Behavioural economics consulting focuses on applying psychological insights to enhance decision-making processes, optimize consumer behavior, and improve organizational strategies by understanding cognitive biases and social influences. Mergers and acquisitions consulting, on the other hand, centers on financial analysis, due diligence, and strategic planning to facilitate successful business combinations and maximize shareholder value. Explore how these distinct consulting approaches can drive transformative growth and strategic advantage in your organization.

Why it is important

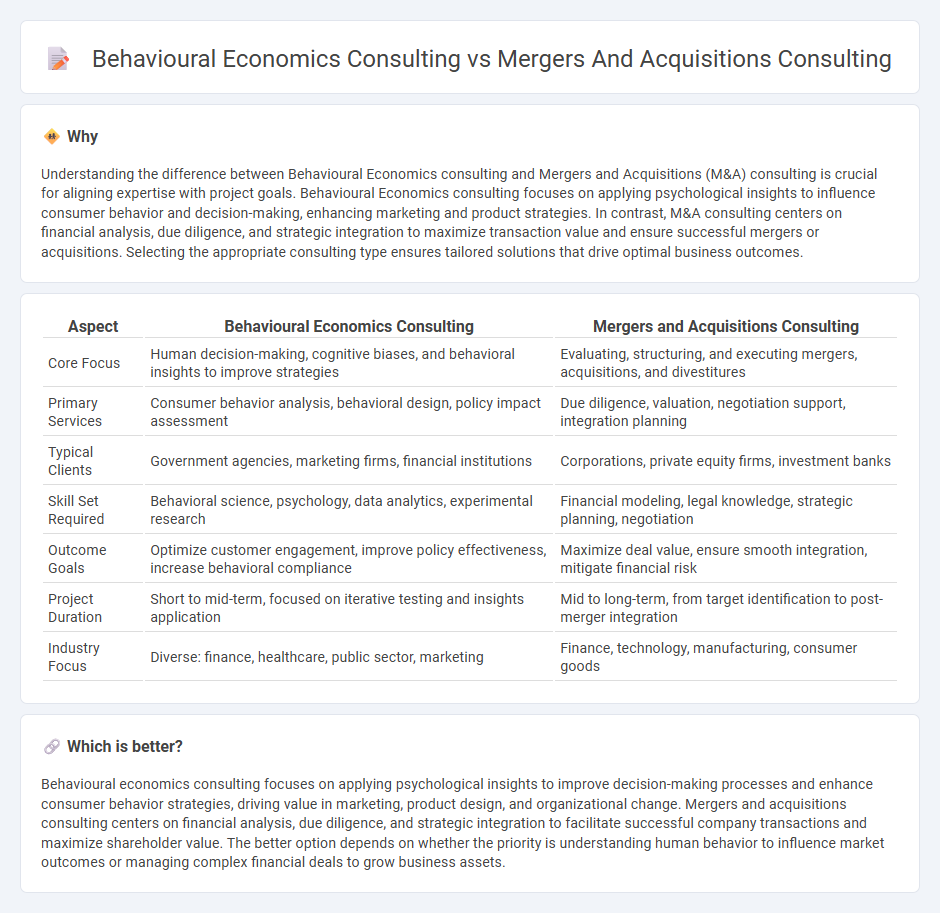

Understanding the difference between Behavioural Economics consulting and Mergers and Acquisitions (M&A) consulting is crucial for aligning expertise with project goals. Behavioural Economics consulting focuses on applying psychological insights to influence consumer behavior and decision-making, enhancing marketing and product strategies. In contrast, M&A consulting centers on financial analysis, due diligence, and strategic integration to maximize transaction value and ensure successful mergers or acquisitions. Selecting the appropriate consulting type ensures tailored solutions that drive optimal business outcomes.

Comparison Table

| Aspect | Behavioural Economics Consulting | Mergers and Acquisitions Consulting |

|---|---|---|

| Core Focus | Human decision-making, cognitive biases, and behavioral insights to improve strategies | Evaluating, structuring, and executing mergers, acquisitions, and divestitures |

| Primary Services | Consumer behavior analysis, behavioral design, policy impact assessment | Due diligence, valuation, negotiation support, integration planning |

| Typical Clients | Government agencies, marketing firms, financial institutions | Corporations, private equity firms, investment banks |

| Skill Set Required | Behavioral science, psychology, data analytics, experimental research | Financial modeling, legal knowledge, strategic planning, negotiation |

| Outcome Goals | Optimize customer engagement, improve policy effectiveness, increase behavioral compliance | Maximize deal value, ensure smooth integration, mitigate financial risk |

| Project Duration | Short to mid-term, focused on iterative testing and insights application | Mid to long-term, from target identification to post-merger integration |

| Industry Focus | Diverse: finance, healthcare, public sector, marketing | Finance, technology, manufacturing, consumer goods |

Which is better?

Behavioural economics consulting focuses on applying psychological insights to improve decision-making processes and enhance consumer behavior strategies, driving value in marketing, product design, and organizational change. Mergers and acquisitions consulting centers on financial analysis, due diligence, and strategic integration to facilitate successful company transactions and maximize shareholder value. The better option depends on whether the priority is understanding human behavior to influence market outcomes or managing complex financial deals to grow business assets.

Connection

Behavioural economics consulting enhances mergers and acquisitions (M&A) consulting by providing insights into human decision-making biases that impact deal negotiations and integration processes. Applying behavioural science helps M&A consultants predict stakeholder responses, optimize communication strategies, and mitigate risks associated with cultural clashes or resistance to change. Integrating these disciplines leads to more informed valuation assessments and smoother post-merger integration, boosting overall transaction success.

Key Terms

**Mergers and Acquisitions Consulting:**

Mergers and acquisitions consulting centers on strategic advisory to optimize deal valuation, due diligence, and integration processes, ensuring seamless transitions and maximized shareholder value. This consulting leverages financial modeling, market analysis, and risk assessment to guide companies through complex transactions and regulatory environments. Explore how expert M&A consulting accelerates growth and competitive advantage for businesses.

Due Diligence

Mergers and acquisitions consulting emphasizes rigorous financial due diligence, identifying risks, synergies, and valuation discrepancies to support strategic decisions. Behavioural economics consulting enhances due diligence by analyzing cognitive biases, decision-making patterns, and cultural dynamics that affect negotiation outcomes and integration success. Explore how combining these approaches can optimize your M&A process and ensure comprehensive risk assessment.

Synergy Evaluation

Mergers and acquisitions consulting emphasizes synergy evaluation by analyzing financial metrics, operational efficiencies, and market positioning to forecast combined entity value. Behavioural economics consulting integrates cognitive biases and decision-making patterns to assess how human factors impact perceived synergies and integration success. Discover more about how these consulting approaches uniquely optimize synergy evaluation in complex transactions.

Source and External Links

M&A (Mergers & Acquisitions) Strategy Consulting | BCG - BCG provides end-to-end M&A consulting, helping clients develop strategies, identify and evaluate targets, negotiate deals, and implement post-merger integration using proprietary methodologies and digital tools to maximize value creation and avoid common pitfalls.

M&A consulting | EY - US - EY's M&A consulting teams deliver services ranging from growth strategy and portfolio reshaping to deal execution, post-merger integration, divestitures, and restructuring, leveraging advanced analytics, AI, and industry expertise to help clients achieve strategic goals and optimize deal value.

M&A consulting | McKinsey & Company - McKinsey partners with clients to enhance M&A success by offering capabilities in portfolio transformation, deal strategy, execution, and building long-term organizational capabilities to capture synergies and drive sustainable growth.

dowidth.com

dowidth.com