Interim executive placement involves temporarily assigning experienced leaders to manage organizational transitions or fill critical roles, ensuring continuous operational stability. Risk management consulting focuses on identifying, assessing, and mitigating financial, operational, and regulatory risks to safeguard company assets and reputation. Explore the distinct advantages each consulting service offers to optimize your business strategy.

Why it is important

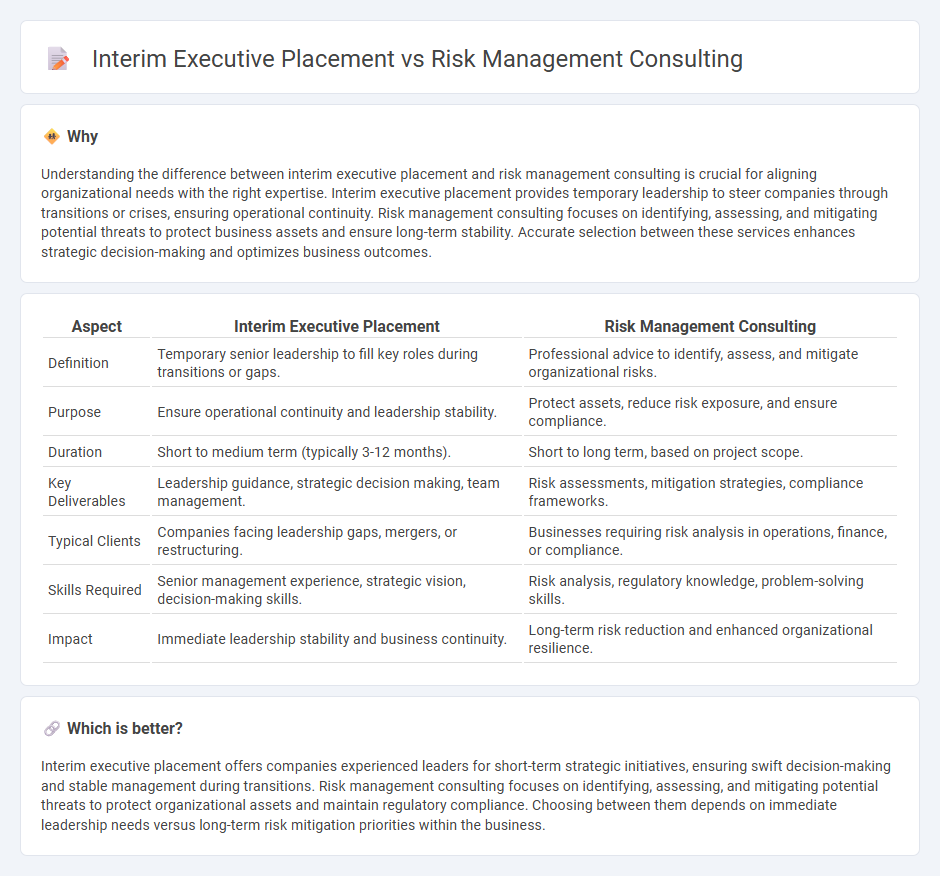

Understanding the difference between interim executive placement and risk management consulting is crucial for aligning organizational needs with the right expertise. Interim executive placement provides temporary leadership to steer companies through transitions or crises, ensuring operational continuity. Risk management consulting focuses on identifying, assessing, and mitigating potential threats to protect business assets and ensure long-term stability. Accurate selection between these services enhances strategic decision-making and optimizes business outcomes.

Comparison Table

| Aspect | Interim Executive Placement | Risk Management Consulting |

|---|---|---|

| Definition | Temporary senior leadership to fill key roles during transitions or gaps. | Professional advice to identify, assess, and mitigate organizational risks. |

| Purpose | Ensure operational continuity and leadership stability. | Protect assets, reduce risk exposure, and ensure compliance. |

| Duration | Short to medium term (typically 3-12 months). | Short to long term, based on project scope. |

| Key Deliverables | Leadership guidance, strategic decision making, team management. | Risk assessments, mitigation strategies, compliance frameworks. |

| Typical Clients | Companies facing leadership gaps, mergers, or restructuring. | Businesses requiring risk analysis in operations, finance, or compliance. |

| Skills Required | Senior management experience, strategic vision, decision-making skills. | Risk analysis, regulatory knowledge, problem-solving skills. |

| Impact | Immediate leadership stability and business continuity. | Long-term risk reduction and enhanced organizational resilience. |

Which is better?

Interim executive placement offers companies experienced leaders for short-term strategic initiatives, ensuring swift decision-making and stable management during transitions. Risk management consulting focuses on identifying, assessing, and mitigating potential threats to protect organizational assets and maintain regulatory compliance. Choosing between them depends on immediate leadership needs versus long-term risk mitigation priorities within the business.

Connection

Interim executive placement plays a crucial role in risk management consulting by providing organizations with experienced leadership during periods of transition or crisis, ensuring continuity and strategic decision-making. Risk management consultants leverage interim executives to quickly implement risk mitigation strategies and adapt to regulatory changes or market disruptions. This symbiotic relationship enhances organizational resilience and minimizes potential financial, operational, and reputational risks.

Key Terms

**Risk Management Consulting:**

Risk management consulting provides organizations with expert analysis and strategies to identify, assess, and mitigate potential risks that could impact business operations, compliance, and financial stability. Consultants leverage advanced risk assessment tools and industry-specific knowledge to develop customized frameworks that enhance resilience against market volatility, regulatory changes, and operational disruptions. Explore how specialized risk management consulting can safeguard your company's future by diving deeper into its critical methodologies and benefits.

Risk Assessment

Risk management consulting focuses on identifying, evaluating, and mitigating potential risks to an organization's assets, operations, and reputation through systematic risk assessment frameworks and tailored strategies. Interim executive placement provides experienced leaders who drive risk assessment initiatives, ensuring real-time decision-making and operational adjustments to minimize impact during transitional periods. Explore how integrating both approaches can enhance your organization's resilience and strategic risk management capabilities.

Compliance

Risk management consulting focuses on identifying, assessing, and mitigating compliance risks through strategic frameworks and regulatory adherence, ensuring organizations meet industry standards. Interim executive placement provides temporary leadership with expertise in compliance management to drive immediate, actionable improvements and bridge governance gaps during transitional periods. Explore how integrating these approaches can enhance your organization's compliance strategy.

Source and External Links

Marsh Advisory - Offers an integrated approach to identifying and assessing business-critical risks, assisting in risk appetite, mitigation strategies, and communication processes.

ICA Risk Management Consultants - Provides impartial and independent risk management consulting services, focusing on insurance verification and cost-effective solutions.

Aon Risk Management - Offers specialist advice and analytics to help clients understand and mitigate risks, ensuring business continuity and resilience.

dowidth.com

dowidth.com