ESG due diligence evaluates a company's environmental, social, and governance practices to identify risks and opportunities related to sustainability and ethical impact. Legal due diligence focuses on reviewing contracts, compliance, and regulatory issues to uncover potential legal liabilities in transactions. Explore the distinctions between ESG and legal due diligence to enhance your risk management strategy.

Why it is important

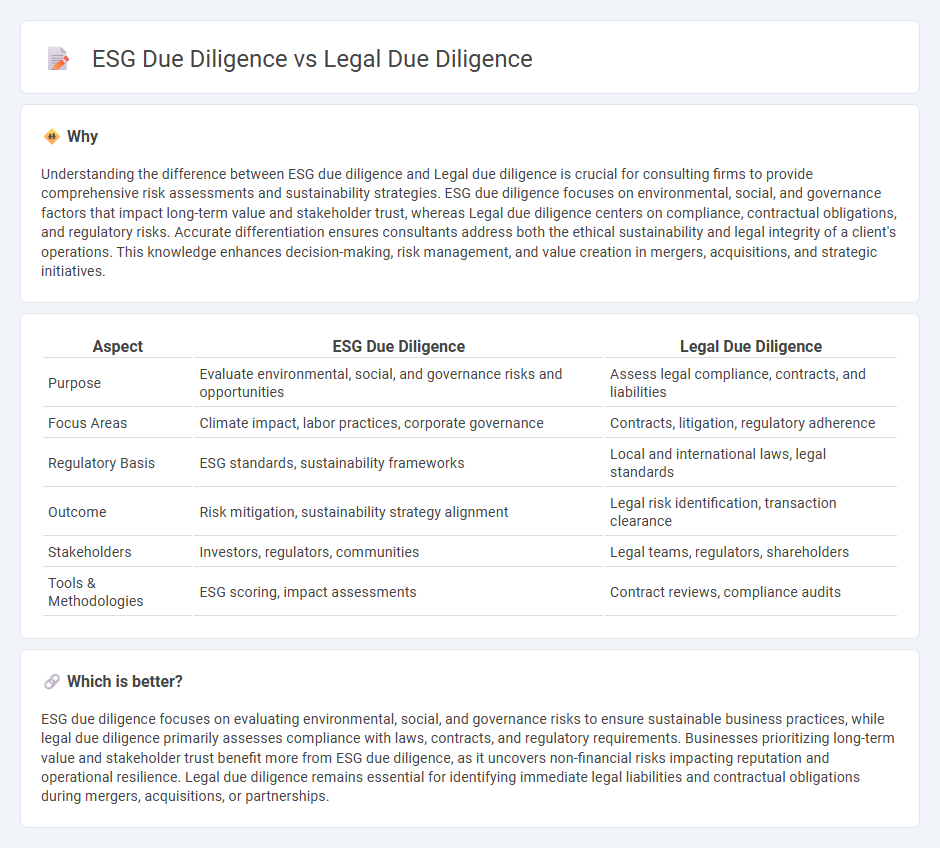

Understanding the difference between ESG due diligence and Legal due diligence is crucial for consulting firms to provide comprehensive risk assessments and sustainability strategies. ESG due diligence focuses on environmental, social, and governance factors that impact long-term value and stakeholder trust, whereas Legal due diligence centers on compliance, contractual obligations, and regulatory risks. Accurate differentiation ensures consultants address both the ethical sustainability and legal integrity of a client's operations. This knowledge enhances decision-making, risk management, and value creation in mergers, acquisitions, and strategic initiatives.

Comparison Table

| Aspect | ESG Due Diligence | Legal Due Diligence |

|---|---|---|

| Purpose | Evaluate environmental, social, and governance risks and opportunities | Assess legal compliance, contracts, and liabilities |

| Focus Areas | Climate impact, labor practices, corporate governance | Contracts, litigation, regulatory adherence |

| Regulatory Basis | ESG standards, sustainability frameworks | Local and international laws, legal standards |

| Outcome | Risk mitigation, sustainability strategy alignment | Legal risk identification, transaction clearance |

| Stakeholders | Investors, regulators, communities | Legal teams, regulators, shareholders |

| Tools & Methodologies | ESG scoring, impact assessments | Contract reviews, compliance audits |

Which is better?

ESG due diligence focuses on evaluating environmental, social, and governance risks to ensure sustainable business practices, while legal due diligence primarily assesses compliance with laws, contracts, and regulatory requirements. Businesses prioritizing long-term value and stakeholder trust benefit more from ESG due diligence, as it uncovers non-financial risks impacting reputation and operational resilience. Legal due diligence remains essential for identifying immediate legal liabilities and contractual obligations during mergers, acquisitions, or partnerships.

Connection

ESG due diligence and legal due diligence are interconnected through their joint focus on assessing risks and compliance factors critical to investment and business transactions. ESG due diligence evaluates environmental, social, and governance risks that might affect a company's long-term sustainability, while legal due diligence ensures adherence to regulatory frameworks, contractual obligations, and potential legal liabilities. Integrating both due diligence processes provides a comprehensive risk assessment, enhancing decision-making and aligning business practices with regulatory expectations and stakeholder values.

Key Terms

Compliance

Legal due diligence primarily assesses compliance with laws, regulations, and contractual obligations to identify potential legal risks in transactions or business operations. ESG due diligence evaluates adherence to environmental, social, and governance standards, highlighting risks related to sustainability, ethical practices, and corporate responsibility. Discover how integrating both due diligence processes can enhance comprehensive risk management and regulatory compliance.

Risk Assessment

Legal due diligence primarily assesses compliance with laws, contracts, and regulations to identify potential legal risks and liabilities. ESG due diligence evaluates environmental, social, and governance factors to uncover sustainability risks that could impact long-term business value and stakeholder trust. Explore comprehensive strategies to integrate legal and ESG risk assessments for informed decision-making.

Regulatory Framework

Legal due diligence primarily examines compliance with laws, contracts, and regulations specific to the transaction, focusing on potential legal risks and liabilities. ESG due diligence evaluates adherence to environmental, social, and governance standards within the regulatory framework, emphasizing sustainability and ethical practices impacting long-term value. Discover how integrating both approaches strengthens risk management and corporate responsibility in your projects.

Source and External Links

Due Diligence Checklist - Provides a comprehensive guide to legal and regulatory due diligence, including company structure, contracts, intellectual property, and regulatory compliance.

What is Legal Due Diligence? - Explains the purpose and process of legal due diligence in mergers and acquisitions, focusing on shareholder relations and legal compliance.

What Is Legal Due Diligence in M&A & How To Do It - Discusses the process and key components of legal due diligence in M&A transactions, including contracts, intellectual property, and regulatory compliance.

dowidth.com

dowidth.com