A pitfalls and create replicable processes in-house.

Mergers & Acquisitions Consulting Services | Dryden Group - Dryden Group specializes in premium M&A consulting focused on procurement processes, including due diligence, spend and vendor analysis, and leveraging economies of scale to optimize post-merger efficiency and reduce costs.

M&A Consulting | EY - EY provides end-to-end M&A consulting services from growth strategy and portfolio reshaping to due diligence, post-merger integration, and restructuring, supported by AI-enabled technology and advanced analytics to maximize deal value for both buy- and sell-side clients.

dowidth.com

dowidth.com